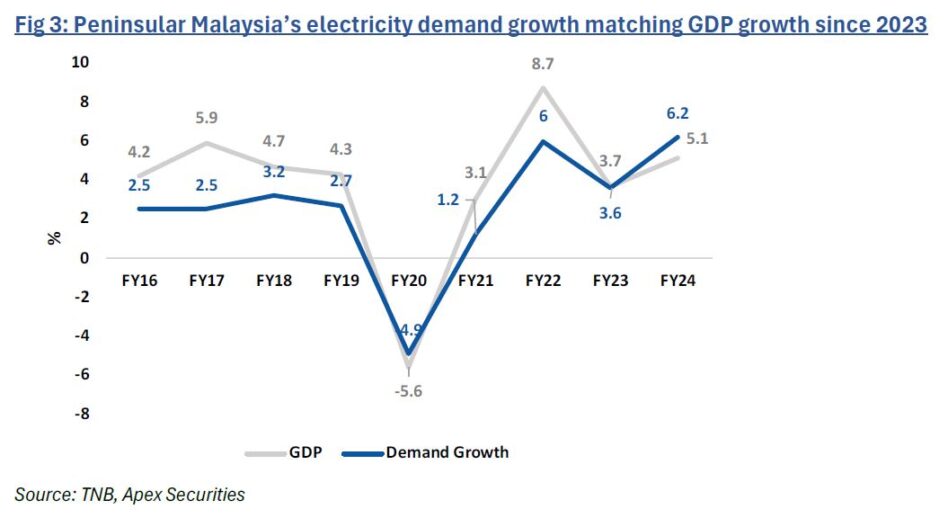

ELECTRICITY demand in Peninsular Malaysia is accelerating, now matching gross domestic product growth due to the expansion of data centres (DCs) and AI infrastructure.

Strong commitments from cloud service providers, including Amazon Web Services, Tencent Cloud, Google Cloud, and others across the Asia-Pacific region have supported DC expansion and, in turn electricity demand growth.

2025 is expected to be a year of execution, as global cloud providers have committed to a strong pipeline of new DC projects totalling 1,313MW, significantly higher than the 505MW of live capacity.

As of Dec-2024, 12 projects in peninsular Malaysia with a combined maximum demand of 2.2GW that have signed electricity supply agreements (ESAs) but are yet to be delivered.

“Based on our back-of-the-envelope calculations, this requires approximately 12 to 13 new 275kV/33kV substations,” said APEX Securities in the recent Sector Update Report.

The actual amount is likely higher at 15 to 18, taking into account redundancy and reliability requirements typically demanded by DC operators.

In Regulatory Period 4 (RP4), the allowed capital expenditure (capex) has increased by 108% to RM42.8 bil, comprising RM26.6 bil in base capex and RM16.3 bil in contingent capex. Of this, base capex includes only DC projects with signed ESAs.

Given the substantial number of DC projects yet to commit to an ESA, TNB anticipates that 60%–70% of the contingent capex will be triggered.

The surge in RP4 capex is poised to benefit electrical contractors, mechanical and electrical (M&E) service providers, underground utility solution providers, and electricity distribution equipment manufacturers over the near to medium term.

Concerns of DC growth have surfaced since early this year, driven by the AI Diffusion Framework and the rollout of Deepseek.

These concerns have been further compounded by tariff uncertainties in the US, prompting several DC operators to pause or delay investments pending greater policy clarity.

“Nonetheless, we believe the current slowdown in DC investments reflects a temporary headwind rather than a structural shift,” said APEX.

For instance, while AWS has paused or restructured some international projects, it has reaffirmed a RM29.2 bil commitment to Malaysia through 2038.

Furthermore, NVIDIA’s continued ramp-up of H100 and B100 GPU production signals sustained hyperscaler demand.

“While we acknowledge a potential slowdown in the data centre growth due to macroeconomic uncertainties, we remain positive about the longer-term outlook,” said APEX.

The recent weakness in share prices of power ancillary players presents an attractive buying opportunity for investors. APEX maintains its overweight stance on the sector. —May 2, 2025

Main image: Getac