MAYBANK IB Research has upgraded both Capital A Bhd – the operator of budget carrier AirAsia – and its long-haul sister airline AirAsia X Bhd – to “buy” following the release of merger details between Capital A’s four airlines and AAX.

However, the research house contended that more needs to be done by Capital A to lift its Practice Note 17 (PN17) classification.

“The merger is value dilutive in the short term but may be value accretive in the long term. We restore our ‘buy’ call with a 94 sen SOP (sum-on-parts) target price (TP) on Capital A,” projected analyst in a Malaysian aviation sector review.

“For AAX, the merger is EPS (earnings per share) neutral but may be value accretive due to the more stable earnings profile of the enlarged group; we maintain our RM1.52 TP. With 26% upside, we upgrade AAX to ‘buy’.”

Stating that “a little more work still needs to be done”, Maybank IB Research expects Capital A’s shareholders’ equity position to still be negative to the tune of -RM2.5 bil to -RM1.3 bil even after undertaking the merger exercise.

“Yet, recall that Capital A intends to list the vehicle that will own its AirAsia brand on the NASDAQ. This will narrow its negative shareholders’ equity position by another RM2.5 bil and turn its shareholders’ equity position positive in an effort to uplift its PN17 classification,” opined the research house.

“Post disposal, Capital A will not generate much earnings going forward. Substituting our valuation of the four airlines with the afore-mentioned RM3.0 bil implies that our valuation per share will be reduced to 81 sen from 94 sen. While the disposal is value dilutive in the short term, there will be upside if AirAsia Group’s (AAG) share price rises in the long term.”

‘AAX likely the surprise winner’

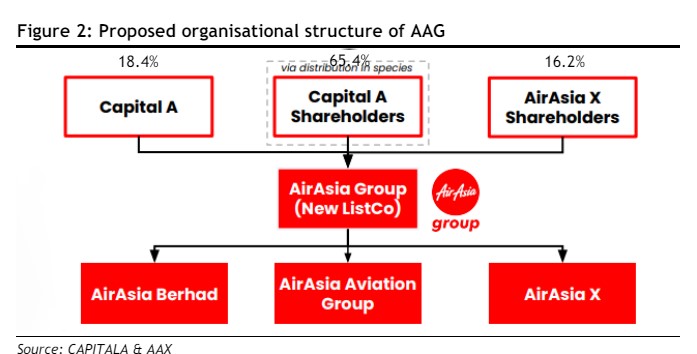

For context, AAX is poised to create a ‘New ListCo’ called AirAsia Group (AAG) to which it will transfer its listing status to and carries out a 1:1 share exchange.

AAG will acquire 100% of Malaysia AirAsia (MAA) from Capital A for RM3.8 bil but no cash will be exchanged.

Additionally, AAG will also acquire 43% of Thailand AirAsia (TAA), Indonesia AirAsia (IAA) (49%, Philippines AirAsia (PAA) (100%) and 51% of Cambodia Airsia (CAA) from Capital A for RM3.0 bil via 2.3 billion new AAG shares at RM1.30/share (1.7 billion shares will be distributed in-specie to Capital A shareholders).

At the end of the day, AAG will own 100% of MAAX (AirAsia X), MAA & PAA; 51% of CAA; 49% of TAAX (Thai AirAsia X) & IAA and 43% of TAA.

To AAX shareholders, one free warrant will be issued for every two AAX shares with AAG intending to undertake a RM1.0 bil private placement during the pre-merger period.

At the end of the day, Maybank IB Research reckoned that AAX “could be the surprise winner” from the merger exercise.

“While the acquisition of Capital A’s four airlines is EPS neutral, we note that the operations of Capital A’s four airlines are a lot more stable than AAX’s due to resilient demand for the former’s short haul flights as opposed to AAX’s medium to long haul flights,” envisages the research house.

“When all of Capital A’s four airlines’ aircraft return to service, the enlarged AAG’s group earnings ought to be more stable than AAX’s currently. Thus, we do not discount the possibility that the investing community will ascribe more generous valuation to it.”

Added Maybank IB Research: “As such, we are of the opinion that existing AAX shareholders could be more positively impacted by this development with their more valuable AAG shares and free warrants.” – April 29, 2024