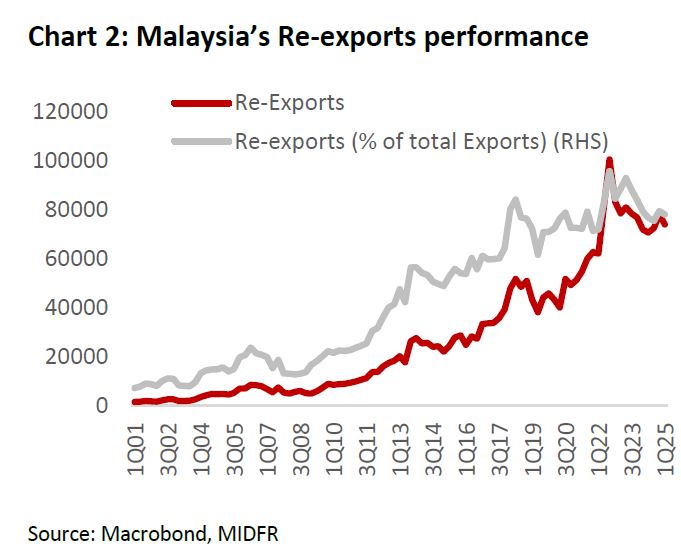

MALAYSIA’S re-export activities have demonstrated a significant increase, constituting approximately 19-22% of total exports in 2023-2024, a notable rise from 13-14% observed in 2015-2016.

This upward trend suggests an enhanced role for Malaysia as a trans-shipment hub, potentially influenced by intensified US-China trade tensions.

The United States remains a key destination for these re-exports, accounting for an estimated 5.0-6.0% of the total and ranking as the fifth largest recipient.

In 2024, Malaysia mainly exports manufactured goods to the US (98.1%), followed by mining (0.1%) and agriculture (1.8%). Under the E&E segment, semiconductors account for just 24% of the broader category.

This underscores the limited diversification of Malaysia’s exports to the US, which are heavily concentrated in manufactured goods, particularly E&E products.

Nonetheless, the high share of E&E imports reflects Malaysia’s integral role in the global electronics supply chain, especially in semiconductor packaging and testing.

The US remains Malaysia’s third-largest trading partner. Specifically, if Malaysia were to secure a transhipping tariff rate below the 20% that currently applies to overall goods from Vietnam (and certainly below the 40% rate imposed on specific “transhipping” activities as seen with Vietnam), it could substantially enhance its competitive advantage.

Such a favourable rate would make Malaysia an even more attractive intermediary for international trade flows destined for the US, particularly when compared to Vietnam’s current tariff environment.

This could potentially lead to a significant increase in Malaysia’s re-export volumes, further solidifying its position in global supply chains.

Furthermore, this enhanced trade activity would directly benefit associated domestic sectors, including logistics, warehousing, and trade facilitation services, driving economic growth and creating new opportunities within the country.

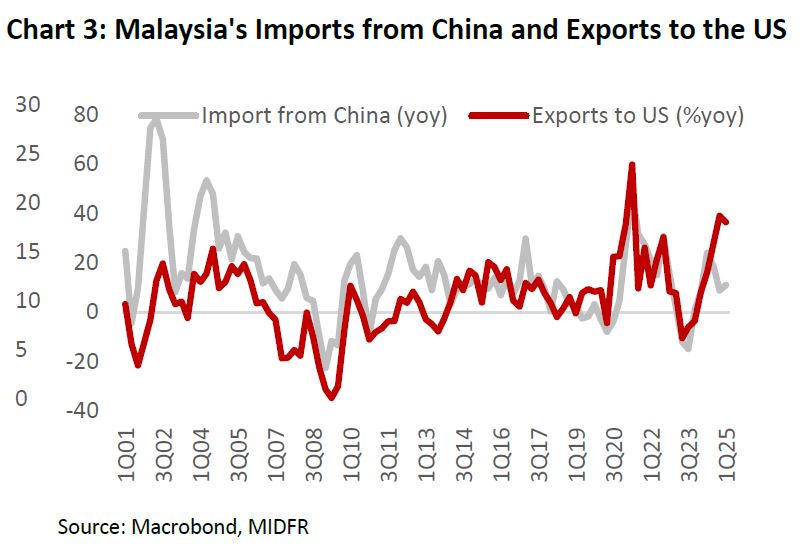

While Vietnam exhibits a very strong correlation, a similar analysis for Malaysia reveals that its imports from China and subsequent exports to the US also demonstrate a notable relationship.

A correlation study between China’s imports to Malaysia and Malaysia’s exports to the US yielded a high correlation of 78.7%, also with a strong one-month lag impact.

This indicates that these two series are highly sensitive to each other, though to a lesser extent than observed with Vietnam.

