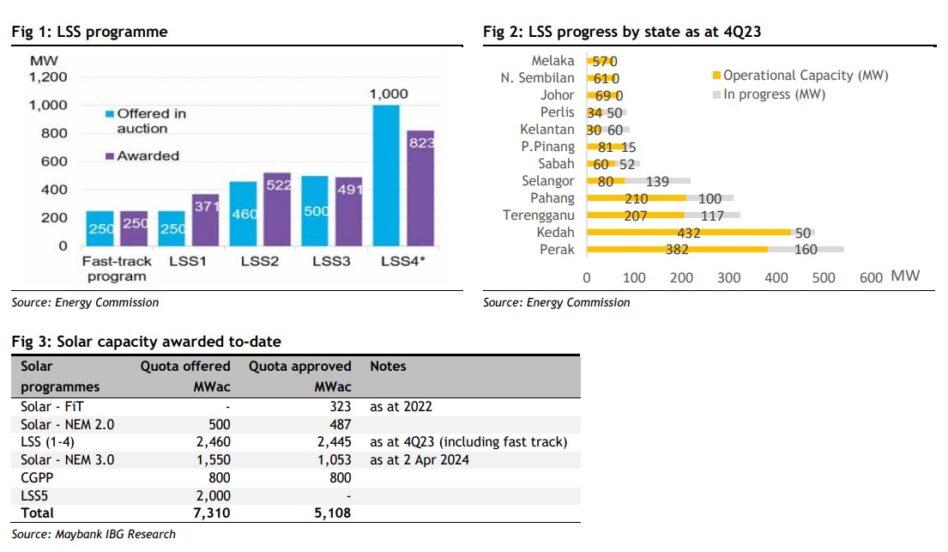

MAYBANK IB Research has reiterated its positive stance on Malaysia’s renewable energy (RE) industry outlook following unveiling of the fifth cycle of the Large-Scale Solar (LSS5 or LSS PETRA) tender.

The Energy Transition and Water Transformation Ministry via the Energy Commission (EC) is currently seeking proposals through a competitive bidding process to develop the LSS5 projects totalling 2GW (gigawatt) in capacity. All LSS5 projects are scheduled to commence operations by 2026.

“To-date, no EPCC contracts have been awarded from the 800MW of Corporate Green Power Programme (CGPP),” analyst Nur Farah Syifaa highlighted in a research note on the Malaysian RE scene.

“We understand from industry players that the awards will be soon. The roll-out of LSS5, on-going NEM (Net Energy Metering) and CGPP (Corporate Green Power Programme) will keep the RE players busy for the next two to three years.”

There are four packages available under LSS5 with project capacity ranging between 1MW-500MW each. Three out of the four packages are for rooftop or ground-mounted solar projects with an aggregate quota of 1.5GW.

The fourth package is for floating solar projects with a total quota of 500MW (megawatt). The tender requires minimum Bumiputera or local Malaysian equity requirements to increase local participation in the RE industry.

“Assuming EPCC works value of RM3.6 mil per MW, we estimate the offered capacity is worth about RM7.2 bil in EPCC works,” envisages Maybank IB Research. “We expect the shortlisted bidders to be announced in 4Q 2024 after the deadline for proposals submission on July 25.”

Notable solar EPCC players include Solarvest Holdings Bhd, Cypark Resources Bhd, Sunview Group Bhd, Pekat Group Bhd and Samaiden Group Bhd.

Among the RE pure-plays, Maybank IB Research has “buy” rating on Solarvest (target price: RM 1.76) while in the broader utilities space, the research house has a “buy” on Mega First Corp Bhd (MFCB) (target price: RM4.70). – April 4, 2024

Main image credit: StarBiz