MALAYSIA’s annual inflation rate stood at 2% in July 2024, marking the third consecutive month of stability.

“Core consumer prices increased by 1.9% year-on-year in June, maintaining a steady rise for the fourth month and reaching the highest rate since December 2023,” said AMBank (AMB) in the recent Daily Market Snapshot report.

On a monthly basis, the Consumer Price Index (CPI) edged up by 0.1%, the smallest increase in four months, following a 0.2% rise in June.

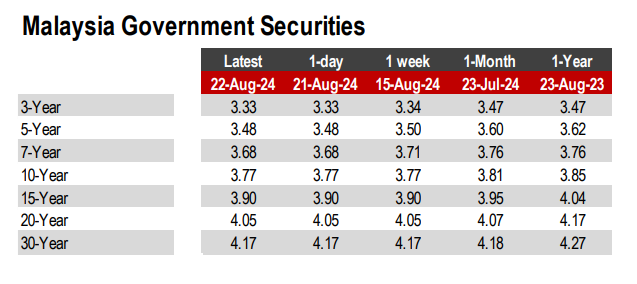

Benchmark Malaysian government bonds closed flat as the overall market saw buying interest countered by profit-taking pressure.

Print of firm UK manufacturing purchasing managers index (PMI) but downbeat Eurozone corresponding data for August added to the two-way flow in the MYR govvies.

In any case, sentiment remained guarded as markets await the Jackson Hole event.

Amid the guarded trading over in the govvies segment, the MYR private debt securities market saw mixed trading yesterday, though there were large flows along select papers yesterday.

“We think investors were looking for fresh catalysts amid the guarded global bond trading before the major economic event later this week,” said AMB.

Larger flows yesterday include Sabah Credit 04/25 (AA1), which was unchanged at 3.68%, and AA2-rated RHB, which fell 1 bps to close at 3.79%

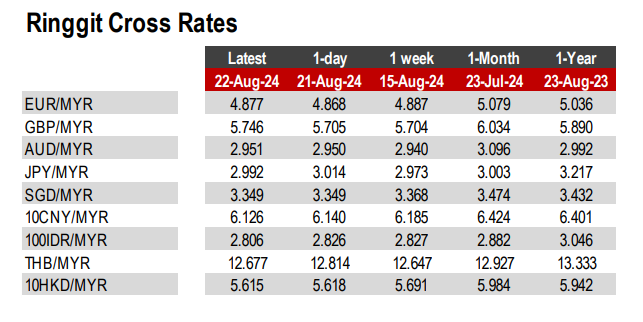

Towards Asia Pacific, as the dollar rose, the yen fell 0.7% to close at 146.29. Also, some downward pressure on the currency could come from the disappointing PMI data.

The JIbun Bank Manufacturing PMI Flash print increased to 49.5 but fell short of the market consensus of 49.8.

This morning, Japan’s core inflation rate in July rebounded to 2.7% year-on-year from 2.6% year-on-year, while its headline inflation stayed at 2.8% for the third straight month.

These perhaps underpin sustainable inflationary pressure that the Bank Of Japan is looking for to raise its interest rates further. In China, the yuan weakened by 0.2%, translating into a weaker AUD by 0.6% day-to-day.

Nonetheless, some good news in Australia is that the Composite PMI went up to 51.4 from 49.9.

The ringgit was flat amidst a cautious market before a major weekend event. However, the ringgit performed better than regional ASEAN currencies. Traders largely ignored yesterday’s Malaysia CPI, which was at a low 2%. – Aug 23, 2024

Main image: astroawani.com