The slightly lower correlation for Malaysia (78.7% compared to Vietnam’s 95.7%) suggests that while re-export of Chinese products through Malaysia to the US is still significant.

Nevertheless, this strong positive correlation for Malaysia also suggests a significant re-export of Chinese products through Malaysia to the US.

To enhance the integrity of trade flows and mitigate illicit transhipment, Malaysia’s Ministry of International Trade and Industry (MITI) has taken a decisive step to centralise the issuance of Certificates of Origin for all exports destined for the US.

Effective in May-25, the authority to issue these crucial documents, which verify a product’s origin for customs and trade requirements, will be exclusively held by MITI, discontinuing the previous practice of delegation to business councils, chambers, or associations.

This stringent measure directly addresses concerns regarding the potential misuse of Malaysia as a conduit for third-country goods, particularly those from China, seeking to circumvent US tariffs.

By tightening control over origin documentation, Malaysia aims to bolster transparency and credibility in its trade with the US, thereby fostering stronger, more reliable bilateral trade relations and reducing instances of trade circumvention

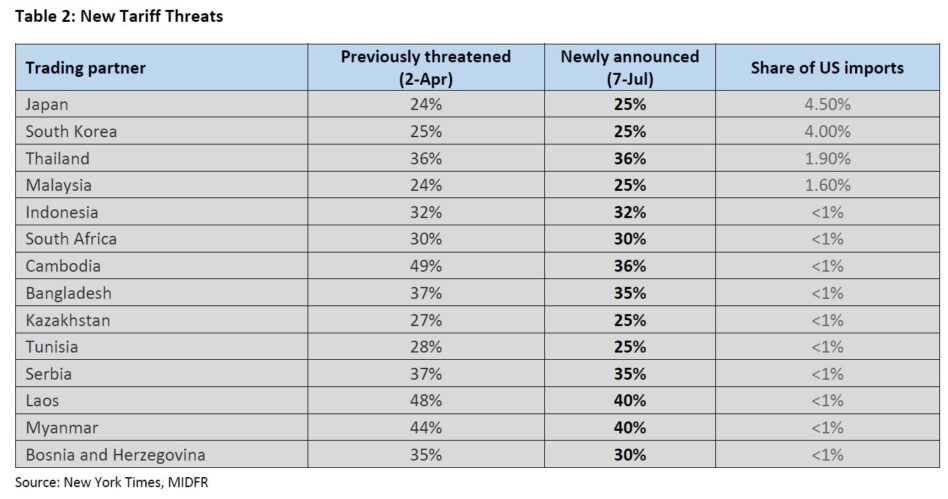

However, even with the new rates, Malaysia remains one of the lowest among the ASEAN countries, which is a competitive advantage against regional peers (excluding Vietnam at 20%).

Malaysia remains among the lowest. Given the new US transhipment rules, which impose a higher tariff based on the rerouting of the goods for the US market, in our view becomes a paramount factor in attracting Foreign Direct Investment (FDI) aimed at serving the US market.

This means that countries able to secure a lower general tariff rate for their exports to the US, coupled with robust and verifiable rules of origin to avoid the severe transhipment penalty, will disproportionately benefit in terms of FDI inflows.

For businesses seeking to “de-risk” their supply chains from higher-tariff origins (like China), investing in production facilities within a country that offers both a genuinely lower tariff for direct exports to the US and the assurance of avoiding transhipment accusations becomes a strategically attractive proposition.

This dynamic incentivises real value-added manufacturing and supply chain transparency, rather than mere logistical rerouting. Malaysia is benefiting from the transhipment rule.

On the other hand, MITI reaffirmed Malaysia’s independent foreign and economic policy stance, and the engagement with any multilateral platform is focused on trade facilitation and sustainable development, guided by national interest, not ideological alignment.

For Malaysia, which is a partner country of BRICS, the implication of this latest threat is speculative; after the negotiation, if Malaysia were to fall under the 10% blanket tariff, this additional BRICS-related tariff could potentially raise its total tariff rate to 20%.

However, at this juncture, this post is widely perceived as a threat rather than an imminent policy. Even at the current 25% tariff, nevertheless, added with a potential additional 10% BRICS tariff (total: 35%), Malaysia is still competitive relative to its ASEAN peers.

Assuming that the 10% additional tariff will be implemented, other ASEAN countries like Indonesia (42%), Thailand (46%), and Vietnam (30%) are also partnering countries, which effectively will increase their rates as well; therefore, Malaysia will remain competitive among the ASEAN countries.

We believe that these letters signal that the US is willing to continue negotiating. In the case of Malaysia, the slightly higher tariff can be seen as an indication that should Malaysia is not able to come to an agreement, that tariff will be enacted. —July 9, 2025

Main image: The Sun