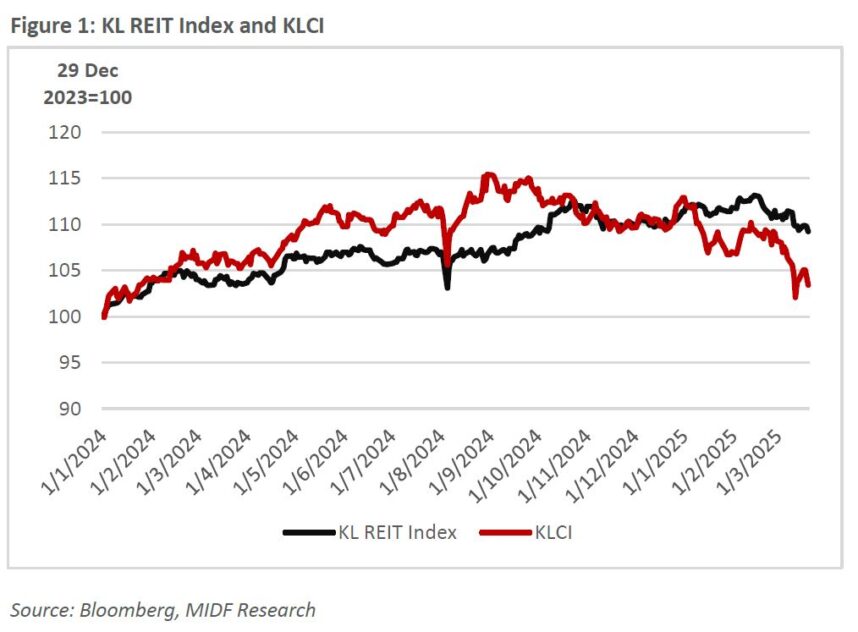

PERFORMANCE of the real estate investment trust (REIT) sector was relatively stable amid volatile market with marginal decline of -1.8% against KLCI’s decline of -8.4%.

The resilient performance of KL REIT Index was mainly underpinned by flight to safety and strong interest on defensive stocks during market turbulence.

Overall, earnings growth of REIT in calendar year 2024 (CY24) were driven by recovery of retail market which support tenant sales growth and positive rental reversion.

Rental reversion of malls was positive at mid-single digit as shopper footfall at malls remains encouraging.

“Looking forward, we expect earnings in CY25 to continue support by organic growth of positive rental reversion,” said MIDF Research (MIDF) in the recent Thematic Sector Report.

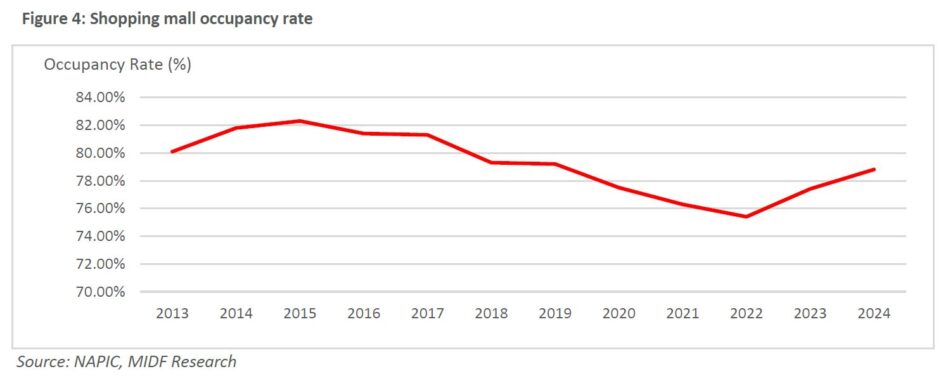

According to data released by National Property Information Centre (NAPIC), occupancy rate of shopping complex in Malaysia recovers to 78.8% in 2024 from 77.4% in 2023.

Note that occupancy rate of shopping complex dipped to 75.4% in 2022 due to Covid-19 pandemic and subsequently recovered to 77.4% in 2023 as retail industry in Malaysia recovered.

The recovery in occupancy rate of shopping complex in Malaysia was mainly driven by improving tenant sales as a result of higher shopper footfall and recovery in consumer spending at malls.

