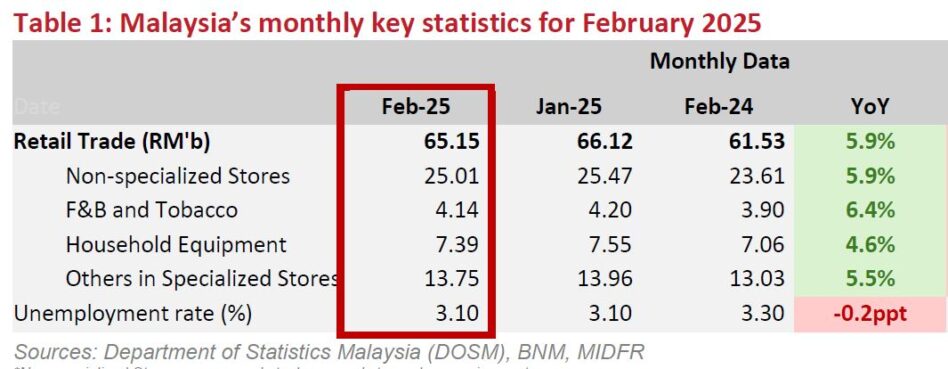

MALAYSIA’s retail trade continued to chart a resilient growth trajectory, expanding 5.9% year-on-year (yoy) to RM65.15 bil in Feb-25.

This brought cumulative retail sales for the first two months of the year to RM131.27 bil, up +7.0% yoy from RM122.64 bil in the second month of calendar year 2024 (2MCY24), signalling unwavering domestic consumption strength.

“The expansion was fuelled by buoyant demand in food & beverage and tobacco, alongside sturdy sales in non-specialized stores, which include hypermarkets, supermarkets, and convenience outlets,” said MIDF (MIDF) Research in the recent Monthly Sector Report.

While monthly growth saw a modest dip following January’s festive-driven surge, the broader trend remains upbeat.

Malaysia’s labour market continues to be the bedrock of consumer resilience, with the unemployment rate steady at 3.1% and employment growth consistently outpacing labour force expansion for 43 consecutive months.

On the price front, inflation pressures stayed well-anchored. Headline consumer price index (CPI) moderated to +1.5% yoy in Feb-25, while core CPI edged up slightly to +1.9% yoy, signalling limited erosion to consumer purchasing power.

“Looking ahead, we expect retail consumption to stay upbeat, underpinned by structural tailwinds such as civil servant pay hikes, higher minimum wages, cash assistance, and a recovering tourism sector,” said MIDF.

These factors are set to enhance household spending capacity and drive sustained momentum across the retail landscape.

Malaysia’s tourism sector is off to a strong start in 2025, sustaining the solid momentum seen throughout 2024.

International tourist arrivals climbed to 4.3 mil in the first two months of the year, surpassing the 3.7 mil recorded in 2MCY24 and inching closer to the pre-COVID peak of 4.4 mil in 2MCY19.

This marked resurgence underscores the return of travel confidence, bolstered by visa-free entry policies for China and India, improved flight connectivity, and proactive global marketing campaigns.

With momentum building early in the year, Malaysia is well on track to meet its Visit Malaysia Year 2026 target, reinforcing the tourism sector’s role as a key pillar of domestic economic recovery.

Sabah’s tourism revival has gained remarkable traction, positioning the state as a key beneficiary of Malaysia’s broader travel resurgence.

Tourist arrivals reached 0.6 mil in 2MCY25, rising from 0.5 mil in the previous year and closing in on pre-pandemic benchmarks.

In 2024, Sabah welcomed 3.15 mil visitors, exceeding its full year target of 3.0 mil, and has now set an ambitious goal of 3.5 mil arrivals for 2025.

This is supported by stronger air traffic, particularly from AirAsia, which aims to bring in 5.0 mil passengers to Sabah this year, versus 3.7 mil in 2024.

The influx of international and domestic travellers is expected to drive robust spillover demand across F&B, retail, and convenience services, especially in tourism-heavy zones such as Kota Kinabalu, Sandakan, and Semporna.

“Looking ahead, we anticipate sustained strength in Malaysia’s tourism momentum, underpinned by robust government initiatives and long-term structural drivers,” said MIDF.

The RM550 mil allocation for tourism under Budget 2025, coupled with continued visa facilitation for key markets, is expected to reinforce international arrivals.

The Visit Malaysia Year 2026 campaign, which targets 35.6 mil tourists and RM147.1 bil in receipts, will serve as a key anchor for long-term growth.

At the same time, enhancements in international air connectivity, airport infrastructure upgrades, and a pivot toward high-value experiential tourism are set to drive higher per capita tourist spending, catalysing broader consumption across the domestic economy.

The resurgence in tourist arrivals is expected to translate into meaningful gains for consumer-facing businesses with strong exposure to travel-centric spending.

“As international arrivals continue to climb, we believe the consumer sector remains one of the most direct and compelling beneficiaries of Malaysia’s revitalised tourism landscape,” said MIDF.

“Despite a more subdued macro-outlook, we continue to hold a positive view on the consumer sector, which remains underpinned by structural consumption drivers and defensive earnings visibility,” said MIDF.

Household spending is expected to remain resilient, supported by wage adjustments in the services sector, targeted government assistance, and favourable base effects.

In particular, the consumer staples segment is likely to outperform, benefiting from non-discretionary demand and limited exposure to external shocks.

“With rising disposable income, stable employment, and manageable inflation, we believe domestic consumption will remain a key anchor of gross domestic product growth in 2025,” said MIDF.

MIDF reiterates their positive stance on the consumer sector, underpinned by a compelling combination of macro stability and sector-specific tailwinds. In their view, the sector is well-supported by five key catalysts:

1/ Rising disposable income, fuelled by broad-based wage adjustments, civil service salary revisions, and sustained government support.

2/ Resilient household spending, anchored by a robust labour market and low unemployment.

3/ A continued surge in tourist arrivals, which is set to lift footfall across F&B and retail channels.

4/ Improving cost dynamics, as a firmer ringgit and lower commodity prices ease margin pressures.

5/ The sector’s defensive earnings profile, with consumer staples offering attractive downside protection amid market volatility. —Apr 21, 2025

Main image: Business Today