MALAYSIA’S economy is projected to grow within the range of 4.0% to 5.0% next year, led by the services sector compared to the forecast of about 4.0% for 2023, the Ministry of Finance (MOF) said.

In its Economic Outlook 2024 report released today, the ministry said the growth is envisaged to be broad-based, led by the services sector as intermediate and final services groups are anticipated to rise further, driven by sustained domestic consumption and improved export activities.

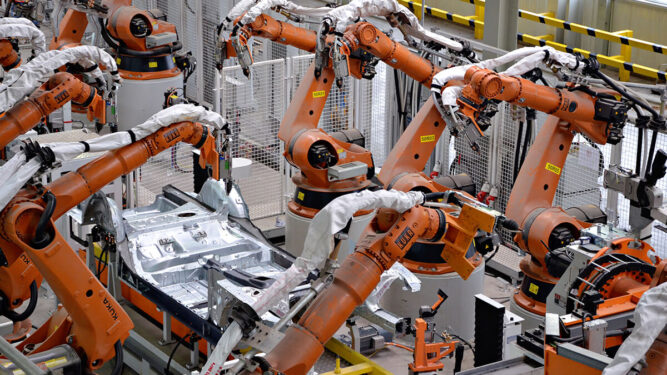

“The manufacturing sector is expected to accelerate, accounted by improved export-oriented industries particularly the electronics and electrical (E&E) products as external demand recovers, while the domestic-oriented industries are anticipated to remain favourable in line with robust domestic consumption and investment,” it said.

For this year, MOF said Malaysia’s gross domestic product (GDP) – driven by domestic demand – is anticipated to register a growth of approximately 4.0% this year.

The ministry said during 1H 2023, Malaysia’s GDP posted a growth of 4.2%, supported by resilient domestic demand, in particular private expenditure.

“The increased external uncertainties will pose risks to the economic growth. Notwithstanding these challenges, the economy continues reaping the benefit from policies and initiatives undertaken over the years to enhance resilience and competitiveness,” it said.

Prime Minister Datuk Seri Anwar Ibrahim said the execution of several policies announced recently, including the implementation of projects under the Mid-Term Review of the 12th Malaysia Plan, will solidify Malaysia’s efforts in becoming Asia’s most dynamic economy in the near future.

“While we may encounter challenges and structural changes, our resilience and capacity to innovate are formidable. It is a collective mission for all Malaysians to unite in harmony, embrace changes and prioritise sustainable growth strategies.

“It is vital to ensure that the economic pie distribution is fair and equitable, prioritising excellent healthcare services and quality education for all Malaysians,” he said in the report.

Manufacturing outlook

According to the report, the manufacturing sector is forecast to expand by 4.2% in 2024, driven by better performance in both export- and domestic-oriented industries.

“The export-oriented industries are expected to benefit from the recovery of external demand with the E&E segment projected to surge, primarily driven by memory products. This is in line with the rebound in demand for technologically advanced products,” it said.

In addition, the report said the implementation of initiatives under the Chemical Industry Roadmap 2030, the National Energy Transition Roadmap (NETR) and the New Industrial Masterplan 2030 (NIMP 2030) will further strengthen the sector’s growth.

Services sector outlook

The services sector is forecast to increase by 5.6% in 2024, driven by expansion in all sub-sectors, while vibrant tourism-related activities as well as continuous consumer spending are expected to further spur the growth of the sector.

Meanwhile, the report said the agriculture sector is expected to grow by 1.2% next year, driven by expansion in most sub-sectors, particularly oil palm, other agriculture and livestock.

With the anticipation of minimal impact from the El Niño phenomenon and labour conditions returning to the pre-pandemic level, the report stated that palm oil production is projected to increase, contributing to the sub-sector’s growth.

“The crude palm oil (CPO) price is forecast to average within the range of RM4,000 and RM4,500/metric tonne in 2024, partly attributed to anticipation of low output from other vegetable oils and higher demand for CPO from major importing countries,” it said.

MOF said the mining sector is forecast to rebound by 2.7% in 2024, driven by the remarkable performance in natural gas as well as crude oil and condensate sub-sectors.

The construction sector is forecast to increase by 6.8% next year following better performance in all the sub-sectors.

“The civil engineering sub-sector continues to be bolstered by strategic infrastructure and utilities projects, which include ongoing projects such as the Central Spine Road (CSR), the Pan Borneo Sabah Highway and acceleration of projects under the 12th Malaysia Plan, 2021-2025,” it said.

On the demand side, MOF said growth will be buoyed by strong private sector expenditure and improving global demand while consumer spending is envisaged to be robust, supported by improved labour market conditions.

Furthermore, it said recovery in external demand is anticipated to boost exports performance, leading to a larger trade surplus.

“This surplus is attributed to higher export receipts from the goods account, which will cushion the net outflows from transport and other services accounts. Thus, the current account is projected to post a surplus of RM62.2 bil or 3.2% of gross national income (GNI),” it said.

In 2024, MOF said gross exports are anticipated to grow by 5.1% across all sectors, supported by better performance in global trade and improved prospects in the commodity sector.

The growth is partly attributed to the ratification of trade agreements, namely the Regional Comprehensive Economic Partnership (RCEP) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

“Gross imports are expected to increase by 4.9% in 2024, buoyed by higher demand for intermediate, capital and consumption goods,” it added.

In addition to Malaysia’s good economic fundamentals, MOF said expectations of the US Federal Reserve (Fed) reaching the end of its hiking cycle and China’s economic recovery may provide support for the ringgit moving forward.

NO SALES; NO ARCHIVE; RESTRICTED TO EDITORIAL USE ONLY. NOTE TO EDITORS: This photos may only be used for editorial reporting purposes for the contemporaneous illustration of events, things or the people in the image or facts mentioned in the caption. Reuse of the pictur

“Since Malaysia adopts a flexible exchange rate regime, the value of the local currency will continue to be market-determined, and its performance will be influenced by global and domestic developments,” it said.

According to the report, the movement of the ringgit in the first eight months of 2023 was mainly driven by global factors, particularly development in the US and the weaker-than-expected recovery of China’s economy.

“The ringgit began the year on ad strong note, appreciating by 3.2% to close at RM4.2677 against the US dollar as at end-January. The strong performance was buoyed by expectations that the Fed will reach its terminal interest rate soon and optimism surrounding China’s re-opening.

“Nevertheless, the ringgit began to experience a series of depreciation from the middle of February until August. The depreciation was attributed to the change in narrative towards a hawkish tone regarding US policy rate increases during this period,” it noted.

The report stated that inflation rate is forecast to range between 2.1% and 3.6% next year, partly attributed to a gradual shift towards a targeted subsidy mechanism in ensuring a more equitable distribution of resources.

Additionally, it said the potential risks to the inflation outlook remain subject to the fluctuations in exchange rates and supply-related factors, such as global commodity prices, geopolitical uncertainties and climatic conditions.

“The unemployment rate in 2024 is anticipated to return to the pre-pandemic level at 3.4%. The total employment is projected to expand by 2.0% to reach 16.1 million persons with more than 80% of employment opportunities continuing to be provided by the services and manufacturing sectors,” added the report. – Oct 13, 2023