OUT of the nine companies under RHB’s coverage that reported results, three were in line, three exceeded, and three fell below estimates.

“All in, we believe that contractors will continue to be occupied with their respective jobs on hand as well as the upcoming ones,” said RHB in the recent Malaysia Sector Update Report.

In Calendar Year (CY24), the total value of work done stood at MYR159 bil, the highest on record.

Cushman and Wakefield reported that there is 822MW of planned Data Centre (DC) capacity in Johor.

Furthermore, Negeri Sembilan could be an upcoming DC hot spot, with Gamuda acquiring 389 acres of land in Port Dickson, which could potentially accommodate between 500MW and 1GW of DC capacity.

Moreover, HSS Engineers (HSS MK, NR) is eyeing a separate DC project in Negeri Sembilan with a potential size of 100MW.

“Overall, we view the prominence of DC developers from Tier 1 countries in Malaysia that are eligible for validated end user status to mitigate risks from the US AI Diffusion Rules,” said RHB.

The urgent need to complement the Johor Bahru–Singapore Rapid Transit System (RTS) Link will entail the requirement of other transportation systems, namely the Elevated Autonomous Rapid Transit (EART) in Johor under which a request for proposal for the project will be called soon with an estimated cost of around MYR6-7 bil.

Likewise, the proposed Kita Selangor Rail Line (211km) from Sabak Bernam through Sepang and extend into Negeri Sembilan adds up decently on well flagged projects such as the Penang Light Rail Transit (LRT) (which has MYR5 bil worth of remaining packages) and reinstatement of the five LRT3 stations.

Water related infrastructure could be an avenue of opportunities with the Selangor Government proposing a MYR6 bil underground flood tunnel system.

Also, 35 flood mitigation projects are in the pre-implementation sage while 73 are currently underway, under the MYR22.9 bil approved Fifth Rolling Plan of the 12th Malaysia Plan.

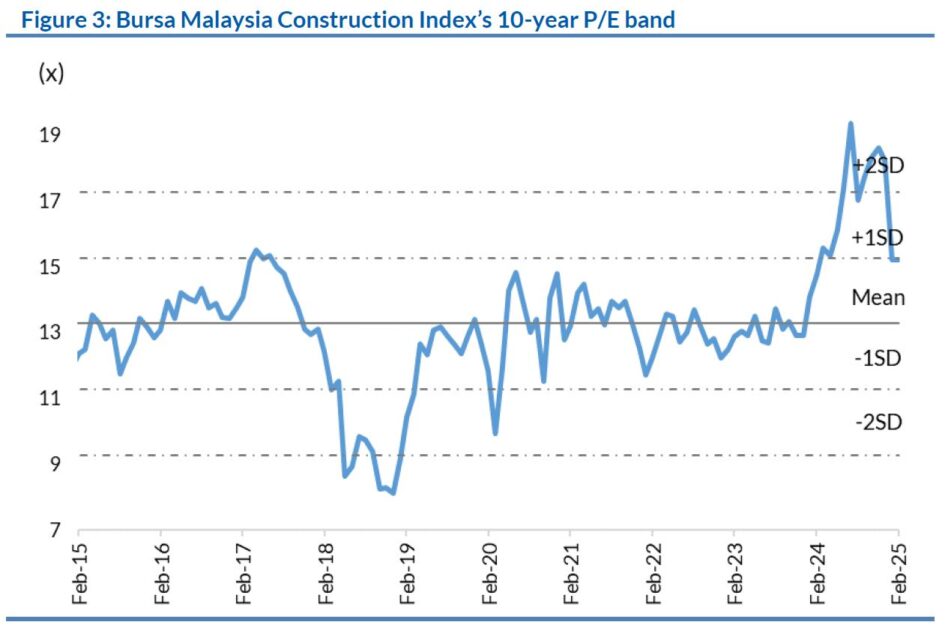

The Bursa Malaysia Construction Index (BMCI) is trading at a forward P/E of 15.2x (vs 19x in late CY24) following jitters from the US AI Diffusion Rule and DeepSeek early this year.

In RHB’s view, the valuation is unjustified as the BMCI was trading at a P/E of around 15-16x during the 2017 construction upcycle (in the absence of DC prospects which we envisage to remain commendable as mentioned above), coupled with the Works Ministry’s projected construction spending of MYR200 bil in CY25.

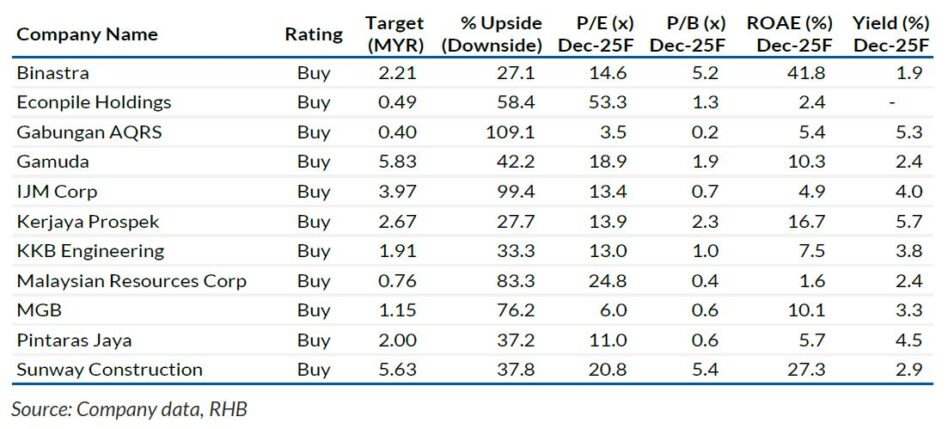

Top Picks include Gamuda, Sunway Construction and Binastra amid steady contract flows combined with commendable earnings visibility over the next two years.

Key criteria for the said Top Picks also cover the diversification of job portfolio, renewable energy for Gamuda in Australia and DCs plus sewage treatment plant jobs for Binastra.

“Key downside risks to our sector call are an unexpected slowdown in job rollouts, labour shortages and scaled down of DC investments into Malaysia,” said RHB.

Overall, the construction sector delivered Financial Year 2024 (FY24) results that were in line with estimates.

“Revenue recognition progress of most contractors did pick up as expected and we anticipate a further ramp-up as jobs secured, especially last year, will transition into the work-intensive phase, in light of better labour conditions and manageable building material price trends,” said RHB. —Mar 5, 2025

Main image: Unitrade