AS predicted beforehand, Bank Negara Malaysia (BNM) has hiked another 25 basis points (bps) in its July Monetary Policy Meeting (MPC), bringing the central bank’s total rate hikes to 50 bps so far in 2022.

In the most recent meeting, BNM governor Tan Sri Nor Shamsiah Mohd Yunus mentioned that there is little likelihood that the OPR will be increased significantly before end-2022.

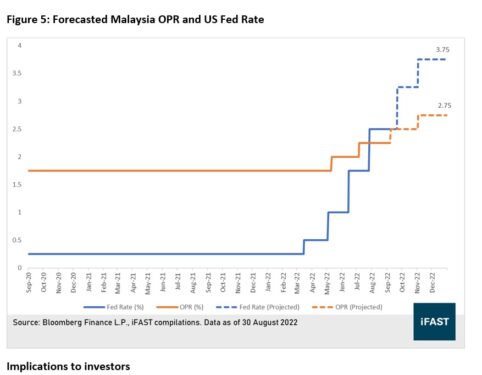

Moving forward, iFAST Research maintains its previous stance that BNM will continue its monetary policy normalisation with another 25bps hike in its benchmark overnight policy rate (OPR) during the next Monetary Policy Meeting (MPC) that is scheduled on Sept 7-8.

Subsequently, we also expect BNM to continue to raise the OPR to 2.75% in November 2022, January 2023 (3.00%) and March 2023 (3.25%).

From our point of view, the OPR hike is unavoidable due to soaring inflation coupled with the US dollar’s appreciation against the ringgit.

Inflationary pressure

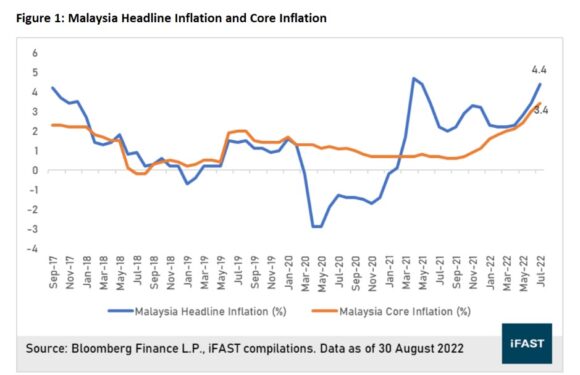

The rate hike expectation is further strengthened amid the latest domestic inflation print which indicates that Malaysia’s inflation continues to be persistently high.

Headline consumer price index (CPI) increased 4.4% year-on-year (yoy) in July 2022 on the back of rising prices of food & non-alcoholic beverages (6.9% yoy), transport (5.6% yoy) and restaurants & hotels (5.8% yoy).

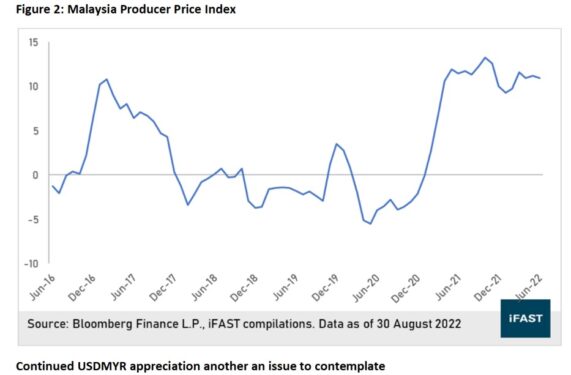

Meanwhile, core inflation also rose 3.4% yoy in July 2022 which is the highest level since March 2016. Although Malaysia’s Producer Price Index (PPI) eased to record a 7.6% yoy growth in July 2022 (vs June’s 10.9% yoy), it is still far above its 10-year average.

The increase in PPI indicates that manufacturers are still facing supply chain bottlenecks and accelerating raw material prices which translate to a higher cost and eventually lead to an upsurge of prices to end consumers.

Furthermore, despite inflation pressures being partly contained by existing price control measures and fuel subsidies, we anticipate that the Government is unlikely to keep the blanket subsidies which is very costly in the long run.

