MALAYSIA’s healthcare sector remains resilient, driven by higher patient volumes and sustained bed occupancy rates (BOR).

“While the proposed DRG (Diagnosis-Related Group) system aims to control medical claims costs, we believe the implementation is still in its infancy stage,” said Public Investment Bank (PIB).

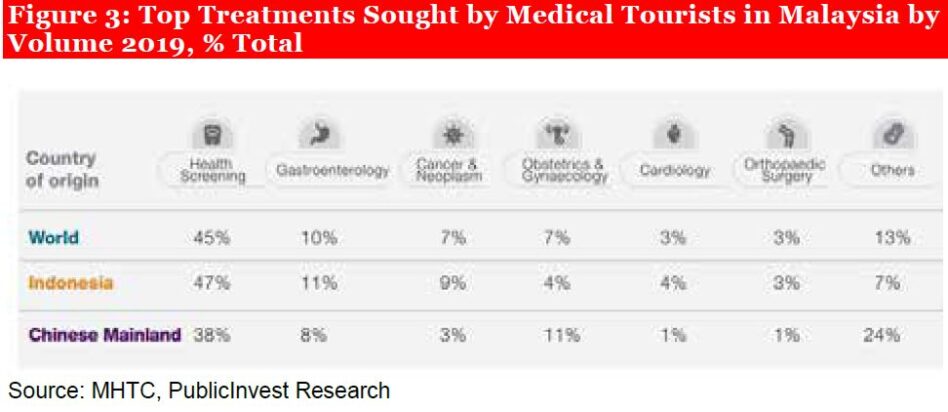

Looking ahead to 2025, we expect the sector to benefit from continued growth in medical tourism and robust expansion plans by private hospitals.

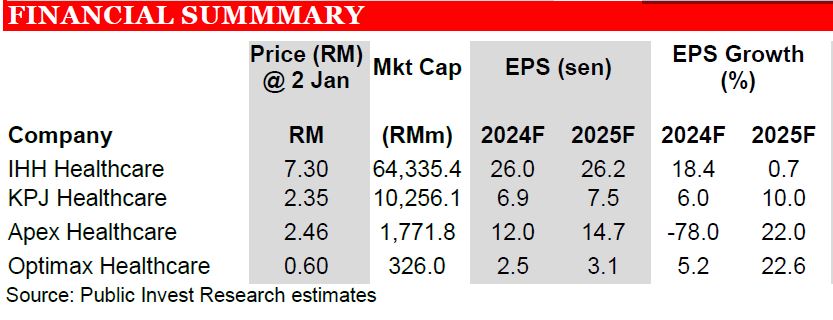

We maintain Overweight on the healthcare sector; reiterating Outperform on both KPJ Healthcare (KPJ) and IHH Healthcare (IHH) due to rising inpatient volumes and strong bed occupancy.

We are also positive on Optimax’s FY25 outlook, driven by its strategic expansion into Vietnam, and the commencement of its eye specialist center at Selgate Hospital.

Meanwhile, we remain Neutral on Apex Healthcare (ApexH), given our cautious outlook on the slowing demand for its core respiratory illness products.

Both IHH and KPJ exceeded our expectations, driven by higher inpatient and outpatient volumes and sustained BOR of 72-73%.

KPJ saw improved average revenue per patient, while IHH benefited from higher revenue intensity through more complex cases.

Optimax’s revenue grew 16% YoY, supported by an increase in cataract and implant vision correction surgeries.

Apex Healthcare faced weaker results, with a 24.3% YoY decline in earnings due to elevated expenses, normalised demand and export disruptions.

The DRG system has been proposed by the Ministry of Health (MOH) to be implemented by the second quarter of 2025, to manage rising medical claims costs in Malaysia through categorising hospital services and applying fixed treatment rates.

While it aims to control costs and improve efficiency, patients might face challenges such as shortened hospital stays, early discharges, and a shift away from personalised care.

Private hospitals may prioritise simpler cases, increasing pressure on overburdened public hospitals. We view that the DRG system may be premature in Malaysia given challenges in capturing detailed cost data.

KPJ’s health tourism revenue up 22% YoY in 9MFY24, and IHH expanding its footprint through the acquisition of Penang Island Hospital.

Malaysia is also targeting medical tourists from China, India, and other regions, capitalising on cultural similarities and accessible flights.

Both KPJ and IHH have robust expansion plans, with KPJ aiming an additional c.1,200 beds by 2027 while IHH targeting 4,000 additional beds by 2028.

We favor IHH given its diversified asset base, robust expansion plans, and strong regional presence across key markets.

We expect IHH’s BOR to remain above 70% in FY25, supported by rising inpatient and outpatient volumes. —Jan 3, 2024

Main image: ASEAN Briefing