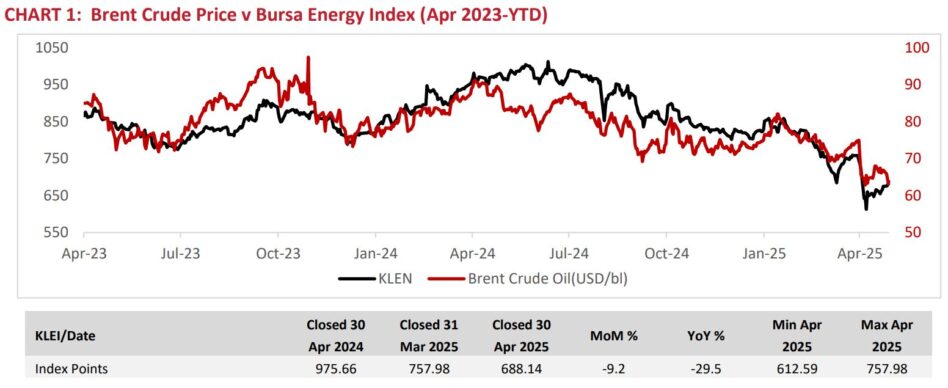

AVERAGE Brent crude oil for Apr 2025 slipped -25.3% year-on-year (yoy) to an average of USD66.53 per barrel (pb), which is lower by -15.7% from 2024’s average of USD79.89 pb.

The decline was due to the anticipated increase in oil production up to 1.4 barrels of oil per day (bbpd) by countries outside of OPEC+ which leads to the accumulation of global oil inventory, and increased OPEC+ production from May.

Also, there was the possibility of increased Iranian oil supply by 400 thousand barrels per day (kbpd) after discussions of renewed nuclear deal.

The continuous decline in oil prices and the uncertainties of the US trade tariffs pushed the KL Energy Index (KLEN) index’s Apr25 spread downwards by -17.9% yoy.

“Moving forward, we anticipates that KLEN will remain volatile until the oil prices are stabilised amid the higher production and higher demand, as well as amid expected minimal impact of the tariffs on conventional fuels,” said MIDF Research (MIDF) in the recent monthly sector report.

With the start of the earnings season, the global oil and gas sector saw significant decline in earnings for both major oil companies and the OGSE players.

For the local front, MIDF expects the trend to echo for local oil and gas companies’ quarter one financial year 2025 (1QFY25) earnings results.

“We believe PETRONAS will continue to operate towards sustaining production at 2mbboepd over the next three years, as highlighted in its Activity Outlook 2025-2027,” said MIDF.

Additionally, 69 development wells are scheduled for 2025, while offshore gas projects such as Kasawari, Jerun and B14 are anticipated to account for nearly 50% of the country’s natural gas production in 2025.

This signals a stable upstream division in the near term, barring any immediate downside risks from oil price crash and increased trade tensions.

Malaysian government had plans to implement a two-tier pricing system for RON95 petrol by mid-CY25, aiming to target the 15% of the wealthiest population to pay at market rates.

“This move is expected to save approximately RM8 bil annually. In light of this, we anticipate that interest for renewables and clean fuels will be renewed, as the ones impacted by the changes in fuel subsidy may invest in,” said MIDF.

This is in line with Malaysia’s goal of constituting 31% of power generation from renewables by CY25, with the aim to reduce carbon intensity by 45% by CY30.

Malaysia’s economy expanded by +4.4% in 1QCY25, driven largely by domestic demand. However, the mining sector, which includes oil and gas, shrunk by -4.9% due to declines in crude oil and natural gas.

“All in all, we maintain our NEUTRAL stance on the oil and gas sector. In Malaysia, we are expecting drags from planned maintenance, weaker production volume, regulatory changes and cost challenges,” said MIDF.

At this juncture, MIDF anticipates that opportunities may shift to other related sectors, notably in renewables and clean energy, as part of ongoing energy transition initiatives and better alignment with ESG mandates. —May 20, 2025

Main image: Energy Capital & Power