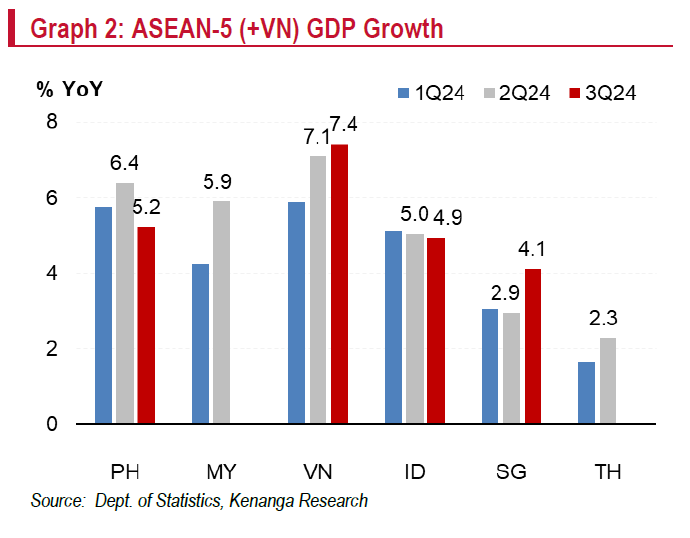

THE Department of Statistics (DOSM) is slated to release its actual quarter three 2024 gross domestic product (GDP) data this Friday, 15th, with growth rate expected at 5.3%.

“This reading is expected to match DOSM’s advance GDP estimate, as well as ours and consensus projections,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

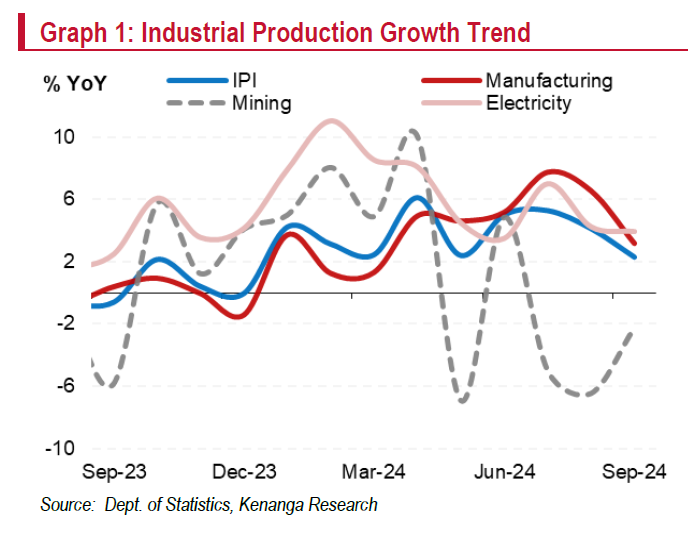

Key macro indicators suggest moderate expansion amid a slowdown in mining and domestic demand but remained supported by manufacturing sector and an unexpected boost from construction sector.

Manufacturing: expected to expand further, marking four consecutive quarters of expansion as the manufacturing output index accelerates to 5.8%.

Note that quarter two of 2024 (2Q24) was 4.9%, backed by strong export-oriented industries (5.8%; 2Q24: 4.0%), particularly in the electrical and electronics subsector.

This aligns with robust export growth, which surged to 7.8% (2Q24: 5.8%), reaching a seven-quarter high or the highest since 4Q22.

Nevertheless, growth may be capped by moderate growth in domestic-oriented industries (5.7%; 2Q24: 6.8%).

Construction: Likely to surprise on the upside, as 3Q24 construction work done rose 22.9% (2Q24: 20.2%) to RM41.1bil (2Q24: RM38.9bil), driven by gains in residential buildings and non-residential buildings projects.

Services: Expected to slow, as distributive trade sales eased to 5.1% (2Q24: 6.4%), reflecting declines in motor vehicles (5.0%; 2Q24: 9.9%) due to temporary Perodua factory closure in September, along with slower retail trade (5.9%; 2Q24: 7.4%) and wholesale trade (4.3%; 2Q24: 4.5%).

Agriculture: Growth is likely to slow due to a sharp drop in crude palm oil production to 7.0% (2Q24: 15.9%), though strong rubber production recovery may offset some of the decline.

Mining and quarrying: expected to underperform, as mining output index down 4.6% (2Q24: 2.4%), a 15-quarter low, due to weaker crude oil & condensate production.

Domestic demand: signals of slower private consumption emerged, with consumption credit growth slowing to 7.6% year-on-year at end-3Q24 (2Q24: 8.2%).

Notably, outstanding balance of credit cards also slowed to 8.6% year-on-year (2Q24: 9.2%). Similarly, the import of consumption goods remained weak, declining by 1.2% in 3Q24 (2Q24: -3.2%).

Kenanga maintains 3Q24 GDP forecast at 5.3%, with full-year growth to settle at 5.0% (2023: 3.6%).

“Based on high-frequency indicators, we estimate 3Q24 GDP growth to moderate to 5.3% (3Q24:5.9%), but aligning with the pre-pandemic neutral rate,” said Kenanga.

Going forward, growth is projected to ease to 4.6% in the final quarter, bringing the overall 2024 growth to 5.0%, within the Ministry of Finance’s (MoF) 4.8% – 5.3% forecast range.

Nevertheless, the growth outlook remains vulnerable to external risks, including potential slowdowns in advanced economies due to the lag effects of higher interest rates, rising geopolitical tensions impacting global supply chain, and potentially a disappointing growth recovery in China despite ongoing stimulus measures.

Notably, the US economy grew 2.8% in 3Q24, slightly lower than 3.0% in the previous quarter, while China’s growth slowed to 4.6% (2Q24: 4.7%). Against this backdrop, Kenanga projects next year’s growth to moderate to 4.8%.

“On the monetary policy front, given the modest growth in the domestic economy and the heightened global economic uncertainties post-US presidential election, we expect Bank Negara Malaysia (BNM) to hold the overnight policy rate at 3.00% through 2025. BNM may maintain its stance to maintain price stability amid inflation risk while supporting growth outlook,” said Kenanga.—Nov 13, 2024

Main image: allrecipes.com