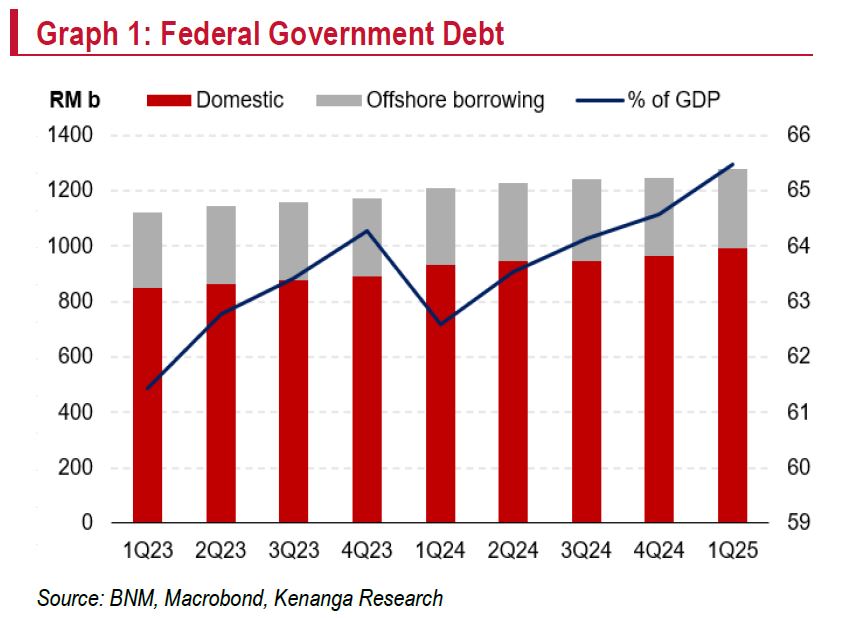

ON A year-to-year (YoY) basis, debt growth moderated to 5.6%, the weakest since quarter two of 2017 (2Q17) which was 4.5%.

However, quarter-on-quarter (QoQ) growth picked up to 2.4% (4Q24: 0.7%), a four-quarter high, in line with seasonal borrowing trend at the start of the year.

Domestic debt: slowed to 6.4% YoY (4Q24: 8.3%), due to slower growth in the medium and long-term debt, which offset continued declines in short term debt. Notably, the short-term debt has now fallen for seven straight quarters.

External debt: rose 3.0% YoY (4Q24: 0.4%), a two-quarter high, steered by a rebound in medium and long-term debt, and a jump in short-term debt.

By currency, growth was led by ringgit-denominated debt which increased by 4.0% (4Q24: 1.2%), while USD, yen and other currencies declined by 6.4%, 8.1% and 55.1%, respectively.

“The demand for both Malaysian Government Securities (MGS) and Government Investment Issues (GII) remained solid, with the year-to-date average bid-to-cover (BTC) ratio at 2.94x. In 2024, the average was 2.37x,” said Kenanga in the recent Economic Viewpoint Report.

This reflects continued investor confidence, supported by relatively stable macro fundamentals, low inflation, and Bank Negara Malaysia’s (BNM) steady policy stance.

In 1Q25, the Federal Government raised RM51.5 bil in gross borrowings, fully sourced from the domestic capital market.

Issuance comprised of RM23 bil in Malaysian Government Securities (MGS), RM25 bil in Malaysian Government Investment Issues (MGII), and Treasury Bills (MTB and MITB) worth RM3.5 bil.

Of the funds raised, RM21.8 bil was used to redeem maturing debt instruments, ensuring smooth rollover of existing obligations.

The remainder financed the fiscal deficit and prefunded upcoming maturities, in line with prudent debt management to reduce refinancing risk and improve funding predictability.

As of April 2025, statutory debt (comprising of MGS, GII, and MITB) stood at RM1,256.9 bil (62.3% of GDP), leaving a fiscal buffer of approximately RM66.1 bil or ~2.7% of GDP before reaching the 65.0% statutory ceiling.

The Federal Government posted a slightly higher fiscal deficit of RM21.9 bil compared to RM21 bil in 4Q24.

However, it was an improvement from the same period of last year (1Q24: RM26.4b), reflecting stronger revenue and disciplined spending in line with the consolidation agenda.

Revenue rose 3.0% YoY to RM72.1 bil, driven by higher tax receipts, notably from Sales and Services Tax (SST) collections and individual income tax, on the back of better compliance and economic activity.

Expenditure fell 2.5% YoY to RM94.2 bil, mainly due to lower subsidy payouts following diesel subsidy rationalisation and softer global crude oil prices.

Despite this, the government maintained its commitment to social protection focus, with increased allocations to targeted assistance schemes.

Transfers to statutory bodies were also streamlined, reflecting improved operational efficiency and institutional performance.

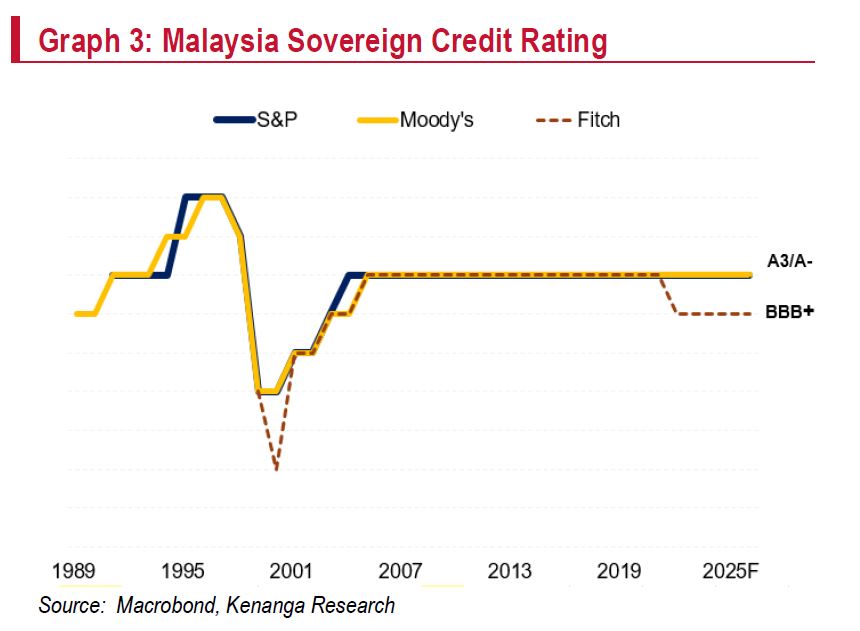

Malaysia’s sovereign credit outlook could improve in the medium term, between 2026 and 2027, with Fitch (BBB+ positive), S&P (A- positive), and Moody’s (A3 stable) signalling possible upgrades if fiscal discipline, structural reforms, and strengthening fundamentals continue.

Malaysia should continue attracting foreign portfolio inflows, supported by fiscal prudence, macro stability, and relatively attractive real yields.

A stronger ringgit may further lift demand for local bonds and exert downward pressure on MGS yields.

The primary driver of issuance expectations is based on the fiscal deficit projection of 4.1% of GDP. However, the impact on supply dynamics is partially offset by fewer MGS and GII maturities, easing rollover pressures. —May 28, 2025

Main image: English News