Recently elected US President Donald Trump had declared a “national energy emergency” prior to his inauguration into office.

The order was invoked under the National Emergencies Act, which would enable the Trump administration to jumpstart energy production, including rapid leasing, siting and permitting.

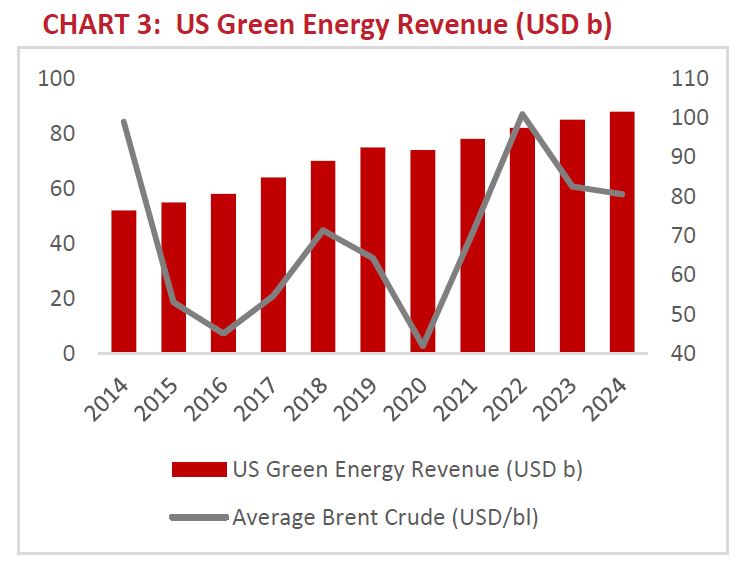

In tandem with the call for more oil drillings, Trump aimed to reverse many climate policies, renewable energy incentives and EV purchasing implemented by the previous administration, as well as pausing the disbursement of funds on these subsectors.

President Trump, during his inauguration event, had announced that his administration intends to impose across-the-board 25% tariffs on all products from Mexico and Canada.

Implementation of a similar tariff to crude oil imports could raise the cost of crude in the long run.

