SOVEREIGN wealth fund Khazanah Nasional Bhd has come under fire from financial-savvy Malaysians following an éxpose by tech newsletter Asia Tech Review (ATR) that early e-commerce pioneer and Malaysian start-up poster-child FashionValet (FV) has been sold in fire sale to local investment firm NXBT Partners.

“How do Khazanah sell 50% below fair value but when they buy, they pay over the roof?” lambasted truth seeker FreeMalaysian (@FreeMsian) in a post on X. “From RM100 mil to just RM1 mil, not including the holding cost for this scam investment?”

How do Khazanah sell below 50% below fair value but when they buy, they pay over the roof? From RM100 million to just RM1 million, not including the holding cost for this scam investment? https://t.co/ypmmJ3ohTE

— FreeMalaysian (@FreeMsian) August 30, 2024

FreeMalaysian had earlier re-posted a tweet by Ekonomi Rakyat (@EkonomiRakyatMY) which cited the ATR report that NXBT Partners now owns 51.25% of FV after paying some US$1.1 mil for shares owned by Khazanah, state-owned Permodalan Nasional Bhd (PNB) and other investors.

“That indicates FV is now valued just slightly over US$2 mil. That’s down significantly from a post-money valuation of S$104.5 mil when it raised money from Khazanah in 2019,” shared ATR.

ATR understands that NXBT Partners is a personal investment vehicle owned by Malaysian entrepreneur Afzal Abdul Rahim. He’s notable for running telco Time dotCom Bhd (as its commander-in-chief) which is worth RM9.4 bil today, employs some 1,400 staff and is notably also a portfolio company of Khazanah.

Commenter ايدي بن داود Eddy Daud (@eddydaud) who reacted to FreeMalaysian’s post wanted the culprit “or the group of scammers to go to jail for the horrible loss stemming from mega cheating or negligence using taxpayers’ money”.

Another commenter suggested that “the Malaysian Anti-Corruption Commission (MACC) should scrutinise this ‘very profitable’ investment given how lavish the duck founder (referring to Vivy Yusof who is the owner of modest fashion brand The dUCk Group) family live now. 🤭🤭”

A commenter even made a ‘sweeping statement’ which sounded harsh but may contain some degree of truth in that “over the past 30 years, I have not seen one company under Khazanah that becomes successful”.

Another commenter reckoned that if Khazanah were to be a private company, “it would have been bankrupt ages ago or undergone reshuffle of its top management”.

“Not their money, no pride whatsoever, greedy, only thought of their own pocket, no meritocracy whatsoever but clever to ride on religion, etc. etc,” berated another.

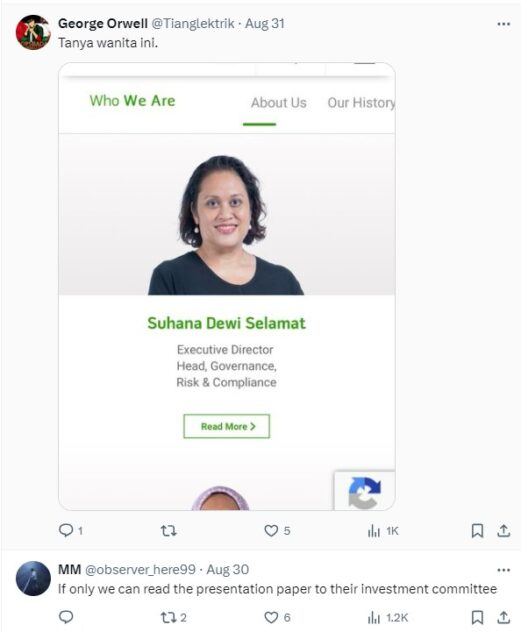

Finally, one commenter suggested that questions be posed to Suhana Dewi Selamat who is Khazanah’s executive director and head (governance, risk and compliance) while another wondered if “the presentation paper by FV to Khazanah’s investment committee” is still available for scrutiny. – Sept 2, 2024