OPTIMISTIC that My EG Services Bhd (MyEG) is poised to deliver supercharged earnings in 2022 premised on its previously revealed new initiatives in the healthcare and road transport segments, UOB Kay Hian Research has accorded a 63% upside to the company’s current share price with a target price of RM1.58.

Reiterating its “buy” stance on MyEG, the research house noted that the group is also carrying out a steep monetisation programme from now till mid-2023 for its start-up investments in Malaysia and China.

“MyEG’s opportunistic ventures into the blockchain and tokenisation domain are also paving way for robust mid- to long-term growth,” justified head of research Vincent Khoo and analyst Jack Goh in a company update.

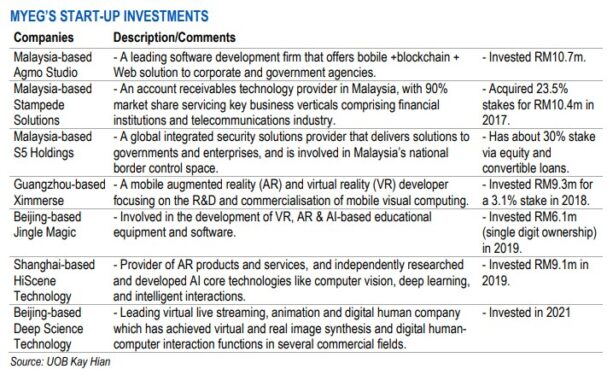

According to UOB Kay Hian Research, the Malaysian Government e-service provider has an extended track record of investing in technology start-up companies in Malaysia with the long list including technology businesses such as FashionValet, Agmo Studio, S5 System and Stampede Solution.

In China, MyEG had also invested in several related start-up companies such as Ximmerse, Jingle Magic and DeepScience Technology.

“We understand that some of these companies are planning a listing this year with a potential collective equity value for MyEG’s stake to be worth RM3 bil-RM4 bil,” projected the research house.

Beyond viable start-up ventures, MyEG may witness the commencement of many potentially exciting new businesses in 1H 2022 such as:

- Full commercial roll-out of its COVID-19 breath test and travel insurance in mid-February 2022;

- Privatisation of travellers’ quarantine system;

- Significant earnings growth from the road-transport segment on the back of motorcycle road tax, e-Testing, civil servants’ road tax and takaful renewal; and

- Revenue streams from the blockchain and tokenisation domain such as Zetrix and MyEG Lock-Earn Wallet.

“For its healthcare segment, MyEG is also exploring new income streams from the vaccine verification services which are required for overseas travel, premised on its Vaccine Management System developed with MIMOS Bhd,” noted UOB Kay Hian Research.

In a related development, the research house has been made to understand that Agmo Studio, one of the Malaysian software development companies that MyEG has invested in is planning a listing on Bursa Malaysia’s ACE Market this year.

In China, MyEG’s investee company – HiScene – is also planning for a potential listing on the Shanghai Stock Exchange’s STAR Market this year.

“These companies are recognised as some of the fastest growing technology companies and are backed by long lists of prominent investors. MYEG’s stake in these various start-ups could potentially be worth more than RM3 bil after listing,” added UOB Kay Hian Research.

At 11.56am, MyEG was up 2.5 sen or 2.58% to 99.5 sen with 27.32 million shares traded, thus valuing the company at RM7.55 bil. – Feb 8, 2022