INFLATIONARY pressure is likely to prompt another interest rate hike at the last Bank Negara Malaysia’s (BNM) Monetary Policy Committee (MPC) meeting this year.

Kenanga Research expects the central bank to stick to its hawkish stance by realigning with the global policy rate trend to combat inflation.

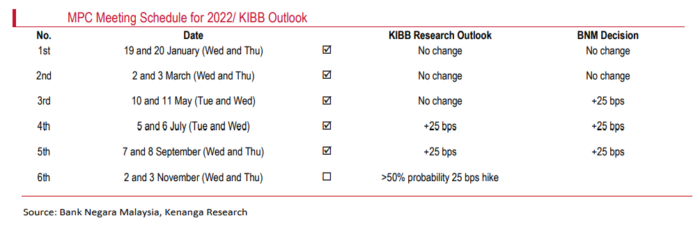

“This would mean BNM would continue to raise the OPR (overnight policy rate) by another 25 basis points (bps) at its next and final MPC meeting for the year (Nov 2-3), bringing it to 2.75%,” projected economic research head Wan Suhaimie Wan Mohd Saidie and team in an economic update.

“Higher inflation and sustained recovery in domestic demand would continue to influence and back its policy decision.”

At its fifth meeting yesterday (Sept 8), MPC expectedly raised the OPR for the third straight time by 25bps to 2.50%.

In concurring with Kenanga Research, Maybank IB Research also expects another round of OPR hike in November.

“Our OPR outlook is total of +100bps hikes to 2.75% in 2022 – of which +75bps hikes to 2.50% have materialise, implying another +25bps hike at the next MPC meeting on Nov 2-3 and another +25bps hike to 3.00% in early-2023, likely at the first MPC meeting next year,” suggested chief economist Suhaimi Ilias.

However, TA Securities Research expects BNM “to take a pause for the rest of this year”.

“We may not see an OPR hike in the November meeting despite rising inflation and economic growth prospects, opined economists Shazma Juliana Abu Bakar and Farid Burhanuddin.

“Instead, the Government is expected to introduce measures under Budget 2023 to rein in the inflationary pressure, including via targeted subsidies and handouts. BNM is likely to resume hiking the OPR again in 2023, bringing the rate to pre-pandemic level of 3.00%. This implies another two rate hikes next year.” – Sept 9, 2022