Instead, we believe that the Government will shift from the blanket subsidies to targeted subsidies for those vulnerable groups to reduce the Government’s fiscal deficit and this will trigger a spike in Malaysia’s inflation rate.

Continued US$/ringgit appreciation

Based on US Federal Reserve chairman Jerome Powell’s speech at Jackson Hole Symposium 2022, the central bank does not see itself stopping rate hikes anytime soon, indicating that 75 basis points in the next Federal Open Market Committee (FOMC) meeting is still on the table.

In the meeting, Powell reiterated the Fed’s stance on combating inflation even if it could affect the economy in the near term. In view of the hawkish message delivered, we believe that the Fed may not cut rates as early as the markets are hoping for in 2023.

The strong hawkish stance from the Fed would result in further greenback appreciation which would be detrimental to the ringgit if BNM continues to maintain OPR at the current level and allow the interest rate differential to widen too rapidly. Hence, we believe that this is another consideration for BNM to continue its monetary policy normalisation.

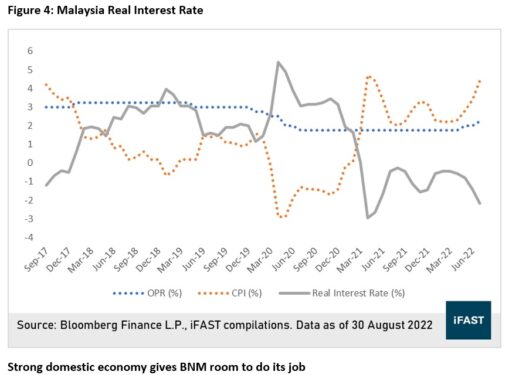

Negative real interest rates

The real interest rate in Malaysia which is the nominal interest rate minus the inflation rate has been in negative territory since 2021. A prolonged negative real interest rate is detrimental to the economy as inflation erodes savings and diminishes the purchasing power of consumers.

With the latest July 2022 inflation data, this situation has worsened, hence we anticipate it is imperative that BNM take proactive measures to reverse the negative real interest rate environment.

Strong domestic economy

Malaysia’s 2Q 2022 economy expanded 8.9% yoy, thanks to the pent-up demand from the loosening restrictions and low base effect last year. Consumer spending jumped 18.3% yoy on easing lockdown measures while manufacturing was up 9.2% yoy as electrical and electronic (E&E) products showed strong worldwide demand.

Also, the unemployment rate has been showing a healthy downtrend since the unprecedented COVID-19 pandemic by reaching 3.87% in 2Q 2022.

With the indicators shown above, we are confident that Malaysia’s domestic economy is on the right track with these healthy macroeconomic data lending to BNM’s stance to continue monetary policy normalisation from the historically low OPR.

BNM has hiked Malaysia’s OPR by 50bps so far in 2022 amid higher inflation alongside rejuvenating economic data. Moving forward, we reiterate our previous stance that there will be two more 25bps hikes left by end-2022, bringing the interest rate to 2.75%. Looking further into 2023, we also expect BNM to raise rates by another two times to bring the OPR to 3.25% by 1H 2023.

Implications to investors

We are going to be surrounded by an elevated inflation environment while monetary tightening is around the corner. As such, we advocate investors grab the opportunities and stay invested to curb inflationary pressures and achieve their financial goals in future.

With more rate hikes on the way, now is probably a good time for investors to reassess their portfolios and position themselves accordingly. We reiterate our view to hold equities vis-à-vis bonds amid the expected tightening environment.

Those with growth-heavy portfolios (eg heavy on US equities) should consider diversifying their equity exposure to include more value-oriented equities as rates rise.

The value sector would be appropriate for Malaysian investors to swim against the hawkish tide. From our point of view, we like the financial industry because financial institutions are the best proxy for economic recovery and a significant benefactor of rising interest rates.

Also, we reiterate our optimistic view on Malaysia equities. Fixed income-wise, we suggest conservative investors stay within short to medium segment. – Sept 5, 2022