EARNINGS delivery of telco companies under Kenanga Research (Kenanga)’s coverage provided a mixed outlook sequentially in quarter one of calendar year 2025 (1QCY25).

Revenue for the local fixed players expanded by 0.8% year-on-year (YoY) ,mainly driven by TIMECOM, as its retail segment delivered solid subscriber growth amidst stable average revenue per user (ARPU)s.

For the overall sector, core net profit contracted by 13% YoY, mainly attributed to CDB as its quarter one of financial year 2024 (1QFY24) was uplifted by a one-off tax provision reversal.

To a lesser extent, earnings was also weighed by TM due to drag from higher 5G wholesale access payments and elevated device costs.

Mobile net adds were strong, but ARPUs declined for MAXIS. In the mobile space, sequential traction in postpaid net adds sustained for both CDB (+46k) and MAXIS (+161k).

“However, while postpaid ARPU was stable for CDB, it declined to RM65 for MAXIS (4QFY24: RM68) – which we believe reflects the impact of the change in revenue recognition for the Maxis Device Care program,” said Kenanga.

“However, while postpaid ARPU was stable for CDB, it declined to RM65 for MAXIS (4QFY24: RM68) – which we believe reflects the impact of the change in revenue recognition for the Maxis Device Care program,” said Kenanga.

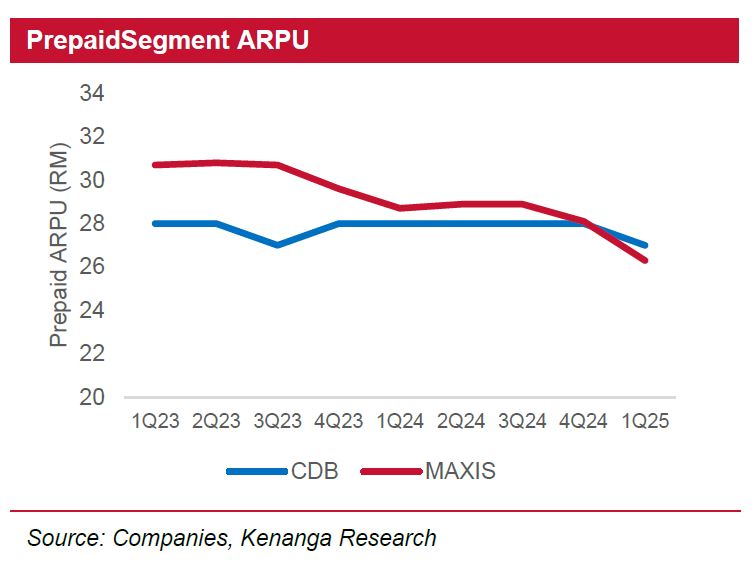

Meanwhile, sequential prepaid net adds remained volatile, although both players recorded stronger quarter-on-quarter (QoQ) net expansion.

In 1QFY25, all major home fiber players (except TIMECOM) recorded sequential declines in net adds and ARPUs, reflecting a sharp rise in competitive intensity.

TM’s ARPU saw the steepest drop, falling to RM127 (from RM134 in 4QFY24), due to aggressive price discounts to retain and attract subscribers.

Meanwhile, CDB (RM96) and MAXIS (RM105) saw ARPUs hitting their lowest levels since 1QFY23.

“We believe competitive pressures initially emerged in 3QFY24 following CDB’s roll-out of converged offerings, mirroring MAXIS’ strategy,” said Kenanga.

However, the impact was initially muted as CDB focused on migrating its existing postpaid base. In 1QFY25, competition intensified sharply as TM turned aggressive in pushing its converged plans, a strategic shift likely triggered by rising 5G costs.

TM’s transition from usage-based billing to a fixed minimum 5G access fee during the quarter may have spurred urgency to accelerate adoption of convergence plans and monetize 5G faster.

This was further supported by higher device subsidies for bundled home-mobile plans to drive subscriber growth in 1QFY25.

Given this is the first quarter showing broad-based competitive pressures, Kenanga maintains a wait-and-see approach until the trend become clearer.

Nonetheless, Kenanga believes that market players, especially incumbent TM, will moderate their aggressiveness, as prolonged price wars could erode long-term industry value for all operators.

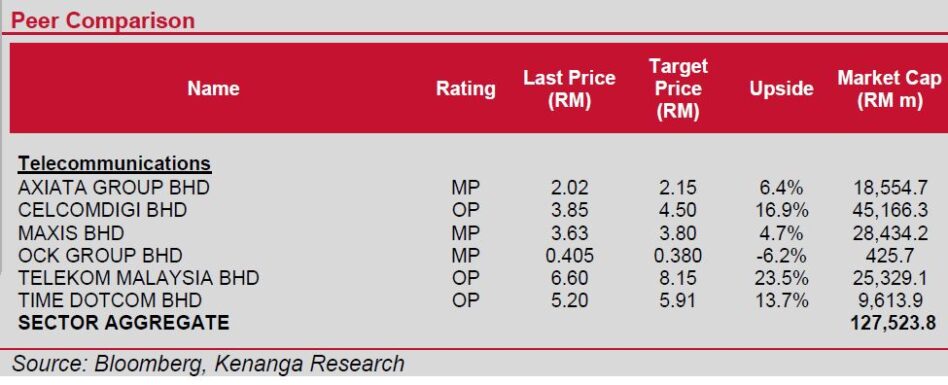

“We maintain our neutral stance on the sector, pending greater clarity on the implementation of Malaysia’s 5G dual network policy,” said Kenanga.

In particular, the final outcome on each MNO’s participation in either NW2 or the existing 5G network will be pivotal in shaping the outlook for earnings, capex, and dividend capacities for the mobile players.—June 9, 2025

Main image: Bernama