WITH few impactful developments ranging from inflationary/recessionary concerns and interest rate spikes becoming inevitable in recent times, CGS-CIMB Research has updated its stock market outlook for Malaysia in tandem with the roll-out of a report that delineates its 2H 2022F equity strategy outlook from a Shariah perspective.

Eight key events to watch in 2H 2022, according to the research house, are:

- Global/Malaysia monetary policy decisions;

- Potential fiscal stimulus measures to avert global slowdown/recession;

- Potential 15th General Election (GE15) and its outcome;

- Developments on the Russia-Ukraine conflict;

- Results seasons in August and November;

- Details of Budget 2023;

- Government policies on 5G, Imbalance Costs Pass Through (ICPT) for Tenaga Nasional Bhd, return of foreign workers and large construction projects; and

- Risk of any major COVID-19 outbreak that forces governments to impose lockdowns.

“We advise investors to take shelter in sectors/stocks with defensive earnings (utilities, telco, healthcare & consumers) and high dividend yields,” opined head of research Ivy Ng Lee Fang in the strategic note. “We also like beneficiaries of rising interest rates and the return of foreign tourists.”

Against the backdrop of the ringgit having depreciated by 6.3% year-to-date (YTD) against the greenback to RM4.425/US$1, CGS-CIMB Research expects a weak ringgit to generally benefit export earners.

This refers to palm oil, rubber gloves, technology, oil and gas (O&G), shipping, furniture, timber and food or manufacturing companies with a high proportion of export earnings or where Malaysia has a competitive edge in terms of land, power, labour costs and investment incentives.

“It is also positive for companies that earn a high proportion of revenue from foreign subsidiaries, notably IHH Healthcare Bhd, PPB Group Bhd and MISC Bhd,” suggested CGS-CIMB Research.

“A weak ringgit is negative for auto players, airlines and F&B (food & beverage) companies if they are unable to pass on the higher costs to consumers due to weak demand. Other key losers of a weaker ringgit are companies with high foreign shareholding and high costs denominated in foreign currencies.”

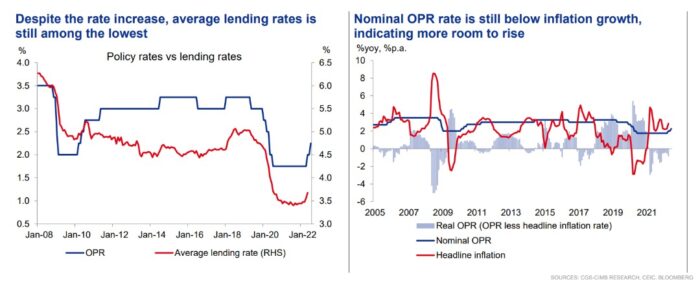

On the current high interest rate environment, CGS-CIMB Research said an overnight policy rate (OPR) hike is positive for banks as their total floating-rate loans are larger than their total fixed deposits (both likely to be re-priced upwards following an OPR hike).

“Companies with high net cash balances could also benefit given the higher interest income,” observed the research house.

“OPR hikes are negative for cyclical sectors such as property, auto and consumer due to the decrease in consumers’ disposable income. A rate hike is also negative for companies with high floating-rate ringgit borrowings due to higher interest expense.”

CGS-CIMB Research expects Bank Negara Malaysia (BNM) to raise its OPR rate by 25 basis points (bps) in September, hence ending 2022 with a rate of 2.50% followed by another two 25bps hikes in 1H 2023F.

With GE15 round the corner, the research house expects the potential beneficiaries to be highly regulated sectors or companies dependent on government contracts.

“(They) are likely to see higher volatility pre-election and could potentially benefit post-election if there is more policy clarity – telcos (Telekom Malaysia Bhd & Maxis Bhd); utilities (Tenaga Nasional & Malakoff Corp Bhd); My EG Services Bhd, and contractors (Gamuda Bhd, HSS Engineers Bhd & IJM Corp Bhd),” reckoned the research house.

“Consumer sector (MR DIY Group (M) Bhd, Farm Fresh Bhd, Kawan Food Bhd, QL Resources Bhd and Bonia Corp Bhd) could do well pre-election as the Government will likely implement market-friendly policies like cash handouts and subsidies to assist consumers.” – July 28, 2022