ALTHOUGH being a small, open emerging economy, Malaysia may still have a few bargaining chips to secure a win-win deal with US negotiators in Washington DC.

“It will be tough, but first, it must overcome the initial hurdle: securing a meeting with President Donald Trump and his inner circle, as over 70 nations are also vying for a spot,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

China’s response has been swift, aiming to match if not catch up to impose tariffs on American imports.

Chinese authorities also threatened to expand export controls on critical minerals used in smartphones and electric vehicles, disrupting the US and global supply chain.

Additionally, China also tightens regulations on more than a dozen US companies operating in China.

In contrast, ASEAN took a non-retaliatory approach. In a joint statement on 10 April, ASEAN economic ministers emphasised the importance of open, constructive dialogue and committed to maintaining a balanced and sustainable economic relationship with the US.

The World Trade Organization (WTO) warned that these developments could reduce US-China bilateral trade by up to 80.0% and significantly weaken global trade flows.

The WTO also cautioned of long-term consequences such as reduced multilateralism, permanent trade fragmentation, and declining global productivity.

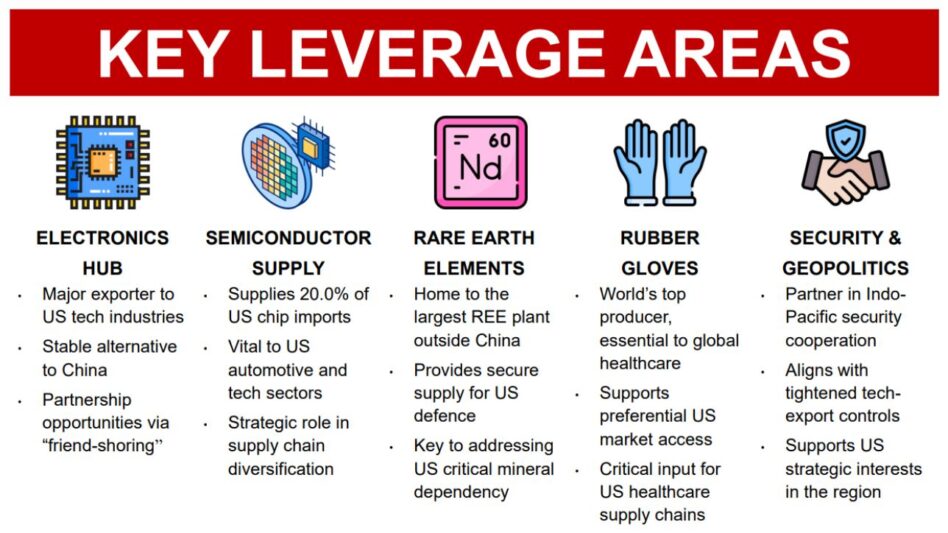

Malaysia can leverage strategic partnerships and key economic sectors to encourage the US to ease punitive tariffs.

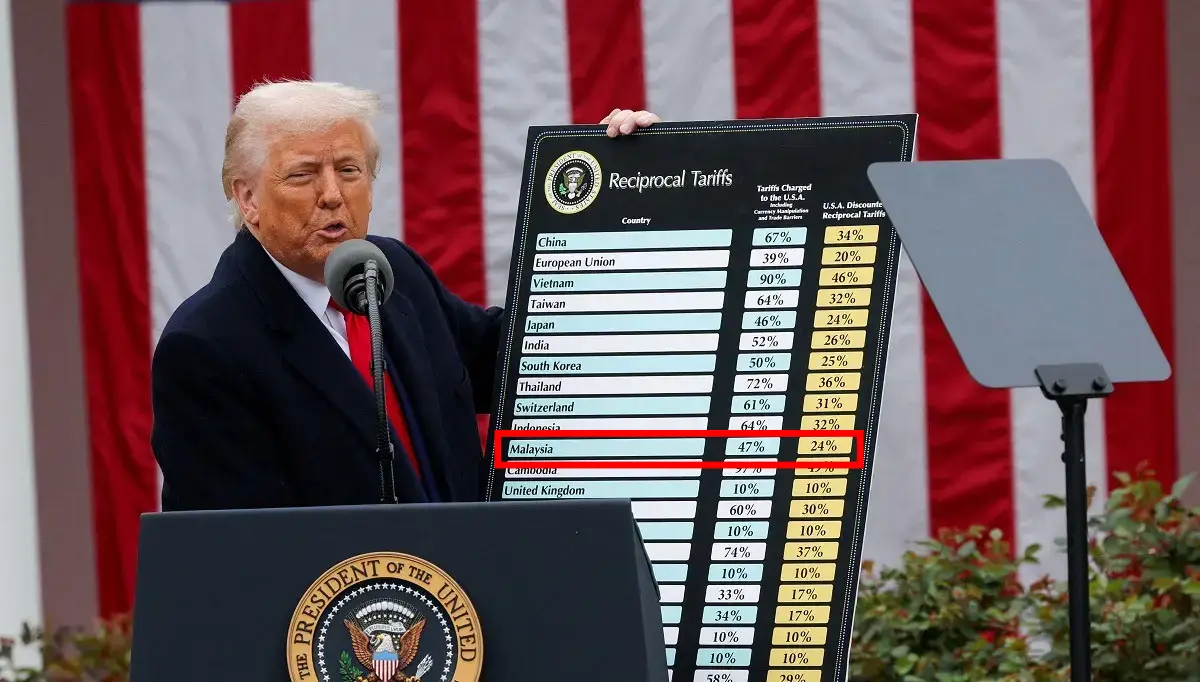

Facing legacy Trump-era tariffs on steel (25.0%), aluminium (10.0%), solar panels (15.0%), and a new 24.0% “reciprocal” tariff (announced April 2, 2025), Malaysia’s best strategy is to capitalise on areas valued by the US, such as reliable supply chains and geopolitical cooperation.

