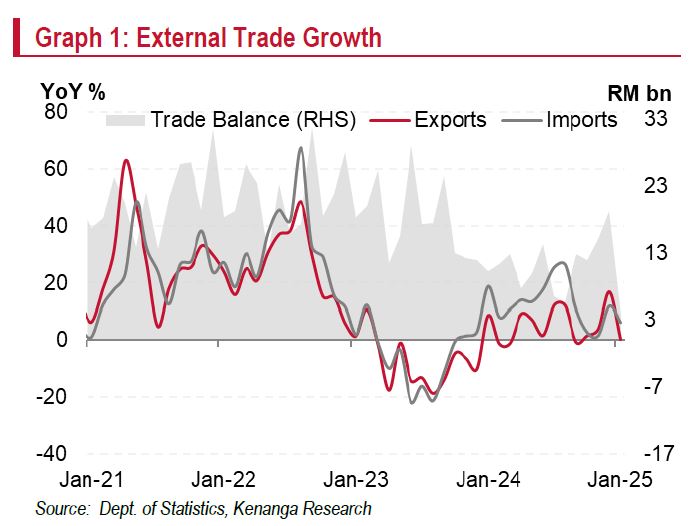

EXPORTS slowed sharply to 0.3% (Dec 24: 16.9%), far below expectations due to seasonal effects from the Chinese New Year holidays.

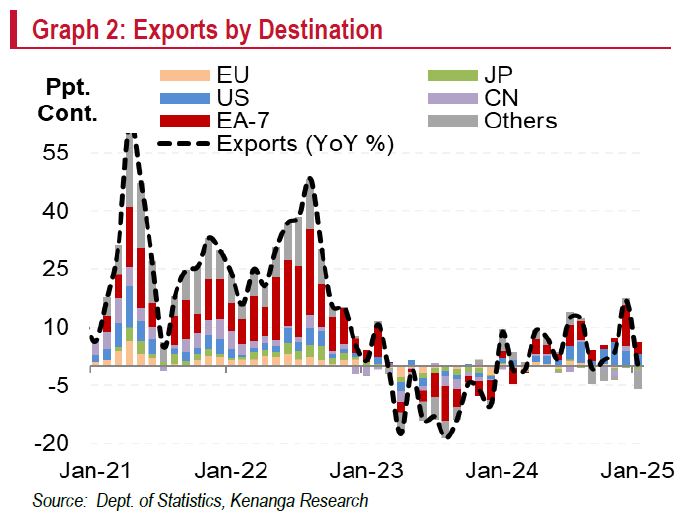

“Note the weaker exports to Singapore, China, Japan and the EU, as well as a broad-based slowdown across key sectors,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

By destination, it was a broad-based slowdown across key trading partners, led by a sharp growth moderation of exports to Singapore, and a decline in shipment to China, Japan and the EU. Meanwhile, exports to the US remained resilient.

By sector, mining contracted further (-12.6%), while manufacturing (0.4%) and agriculture (11.0%) slowed sharply.

In terms of major products, there are the declines in the export of petroleum products (-34.1%) and LNG (-13.3%) as well as a slower electrical & electronics products (14.8%), which weighed on overall export growth.

Imports growth slowed sharply (6.2%) to a two-month low, slightly below the house forecast of 7.0%, but above the consensus of 2.5%.

Trade surplus shrank sharply to RM3.6bil (Dec 24: RM19.1bil), far below expectations. Meanwhile, total trade slowed sharply to 3.1% year-on-year (Dec 24: 14.5%).

2025 exports forecast maintained at 5.0% (2024: 5.7%), with shipment expected to pick up from February onwards.

This is mainly due to the ongoing global tech upcycle led by AI demand and 2024’s approved investments, particularly in manufacturing and technology-related sectors.

Growth will also be supported by key trading partners, China’s gradual economic recovery, and potential spillover from trade diversion amid Trump’s tariff threats.

US exports have grown month-on-month for 13 consecutive months since January 2024. The US is now Malaysia’s second-largest export destination after Singapore, surpassing China, with a 14.1% share in January (Dec 24: 13.7%).

While demand from China remains weak as uncertainty over US tariffs looms, a near-term recovery is expected, bolstering Malaysia’s trade outlook.

Risks are the uncertainty of US policy shifts and Trump tariff threats, alongside a slower-than-expected China recovery, pose downside risk.

The complexity of global demand, supply dynamics, and interlinkages between countries adds to the murky trade outlook.

“We maintain our 2025 gross domestic product growth forecast at 4.8%, reflecting a moderate expansion following a better-than-expected growth achieved last year (2024: 5.1%),” said Kenanga.

This projection accounts for economic normalisation and uncertainties arising from global policy shifts under the new US administration. —Feb 21, 2025

Main image: Hegelmann Group