ACE MARKET-bound independent healthcare provider Cengild Medical Bhd has been accorded a fair value of 42 sen, which is 9 sen or 27.3% above its initial public offering (IPO) price of 33 sen by PublicInvest Research.

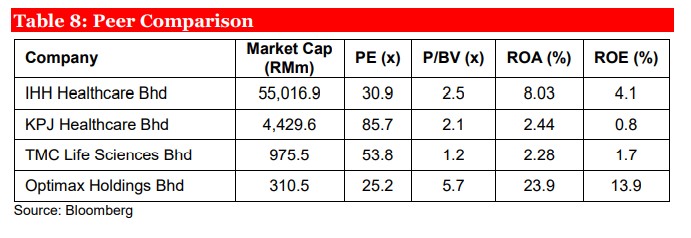

Using a price-to-earnings (P/E) ratio)valuation approach, the research house has benchmarked Cengild against its closest Bursa Malaysia-listed peers that are involved in healthcare business.

“We derive a fair value of 42 sen, pegging a 25 times PE multiple to Cengild’s FY2023F earnings per share (EPS) of 1.7 sen, ascribing circa 30% discount to the peers’ weighted average P/E multiple of 35 times,” justified PublicInvest Research in an IPO note.

“We believe that the discount is justifiable given that Cengild has a relatively smaller market capitalisation compared with its peers.”

Cengild is seeking a listing with an enlarged issued and paid-up share capital of 218.8 million shares, of which 40.94 million shares will be made available to the Malaysian public via balloting.

Pursuant to its IPO listing, Cengild will boast a market capitalisation of RM270.2 mil based on its IPO price of 33 sen. Its IPO applications closed yesterday (April 5) with its listing tentatively slated for April 18.

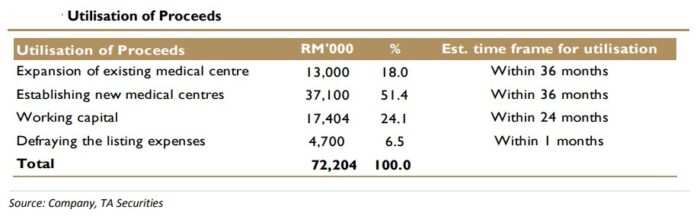

In view of Malaysia’s conducive demographic, Cengild intends to remain focused on its competencies in providing gastrointestinal, liver diseases and obesity-related services with expansion of existing medical centre and medical team as well as to expand its market access in term of geographical locations within Malaysia.

Moving forward, PublicInvest Research expects the group’s earnings to decline marginally in FY2022F by 4.7% after taking into account the listing expenses and weaker 1Q FY2022 performance that has been impacted by the COVID-19 outbreak.

“In contrast, we are expecting Cengild to register earnings growth of 45.7% in FY2023F. We think that the growth will be supported by the expansion in the medical team as well as the geographical expansion,” envisages the research house.

Meanwhile, TA Securities Research has derived a fair value of 34 sen/share on Cengild after ascribing a target P/E multiple of 25 times against the company’s FY2023 EPS. At its IPO price of 33 sen/share, Cengild is priced at a trailing P/E of 27 times against its FY2021 EPS.

“We view that the assigned P/E multiple is fair and reasonable which is lower than the trading PER of Malaysian private healthcare services players given that (i) Cengild’s smaller market capitalisation; and (ii) relatively short operating history (began operations in October 2017) compared to its peers,” noted analyst Tan Kong Jin. – April 6, 2022