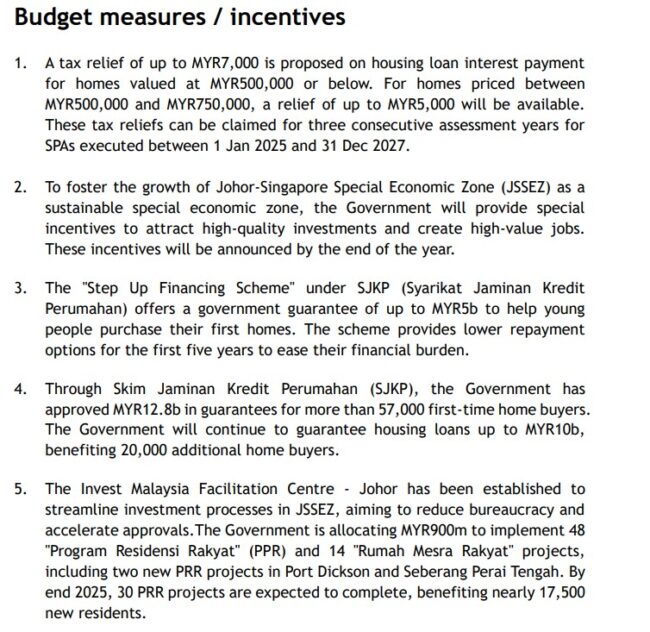

MAYBANK IB Research has described Budget 2025 measures to give Malaysia’s real estate sector a shot in the arm as” below our expectation” given the much-anticipated RM30,000 financial assistance for first-time homebuyers was not announced.

Moreover, while it did not expect the re-introduction of the Home Ownership Campaign (HOC) in Budget 2025, the market did which could lead to disappointment among investors.

“Contrary to popular belief, we think that the HOC would not benefit developers with strong brand names and marketing teams,” commented analyst Wong Wei Sum in a property sector review post last Friday’s (Oct 18) tabling of Budget 2025.

“Instead, it would level the playing field and intensify competition as all developers would be able to offer the stamp duty waiver.”

Looking ahead, Maybank IB Research envisages that near-term investment themes for the property sector include incentives for the Johor-Singapore Special Economic Zone (JS-SEZ) which is expected to be announced in December this year as well as news flow on the Kuala Lumpur-Singapore High-Speed Rail (HSR) project.

“We expect these themes to provide trading opportunities for investors. In contrast, sustainable drivers for the sector remain asset crystallisation – whether through land sale (to data centre operators) – or corporate exercise (such as the listing of the property players’ other operations like healthcare or investment properties),” envisages the research house.

In Maybank IB Research’s reckoning, the most glaring property sector incentive from Budget 2025 seems to be the personal tax relief of up to RM7,000 and RM5,000 on housing loan interest payments for homes valued at ≤RM500,000 and RM500,000-RM750,000 respectively.

Despite the shortcomings, Maybank IB Research retained its “positive” outlook on the property sector.

“Our investment strategy for the sector is unchanged which is to be selective in the JS-SEZ theme by focusing on strong executors with solid fundamentals that can enhance shareholders’ value in the medium term,” projected the research house.

“The JS-SEZ location is likely to cover a larger area which could dilute the positive impact on developers and level the playing field for all landowners. Therefore, strong track record and capable management are key to maintaining competitiveness.”

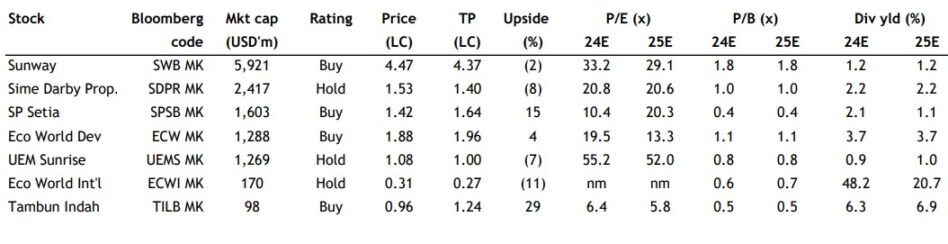

On this note. Maybank IB Research maintained its “buy” recommendations are SP Setia Bhd and Eco World Development Group Bhd. – Oct 21, 2024

Main image credit: EcoWorld