THE Malaysian stock market started 2025 on a volatile note with external uncertainties overshadowing fund flows and investment actions.

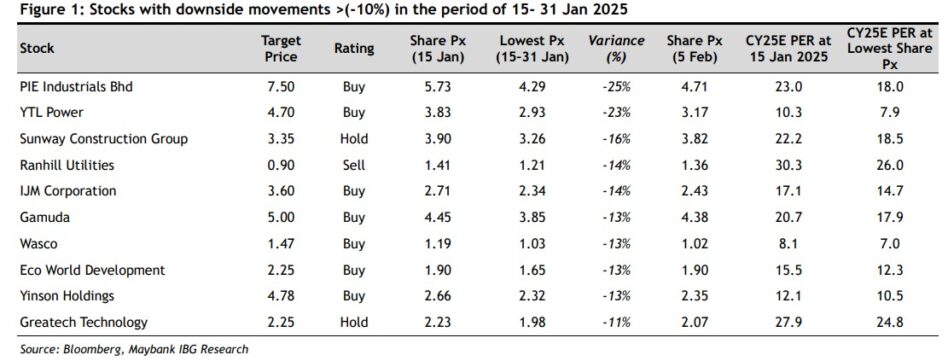

With the FBM KLCI hitting below our bear case of 1,580 (lowest at 1,545), we list stocks that have declined by >10% over the month, thus offering investors an opportunity to accumulate, especially those that were affected by the artistical intelligence-data centre (AI-DC) theme.

The stocks include PIE Industrials Bhd, YTL Power International Bhd, IJM Corp Bhd, Gamuda Bhd and Eco World Development Bhd.

Alternatively, investors could seek shelter in sectors that are agnostic to the AI-DC theme, domestic-driven and defensive.

They comprised banking [AMMB Holdings Bhd, CIMB Group Holdings Bhd & Public Bank Bhd]; consumer [AEON Co (M) Bhd, Mr D.I.Y. Group (M) Bhd & Farm Fresh Bhd]; and healthcare [IHH Healthcare Bhd, KPJ Healthcare Bhd and Optimax Holdings Bhd].

Over-reaction to AI-DC

We believe stocks such as PIE, YTL Power and Gamuda have been unduly punished, hence their pullback offers an opportunity to accumulate.

PIE which carries the weight of its strength from its parent Hon Hai/Foxconn which in turn is a key Nvidia supplier with sales growth driven by rising AI demand, should still be on track to deliver.

With a construction orderbook related to DC of <7%, Gamuda also saw its value decline >10% despite its diversified revenue streams from Australia, Taiwan and infrastructure-led projects in Malaysia.

IJM and Sunway Construction Group Bhd (Suncon) were also affected as contractors; we have since upgraded Suncon to “hold” (from “sell”) on valuations (as we have also reiterated “positive” Malaysia’s construction sector).

While YTL Power took a plunge from this theme, its share price action was further exacerbated by its proposed corporate exercise of a bonus issuance of unlisted warrants.

However, its current valuations suggest that YTL Power’s AI-DC value has been completely discounted.

By sheer association to the AI-DC theme, property developer Eco World was also not spared given its land sales to Microsoft in addition to we seeing value of its potential in the Johor-Singapore Special Economic Zone (JS-SEZ) theme.

Brace for short-term volatility

If we have to stripe out the AI-DC theme from the equation in the market, key sectors that should still drive the FBM KLCI index would be the banks and consumer sectors on domestic-driven factors while healthcare offers defensiveness.

Macro-driven support lends strength to these sectors from expected stronger consumer spending patterns and the investment upcycle.

Demand for healthcare remains robust, further aided by medical tourism. The FBM KLCI index component picks for these sectors are CIMB, Public Bank Mr DIY and IHH. Other potential buys include AMMB, Farm Fresh, KPJ and Optimax.

Our five themes for 2025 – (i) external disruptions; (ii) domestic secular plays; (iii) state-driven activities, (iv) investment realisation; and (v) corporate restructuring – are intact despite short-term volatility.

Wildcards from external trade-related policies may still stir a storm in the cup but we believe there is still upside to the Malaysian market once the dust settles. Our 1,740 year-end FBM KLCI target (15 times 2026E price-to-earnings ratio) is unchanged. – Feb 6, 2025

Lim Sue Lin is a market analyst at Maybank IB Research.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.