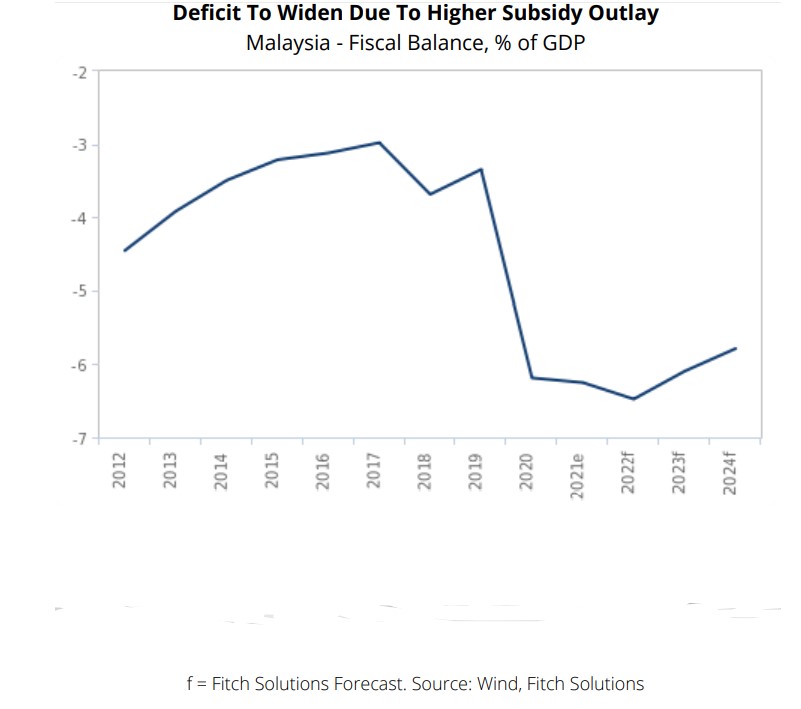

FITCH Solutions Country Risk & Industry Research has revised upward Malaysia’s fiscal deficit forecast for 2022 to 6.5% of gross domestic product (GDP), from 6.3% previously, to reflect a net negative balance between two opposing forces affecting the fiscal situation.

The two forces are higher petroleum-related revenues amid significantly higher oil prices and higher government spending in order to keep inflation at bay.

“While the Government has announced plans to consolidate public finances over the coming months including a more targeted approach to fuel and food subsidies and a possible reversion back to the goods and services tax (GST) scheme from the current sales and services tax (SST), we still see downside risks to our fiscal forecasts,” the research house pointed out.

“To be sure, the Government is likely to prioritise shoring up support ahead of elections that are due by September 2023, which we nonetheless expect to take place sometime in 2H 2022.”

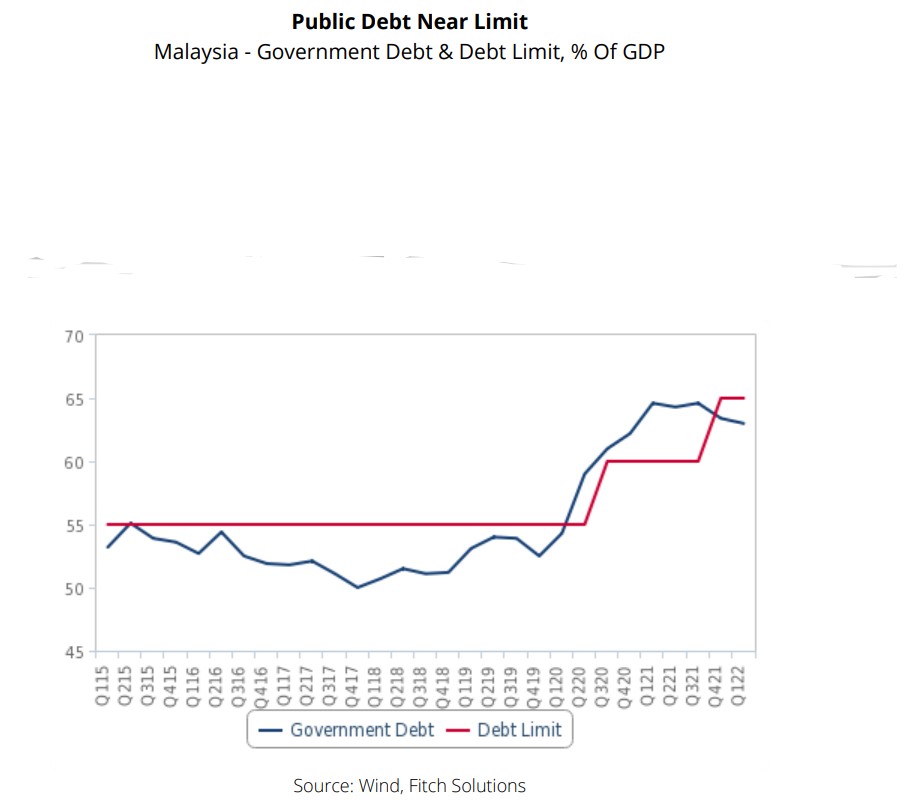

While government debt had fallen slightly to 63% of GDP in 1Q 2022 from 63.4% of GDP in 4Q 2021, Fitch Solutions continues to expect the overall debt load to rise over the course of 2022, especially in light of the wider fiscal deficit that it now expects in 2022.

“Malaysia’s government debt burden is not exceptionally high relative to peers at a similar level of economic development, and the government is unlikely to exceed its debt-to-GDP ceiling of 65% in 2022,” justified the research house which is independent of Fitch Ratings.

“However, we note that the Government’s lack of a concrete medium-term fiscal consolidation plan to bring its budget deficit down to pre-pandemic levels poses downside risk to debt sustainability.”

In a related development, Fitch Solutions said it has revised upward its Malaysia’s revenue forecast to RM256 bil (15.2% of GDP) from RM234 bil (14% of GDP) previously mainly to account for the boost to revenue collection from higher average oil prices.

“While upwardly revised, our forecast has incorporated the marginally lower tax collection from the slightly weaker economic outlook as compared to when we previously analysed Malaysia’s fiscal situation – we have revised our real GDP growth forecast to 5.2% for 2022 from 5.6% previously,” justified the research house.

On the same note, Fitch Solutions has also revised up its expenditure forecast for 2022 to RM364 bil (21.7% of GDP) from RM334 bil (21% of GDP) previously in order to reflect the Government’s additional spending on fuel and food subsidies amid rising prices in order to maintain the purchasing power of its citizens.

On June 3, the Finance Ministry in a statement said unanticipated spending on subsidies amounted to around RM30 bil while Prime Minister Ismail Datuk Seri Ismail Sabri Yaakob said on June 6 that the final subsidy bill for 2022 could exceed RM71 bil.

“While the amount of additional spending has been significant thus far, we believe that these outlays will be reduced in 2H 2022,” projected Fitch Solutions.

Recall that on June 7, Minister in the Prime Minister’s Department (Economy) Datuk Seri Mustapa Mohamed told Bloomberg that the Government would move to a targeted subsidy scheme, only offering assistance to those with lower income.

On June 22, the Domestic Trade and Consumers Affairs Ministry said it would scrap price ceilings for chicken and eggs as well as cease to subsidise the production of chickens from July 1. – June 24, 2022