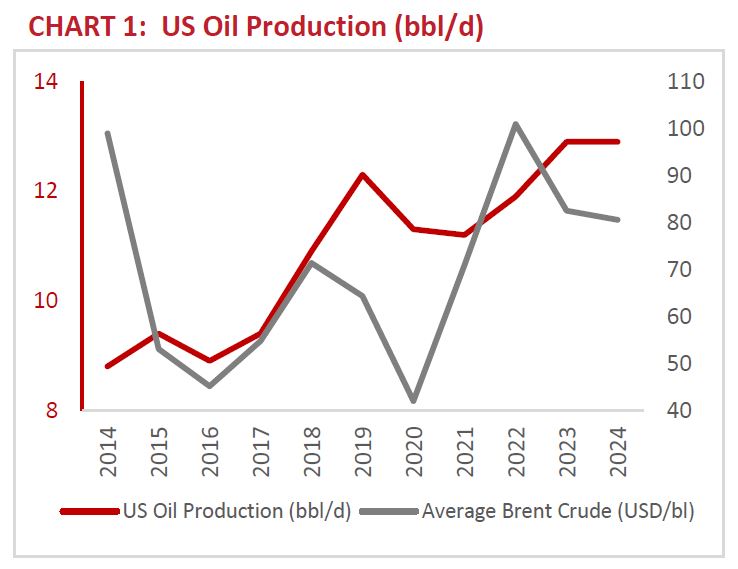

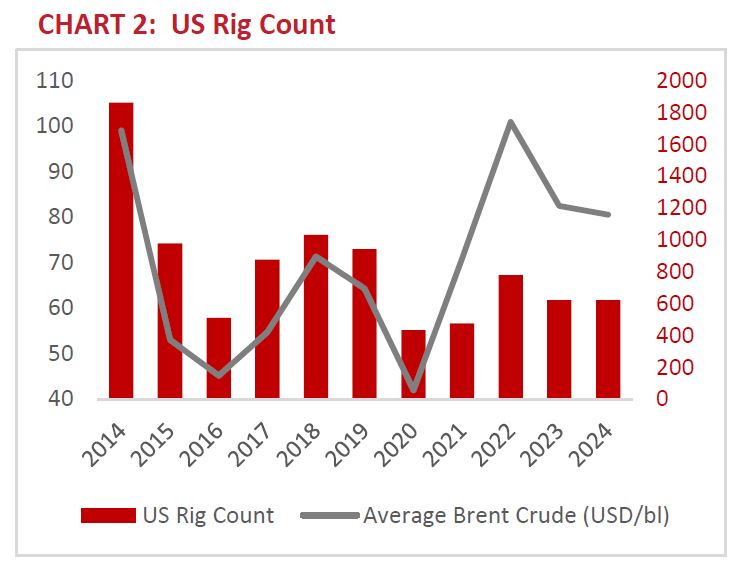

In the scenario that US production is to increase, similarly during Trump’s first presidency (approx. +7% higher than during Obama’s administration), crude oil prices could decline due to greater oil supply, potentially lower energy prices in the US.

“By reducing regulations, we expect that major oil players could lower their operational costs, consequently boosting profitability and economic growth. The higher US production would also reduce the US’s reliance on foreign oil, notably from Canada, while enhancing its own energy security,” said MIDF Research (MIDF) in the recent Thematic Sector Report.

Despite the lower crude prices, MIDF opines that two major factors could control Brent crude into a range bound of USD70-80pb: the US Federal Reserves’ monetary policy and OPEC+ ongoing supply cuts.

Geopolitical tensions in the Middle East and Eastern Europe, while still crucial, had a smaller impact on the movement of oil prices, particularly when the recent announcement of a Russian oil sanction had failed to keep the prices above USD80pb for long.

While increased US production could cause imbalance in the supply-demand of oil globally, note that, during Trump’s similar policy on US oil production between calendar year (CY) 2017-2020, Brent average price movement was subdued to a slower growth but not entirely declining.

This is a testament that OPEC+ still has a say in keeping the prices in a range bound.

Similarly, the energy deregulation agenda is only anticipated to upend Biden’s GHG policies, but maintains the commitment in feasible green solutions, including green LNG, nuclear, hydrogen and carbon capture.

Climate discussions also remain on a negotiation level, amid the expectation that the US would abandon the Paris Agreement in the near term.

“For our local players, we opine that the key drivers would be on the oil price movement,” said MIDF.

MIDF reiterates their positive view for the upstream, in light of 20 hydrocarbon discoveries by PETRONAS since CY23, which they believe could secure Malaysia’s energy security in the long run.

No local oil and gas players are involved directly with US oil production, and considering that Malaysia boasted over 1,800 OGSE companies, MIDF expect that Malaysia’s upstream division would be more focused in SE Asia and the Middle East.

Despite Trump’s drastic changes to the US’s energy environment, ultimately, they believe that the impact of the changes would be minimal to local oil and gas, as well as renewable energy players.

“All in all, we maintain our optimism on the sector, despite the possibility of volatile crude oil prices due to overproduction,” said MIDF.

MIDF believes that, once the renewed US energy policy is fully implemented, Malaysian OGSE companies could take advantage of the increased demand for exploration solutions and fuel transportation.

The deregulation could also open new investment opportunities for Malaysia to penetrate the North American energy sector, consequently increasing the potential for collaboration and trade.

However, uncertainties remain on:

(i) the long-term impact of the increasing US oil production, note the rapid

drop in crude oil prices in CY14-15 by -46% year-on-year (yoy) during the peak of the Shale Oil Boom in the US.

(ii) the environmental impact of unregulated exploration and lower reliance on energy transition.

(iii) supply chain disruptions from the US boosting its domestic manufacturing.

“We strongly believe MISC’s contractual operations in newbuilds and ship charters could mitigate any sudden fluctuations of the oil prices,” said MIDF.

MISC also has a global presence within Asia, Oceania, South America and Europe, providing vessels and vessel services to other oil and gas players.

The group has been actively enhancing its sustainability effort and supporting the LNG market as part of its ESG agenda for cleaner fuel and greener operations within its maritime business.

The major highlight for MISC is its potential to collaborate with another FPSO company, Bumi Armada,for its offshore business, further supporting the local and regional upstream division in the long term. —Jan 28, 2025

Main image: Petrosync