AFTER an amazing 26% growth in 2021, the Malaysia Semiconductor Industry Association (MSIA) expects an industry growth of 8%%-10% in 2022 followed by a weaker 2023 in view of weaknesses in consumer-centric end market, namely personal computer (PC) and smartphone although the automotive segment remains resilient with strong bill-to-book ratio.

Despite the recent scaled-down capex plan by major players (Intel, Micron and TSMC), MSIA opines that this will not impact the industry significantly as the equipment lead time remains long.

“Fabs (microchip manufacturing plants) will continue to get equipped but might put manpower on hold until orders are secured,” the association’s president Datuk Seri Wong Siew Hai told Hong Leong Investment Bank (HLIB) Research.

“(However), global investments remains very robust with a total value of US$1.2 tril planned, broken down into US$511 bil country subsidies and US$695 bil investment roadmaps by companies over the next 10-20 years.”

The impending challenges now include:

- Economic headwinds (inflation, global recession risk and Taiwan-US-China tensions);

- Demand correction in consumer products;

- Supply disruptions (fire incident at Japan fabs, weather disruption in US, power outage in Germany, power allocation in China, Russia-Ukraine conflict, major drought in Taiwan and China’s Zero-COVID policy); and

- Shortage of workers and talents.

In the past 12 months, a total of RM52 bil semiconductor investments which targets to create 11,000 jobs were unveiled. They include (i) Infineon (RM9.1 bil); (ii) Intel (RM30 bil); (iii) TF-AMD (RM2 bil); (iv) Nexperia (RM1.6 bil); (v) Sensata (RM500 mil); (vi) Ferrotec (RM500 mil); (vii) TTM Technologies (RM550 mil); and (viii) AT&S (RM8.5 bil).

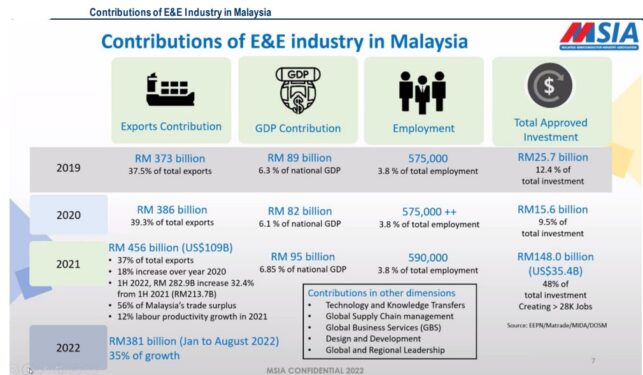

“Malaysia remains a key player in the global supply chain with (i) 7% of total global semiconductor trade flows through Malaysia; and (ii) the country commands 13% of global chip testing and packaging market share,” reveals Wong.

“E&E (electrical & electronic) industry remains the largest contributor to Malaysia’s export. In view of the impending implementation of Global Minimum Tax (15%), MSIA is working with the Government to improve non-monetary incentives (such as automation, talent, supply chain, R&D, connectivity, etc) to attract FDIs (foreign direct investment) into this industry.”

All-in-all, HLIB Research reiterates its “overweight” outlook on the technology sector to experience multi-year earnings growth supported by fundamental exponential demand which is further enticed by government incentives.

“We maintain our tactical position in favour of front-end players as many countries have rushed to develop their semiconductor capabilities, especially in leading edge (≤7nm) front-end fabrication (foundry) to be self-sufficient on the back of national strategic and security interests,” justified the research house.

Its top picks are Frontken Corp Bhd (“buy”; target price RM3.20) and UWC Bhd (“buy”; TP: RM4.38) which have exposures to front-end business segments. – Oct 26, 2022

Main photo credit: CDI Global