MAYBANK IB Research has downgraded the Malaysian glove sector to “neutral” from “tactical positive” on grounds that the sector’s recovery has been partially priced in.

This follows the sector’s inventory replenishment since early-2024 coupled with it set to benefit from a higher 50% US tariff on China-made gloves from 2025 and 100% from 2026.

“This will boost utilisation rates and ASPs (average selling prices). However, risks persist from China rivals in non-US markets, their overseas expansion and potential higher US tariff extending beyond China-made gloves,” opined analyst Wong Wei Sum in her outlook on the Malaysian glove sector.

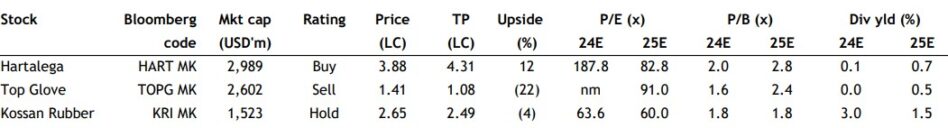

“We downgrade the sector to ‘neutral’ after the recent share price rally. We maintain a ‘buy’ on Hartalega Holdings Bhd but but downgrade Kossan Rubber Industries Bhd to ‘hold’ (from ‘buy’) and Top Glove Corp Bhd to ‘sell’ (from hold’). New contagious diseases outbreaks may offer trading opportunities.”

As it is, Maybank IB Research expects ASPs to improve to US$21-US$23/1,000 pieces in 4Q 2024-2025 based but still below US’ cost of imports from China post higher tariffs from <US$21/1,000 pieces prior to 4Q 2024 which have led to improved margins and a larger market share in the US.

“Higher ASPs for the Malaysia glove makers will also help offset rising costs from the RM1,700 monthly minimum wage hike (from RM1,500) effective February 2025,” projected the research house

“Due to cautious and just gradual capacity expansion, we expect plant utilisation rates to remain high at 65%-85% in 4Q 2024-2025 (vs 30%-50% in 2023).”

Despite the seemingly better prospects, Maybank IB Research reckoned that there are still inherent risks involved for Malaysian glove players.

“China glove makers are responding to US’ higher tariffs with strategies to expand sales to the non-US markets and establishing production facilities outside of China (ie Southeast Asia). This could come onboard as soon as 2H 2026 or 2027,” noted the research house.

“Additionally, potentially higher tariff under the Trump administration on Malaysia gloves could pose risk as any import restrictions by the US or additional tariffs could undermine the growth trajectory of Malaysia’s glove sector and erode its competitiveness in the US market.” – Dec 16, 2024