“We see prospect for shopping complex in Malaysia to remain positive going forward as malls are served as a social hub for gathering which prompted higher tenant mix of food & beverage,” said MIDF.

Besides, shopping at malls have also become a pastime activity in city centre and suburban area.

Hence, MIDF thinks that the stable prospect for retail industry will continue to support positive rental reversion of shopping malls and drive earnings growth of retail REIT.

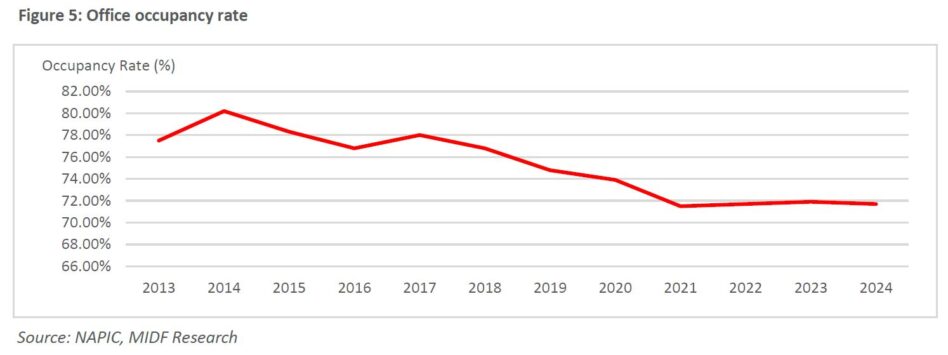

Occupancy rate of office building in Malaysia is subdued at 71.7% in 2024, little-changed from occupancy rate of 71.9% in 2023.

Occupancy rate of office building declined to below 72% in 2021 as Covid-19 pandemic reduced demand for office space and as total office space increased to 18 mil square meter in 2022 from 17.3 mil square meter in 2021.

Meanwhile, total office space in 2024 is flattish at 18.84 mil square meter from 18.7 mil square meter in 2023.

The subdued occupancy rate of office buildings keeps rental rate of office buildings flattish.

“Looking forward, we see less exciting outlook for office building as adoption of hybrid-working arrangement reduced demand for office space and as subdued occupancy rate at 72% level keeps office market remains tenant’s market with low upside to rental rate,” said MIDF.

Industrial property market in Malaysia grew steadily in the past five years due to the resilient demand for industrial property in Malaysia.

Industrial property market saw improving transaction volume and value in the past four years.

Transaction volume and value of industrial property saw a dip in 2020 due to Covid-19 pandemic but subsequently recovered strongly and resumed uptrend trajectory in 2022 to 2024 due to strong demand for industrial property in Malaysia.

The positive prospect for industrial property attracted more REIT increasing exposure to industrial property.

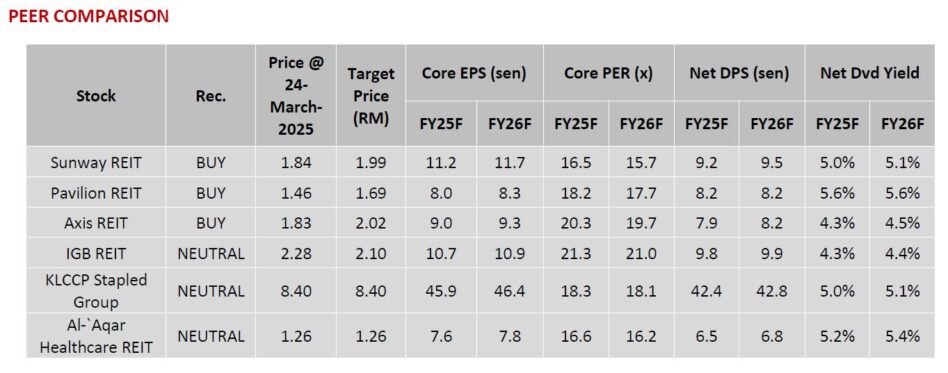

“We remain positive on the outlook for REIT in 2025 as we expect organic growth from positive rental reversion for retail-focused REIT and industrial-focused REIT,” said MIDF.

Retail industry is expected to remain resilient in 2025 as shopper footfall and tenant sales should remain strong. —Mar 26, 2025

Main image: CompareHero