MAYBANK Investment Bank (MIB) visited Keyfield’s Wisdom and Falcon Offshore Support Vessel (OSV)s, which are undergoing periodical maintenance in the Labuan Shipyard & Engineering (LSE) yard.

“Post-visit, we remain NEUTRAL on the OSV sub-segment operating in the MY O&G space as we think that the OSV Daily Charter Rate (DCR) supercycle may be coming to an end soon,” said MIB in a recent report.

While MIB thinks that DCRs will remain elevated due to vessel supply tightness, the lack of certainty on DCR growth going into 2025 may shy investors away from this space.

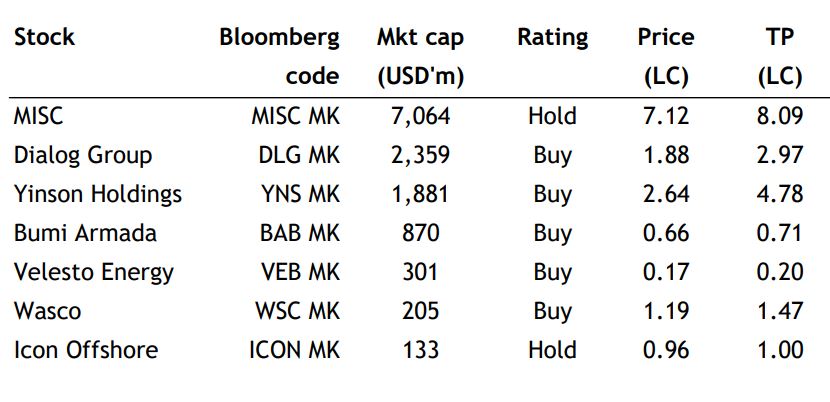

“In the O&G sector, we are selective and prefer the defensive mid-stream space; and floating production storage and offloading names. Dialog and BArmada are our top BUYs,” said MIB.

MIB expects daily charter rates (DCR) to peak soon for some OSV players as:

i) end-clients are negotiating for more “stable & sustainable rates.”

ii) the Malaysia O&G industry may face reduced activities due to potentially lower PETRONAS capital expenditure in 2025.

However, for companies that have managed to secure contract renewals under the PETRONAS POV (Production Operation Vessel) program, they should still see a slight increase in realised DCRs year-on-year in 2025.

MIB also highlighted that vessel supply is also tight currently, with minimal newbuilds in the market due to difficulties in raising financing due to ESG-driven restrictions.

80% of Malaysian vessels would be more than 12 years in age in 2025, based on MOSVA (Malaysia OSV Owners’ Association) data, according to an article in The Edge last year.

Many vessels will soon reach 20 years of age and they will be deemed obsolete, as PETRONAS has limited the age of OSVs to 20 years (extended from 15 years old in 2022) in its tender requirements.

Other than Keyfield, no other Malaysian-listed OSV players are actively building new vessels.

The long-term security of OSV supply for PETRONAS/ Malaysian PACs (Petroleum Arrangement Contractors) is a key concern, in their view.

“The industry had expected the Safina Phase 2 (a build-to-operate program) tender to open in 3Q24, but our checks have indicated that it has been delayed to a later date, likely to be in quarter two of 2025,” said MIB.

The total estimated awards range from the teens to more than 20 vessels. MIB thinks this would enable PETRONAS to secure vessels security.

However, a newbuild process may take 18-24 months before they are fully constructed and ready to deploy. —Jan 17, 2025

Main image: petrosync.com