HONG LEONG Investment Bank (HLIB) conducted on-the-ground visits with eight tech/EMS companies in Penang around the end of April.

What stood out from our discussions with the management of the eight tech/EMS companies were their optimism about Malaysia’s position as a key beneficiary of supply chain relocation.

Under the proposed US reciprocal tariffs, Malaysia’s rate of 24% is the lowest among key manufacturing hubs, well below China (34%), Taiwan (32%), and Vietnam (46%).

“Overall, the companies we met highlighted no major disruptions or changes to order flows following the tariff announcement,” said HLIB. Although it is hard to pinpoint, they feel there is some degree of frontloading activities.

EMS players, in particular, saw a surge in inbound inquiries and site visits since 2nd April. However, momentum tapered off after the 90-day tariff reprieve was announced.

These inquiries largely come from Vietnam and China, including from global multinational corporations that have major production hubs in China looking to relocate or diversify.

Not surprisingly, most companies indicated they have sufficient floorspace and vacant land ready for expansion should opportunities arise.

Quarter one 2025 (1Q25) trade dynamics confirmed that frontloading has indeed been in full swing, as evidenced by the surge in US imports during the quarter.

On Malaysia side, 1Q25 export data also surprised on the upside, growing by +4.4% year-on-year (YoY), primarily driven by a sharp +19.7% YoY increase in electrical and electronics exports.

“We believe this trend has continued into April, as shown by the exceptionally strong export growth coming out from Vietnam (+19.8% YoY) and Taiwan (+29.9% YoY) recently, reinforcing our view that the supply chain is actively stockpiling during this 90-day tariff reprieve,” said HLIB.

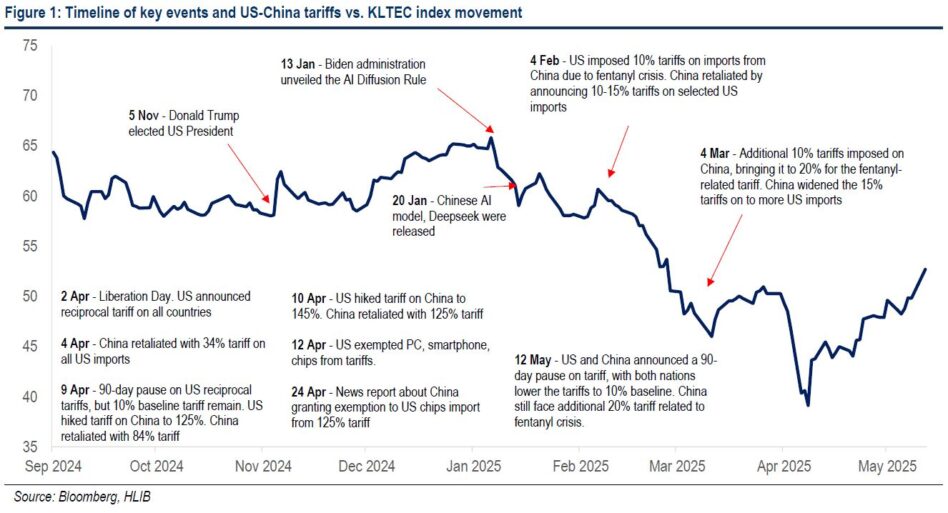

Admittedly, sentiment for the tech sector has also been buoyed by a series of events indicating an easing of trade tensions between the US and China.

“While we anticipated a relief rally after the US exempted several electronics products from tariffs, such as PCs, smartphones, semiconductor equipment, and others, the strength and speed of the rebound far exceeded our expectations,” said HLIB.

Despite the de-escalation in US-China trade tensions, HLIB is still far from a definite resolution, and would argue that the outcome of the sectoral tariff on semiconductors under the Section 232 investigation is the most important key risk event to watch.

While they expect earnings to hold firm through 2Q25, they see mounting risks heading into the second half of 2025 (2H25).

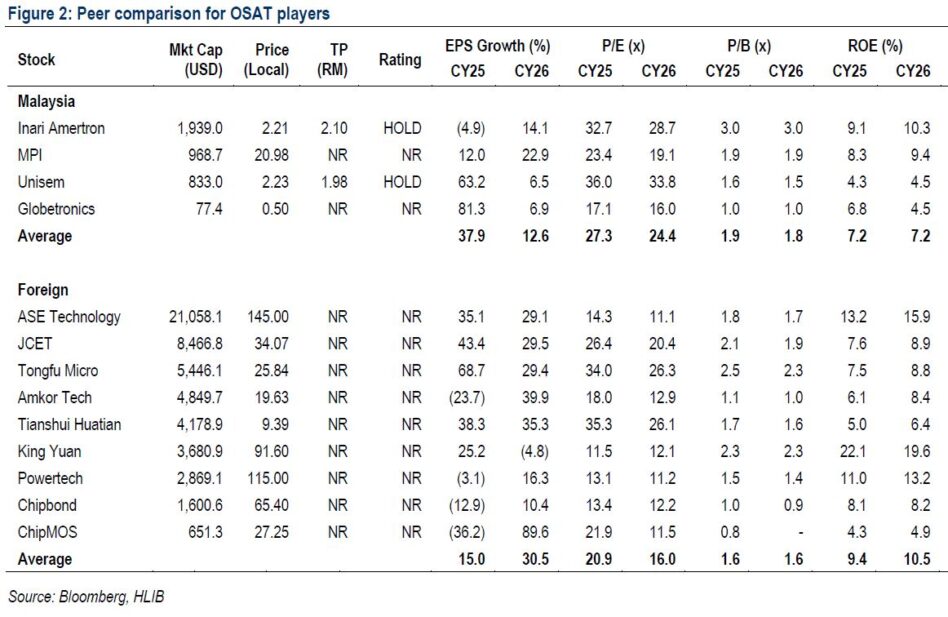

Consensus forecasts for Malaysian tech names continue to reflect strong growth for 2025/2026, with few earnings downgrades thus far despite higher macro risks than before.

“In our view, this sets the stage for potential 2H25 disappointment. We feel that the longer the tariff situation is not fully resolved, the greater the potential economic drag from continued uncertainties throughout 2025,” said HLIB.

Against the backdrop of negative earnings revisions, the relatively high valuations of Malaysian tech companies seem stretched, especially given the limited visibility beyond 2Q25.

HLIB advocates adopting a more tactical “sell into strength” approach and would revisit once earnings expectations reset and the outcomes of US tariff policy become clearer.

“Maintain Neutral, staying selective. Within the tech hardware space, we maintain a preference for names with visible structural growth drivers,” said HLIB. —May 14, 2025

Main image: Yahoo