IPROPERTY has reported a 34% search increase for rental properties in the first half of the year (1H 2022), indicating that renting is a viable option for consumers looking for more freedom and flexibility as well as a financial advantage.

The online property marketplace said a growing number of property seekers are shifting their focus to renting as a solution to upgrade their lifestyle and living space needs.

PropertyGuru Malaysia, which includes the iProperty and PropertyGuru online platforms, attributed this to a challenging economic climate, which includes rising interest rates and a higher cost of living.

The group’s country manager Sheldon Fernandez added that the “encouraging” rental price growth of select properties in the Klang Valley illustrates that the property market has the ability to recover post-COVID-19 pandemic.

This after iProperty also reported double-digit growth for the median rental price growth for top high-rise residential properties in Kuala Lumpur and Selangor in 1H 2022 compared to the second half of last year (2H 2021).

“This provides some assurance to potential buyers and upgraders who are looking to invest in a residential property,” Fernandez said in a statement today.

“On a similar note, this situation provides an opportunity for financially-sound property investors to capitalise on the lucrative potential of rental properties.”

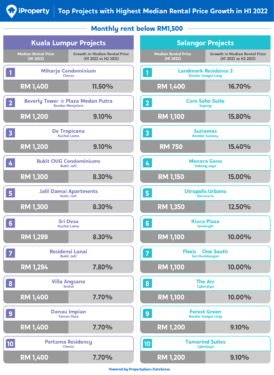

Top properties with rental prices under RM1,500

A strategic location and economical price tags are the primary driving factors behind the median rental price growth of several high-rise properties below RM1,500 in Kuala Lumpur.

Miharja Condominiums in Cheras topped the list with an 11.5% growth. The condominium is located near light rapid transit (LRT) and mass rapid transit (MRT) stations, shopping malls, food courts and restaurants.

Select high-rise properties in Bukit Jalil and Kuchai Lama also emerged as winners, registering between 9.1% (De Tropicana, Kuchai Lama) and 7.8% (Residensi Lanai, Bukit Jalil) in median rental price growth. The positive movement was bolstered by the projects’ convenient accessibility via several major highways.

Meanwhile, properties in Selangor’s suburbs such as Bandar Sungai Long, Cyberjaya and Semenyih continue to be popular among middle-income tenants.

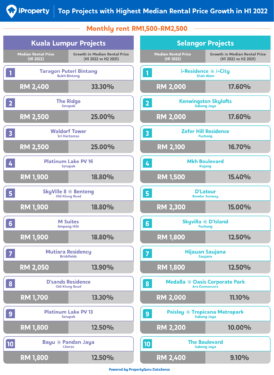

Top properties with rental prices between RM1,500 to RM2,500

Properties in the RM1,500 to RM2,500 price tier, on the other hand, continued to appeal to young urbanites as they are typically in more strategic locations and offer several lifestyle advantages.

One example is Taragon Puteri Bintang in Kuala Lumpur, which saw its median rental price grow by 33.3% in 1H 2022, marking a resurgence of interest in the older Jalan Pudu stretch surrounding the Bukit Bintang vicinity. The property benefits from easy access to shopping malls, entertainment outlets, LRT and Monorail stations.

For similar reasons, some properties in Setapak gained between 25% (The Ridge) and 12.5% (Platinum Lake PV 13) in median rental price growth. Setapak offers more affordable high-rise options with upgraded lifestyle facilities and convenient access to the city centre, boding well with modern mid-income urbanites.

As for Selangor, five rental properties in Subang Jaya and Puchong dominated the top median rental price growth list owing to their traditional appeal as mature neighbourhoods which sustains family and community living.

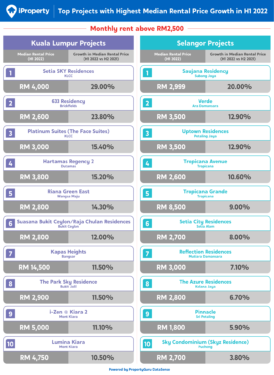

Top properties with rental prices above RM2,500

On the other hand, properties in the above RM2,500 price tier continued to cater to wealthy tenants with a preference for luxury living – thanks to the reopening of international borders which attracted the expatriate community back to Malaysia’s property market.

For example, in Kuala Lumpur City Center (KLCC), Setia SKY Residences recorded a median price rental growth of 29%. Platinum Suites (The Face Suites) gained 15.4% too due to its location within the capital city’s prime business and commercial hubs.

Mont Kiara is another popular area among expatriates that saw its median rental prices rise between 11.1% (i-Zen @ Kiara 2) and 10.5% (Lumina Kiara), making it a favourite target for property investors.

For local tenants in the higher income tier, many considered an enhanced living experience with sizable spaces, conducive green surroundings and enriching lifestyle facilities as critical factors when looking for a property – such as Tropicana Grande, which saw its median rental price rise by 9%. – Sept 25, 2022

Main photo credit: iProperty