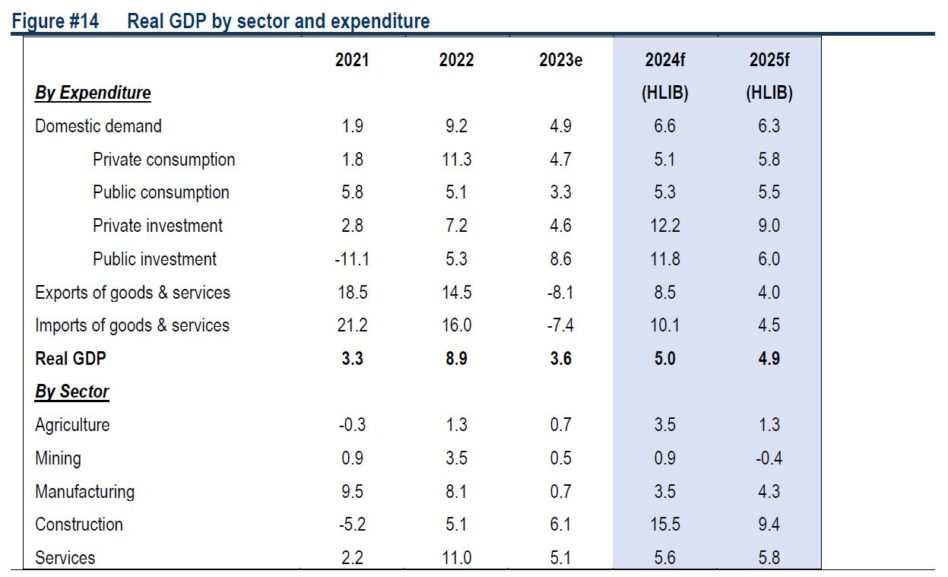

AMID a challenging global environment, Hong Leong Investment Bank (HLIB) projects Malaysia’s gross domestic product to ease slightly to +4.9% year-on-year (YoY) in 2025 compared to 2024 estimate at +5.0%. This is still within the government’s official target range of 4.5%-5.5%.

“This growth will be underpinned by steady improvement in the labour market, income-boosting measures, continued tourism recovery, and execution of approved investments,” said HLIB in the recent Outlook: 2025 Report.

Inflation is forecasted to rise to +2.7% YoY in 2025, with potential upward pressure hinging on the timing of RON95 subsidy reforms, likely to be introduced in the second half 2025 (2H25).

As the inflation uptick is supply side driven, alongside rising external risks from Trump’s tariff plans, HLIB expects Bank Negara Malaysia to stay pat on the overnight policy rate (OPR) at 3.0% for 2025.

“We expect heightened market volatility in 1H25 as investors grapple with the incoming policy risks from Trump’s presidential comeback. That said, we are inclined to believe that he will take a more nuanced approach on tariffs – in a targeted manner rather than blanket – seeing that this would have an inevitable impact on inflation,” said HLIB.

Last year, Malaysia accounted for only 2.5% of US’ trade deficit (ranked 12th), while the top five countries (China, Mexico, Vietnam, Germany and Canada) collectively made up 66%.

While noting the upside bias to inflation from Trump’s tariff tantrums, we still expect the Fed to continue with its rate cuts by -50 basis points in 2025 – though this is softer than its official forecast of -100 basis points.

External headwinds aside, perhaps it would be useful to reflect that Malaysia is now on a sturdier ship with steady growth, subsidy reforms in motion, robust investment pipeline, and a more stable political climate.

“We feel that foreigners have yet to fully appreciate the country’s ongoing rejuvenation given their continued underweight position in Malaysia, though now at a smaller quantum,” said HLIB.

The Fed’s ongoing rate down-cycle should help risk appetite for emerging markets resurface, particularly in countries such as Malaysia that aren’t in the tariff spotlight. A reprieve in foreign shareholding levels should be positive for the KLCI given the 69% correlation between the two.

HLIB remain upbeat on the following investment themes for 2025:

(i) Disposable income boosters.

(ii) Tourism shifting from recovery to record.

(iii) Johor’s developmental reinvigoration.

(iv) Energy transition amidst a data centre boom, – while Trump’s impending presidency could see revived interest in.

(v) Trade war plays.

“We project 2024/2025 KLCI core earnings growth of +5.6%/+8.3%. Our top picks are YTLP, Sunway, RHB, Gamuda, Dialog, Capital A, ITMAX, Aeon, Notion, SMRT, MNH and FocusP – broadly reflecting our key themes,” said HLIB. —Dec 17, 2024

Main image: Environment Buddy