THE Malaysian glove sector remains under pressure as persistent oversupply, cautious customer sentiment, and pricing competition continue to weigh on recovery prospects.

The latest quarterly results from glove manufacturers under Public Investment Bank (PIB)’s coverage reflected a sequential decline in sales volumes, mainly due to earlier frontloading activities by US customers.

“We gather that customers remain cautious, with most adopting a wait-and-see stance, delaying sizeable purchases amid uncertainty from changes in tariff policy,” said PIB.

In light of subdued demand visibility in the near term, PIB downgrades their sector call to Neutral from Overweight.

The recent results from Malaysian glove manufacturers under their coverage indicate a quarter-on-quarter (QoQ) decline in sales volume, primarily due to earlier frontloading activities by US customers.

While tariff adjustments have narrowed the average selling price (ASP) gap between China and Malaysia, China’s glove prices remain relatively uncompetitive in the US market (USD27/1k pcs vs. Malaysia’s USD20/1k pcs at an 80% tariff).

However, the recent invocation of emergency powers has prevented President Trump from enacting broader tariff hikes.

Assuming a more conservative scenario where China faces only a 10% reciprocal tariff, China’s ASP will be at USD24/1k pcs, significantly closing the pricing gap with Malaysia.

Additionally, Chinese producers may absorb part of the tariff cost to defend market share. This will likely keep global ASPs subdued and limit near-term recovery for Malaysian glove makers.

Despite losing market share in the US market, Chinese glove manufacturers are aggressively increasing market share in the non-US market especially EU, pricing as low as USD14-15/1k pcs.

China is currently expanding capacity outside of China in a bid to retain global competitiveness.

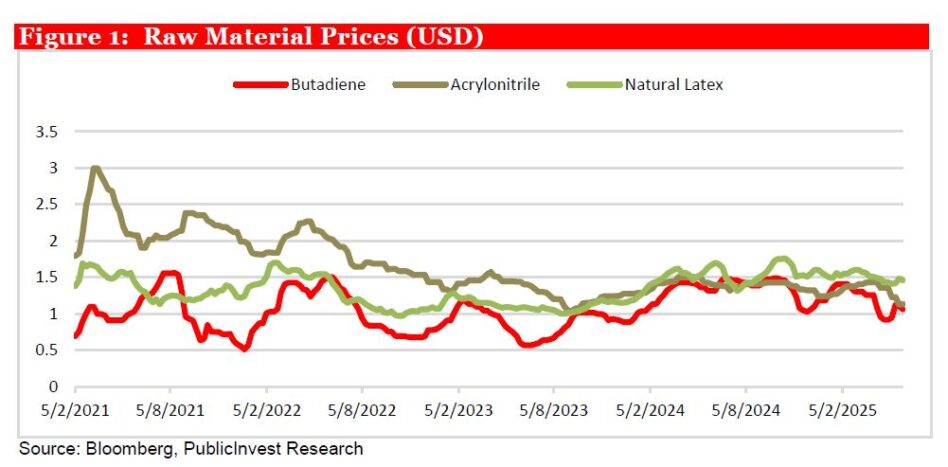

“We observed a 6% decline in natural latex, while nitrile butadiene prices fell by 22% between April – May 2025 compared to the Jan – March 2025 period,” said PIB.

While this provides some buffer to sustain operating margins, it also limits the potential for upward revision in ASPs. We anticipate that overall raw material prices to stabilise in the second half of 2025.

Meanwhile, USD has weakened against MYR to 4.30 level in May. Nevertheless, PIB does not anticipate any material impact on operating costs or profitability, as USD-quoted raw material costs only constitute 30% of total costs.

Any cost savings in ringgit term will act as natural hedge against a lower translated revenue. The Malaysian glove sector remains under pressure, dragged by ongoing oversupply and subdued demand visibility.

Key customers continue to adopt a cautious, wait-and-see approach, holding back on large-volume orders amid lingering market uncertainty.

Meanwhile, raw material costs are trending lower, providing some cost relief but limiting the upside potential for ASPs. Given the subdued near-term outlook, PIB downgrades the sector rating to Neutral. —June 6, 2025

Main image: ASEAN Briefing