Malaysia can’t afford to wait and hope the tariffs go away. If Trump 2.0 is back, it needs to be first in line, not last on the list.

That means bold, strategic, and business-savvy diplomacy — with the right mix of pressure, partners, and pragmatic deal-making.

Malaysia’s high exposure to international trade makes it vulnerable to the impact of Trump’s tariffs.

With both the US and China among Malaysia’s top three trading partners, the country is susceptible to both direct and indirect spillover effects from a prolonged trade conflict between the two giants.

Nevertheless, Malaysia’s neutral stance, strategic location, pro-trade and investment policies, and capacity to substitute production for key global items could present opportunities. Key sectors benefiting from this include:

E&E sector: 39.9% of total exports in 2024 (2023: 40.3%), central to global supply chains. Malaysia leads in integrated circuits (ICs) and microchips, sensors and transistors, and automated machinery components.

Rubber gloves: Malaysia is the largest global exporter of rubber gloves whereby several local companies dominating the global glove market.

Palm oil: The Second largest global producer and exporter of palm oil after Indonesia, with key exports product of crude palm oil, oleochemicals, and processed food-grade oils.

Petroleum and petrochemicals: Major exporter of refined petroleum, LNG, and downstream petrochemical products such as plastics and resins.

Medical devices: Includes catheters, surgical instruments and diagnostic tools. A slowdown in global demand, especially from the US may reduce Malaysia’s export volumes, potentially dragging down industrial production and impact job creation in key export-driven regions such as Penang, Johor, and Selangor.

However, the impact is expected to be contained, as Malaysia could benefit from trade diversion in sectors where it holds a comparative advantage such as semiconductors, medical devices and palm oil.

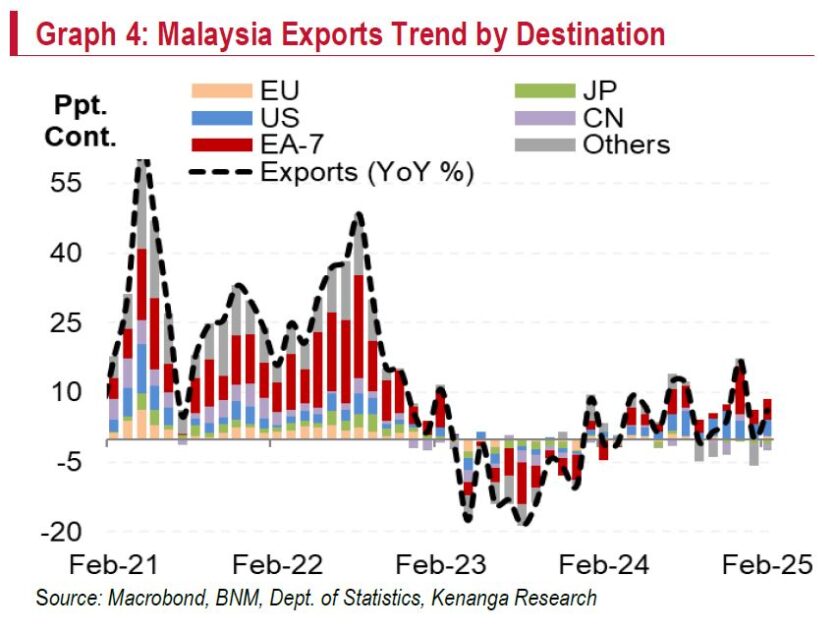

There is still room for Malaysia’s exports to expand in 2025, building on the moderate rebound recorded last year.

Additionally, ongoing efforts to enhance intra-ASEAN trade and diversify its exports beyond traditional markets could further strengthen its external sector.

“Nevertheless, we acknowledge the worst-case scenario where exports contract. Historically, over the past four decades, Malaysia’s export growth has experienced contractions, typically during major global demand and supply shocks, rather than tariff-driven disruptions,” said Kenanga.

These highlight Malaysia’s historical vulnerability to external shocks, but also its capacity to recover and adapt, supported by targeted trade policies, strong regional linkages, and competitive export-driven sectors.

The real concern lies beyond 2025, when the full effects of heightened trade tensions, retaliatory measures, and further tariff escalation could take a toll on trade.

As such, global trade could face a more pronounced slowdown in 2026, raising downside risks for Malaysia’s medium-term export outlook, but the tariff impact may normalise as American consumers adapt to the new tariffs.

Bank Negara Malaysia is expected to maintain its data-dependent stance. If real GDP growth holds above the 3.5% threshold, we believe the OPR will likely remain unchanged.

However, if spillovers from the tariff dispute begin to weigh significantly on domestic demand, bringing growth towards the 3.0% range in 2H25, a rate cut would become more probable.

However, the probability in the near term remains low, as policymakers are likely to favour a targeted approach and preserve the OPR for future shock, while balancing price stability and growth sustainability.

As the USD structural advantages erode. Trump’s tariff agenda may push the US closer to demand-side stagnation, weakening the USD.

This would benefit EM currencies, including the ringgit, particularly if Malaysia’s export mix remains resilient.

A diversified trade structure and continued inflows into local currency debt market should support the currency despite external challenges.

The shift in global capital allocation also works in Malaysia’s favour. As fixed-income investors increasingly looking to reallocate from the US to other markets in search of real yields, Malaysia’s bond market—backed by improving fiscal discipline and reform signals—should attract stable inflows.

A credible path toward subsidy rationalisation would further support local debt, lower term premiums, and reinforce confidence in Malaysia’s medium-term fiscal consolidation strategy. —Apr 18, 2025

Main image: Reuters