ALTHOUGH both property loan application and approved loan have inched up in the first two months of this year (2M 2022) in tandem with the economic recovery sentiment, the outlook for Malaysia’s real estate sector remains sombre to say the least.

Based on MIDF Research’s observation, stringent bank requirement remains a challenge for property developers considering that the percentage of total approved loan over total applied loan for property purchases still hovers below 40% in February 2022.

According to data released by Bank Negara Malaysia (BNM), total loan applied for property purchases inched up to RM28.6 bil (+9.2% year-on-year [yoy]) in February 2022 after growing by +5.4% yoy in January 2022.

Cumulatively, total applied loan for the first two month of 2022 was higher at RM63.2 bil (+7.05% yoy), indicating demand for property is recovering.

Total loan approved for purchase of property was higher at RM11.3 bil (+9% yoy) in February 2022 in line with higher loan application for purchase of property.

Cumulatively, total loan approved for purchase of property climbed to RM26 bil (+20.4% yoy) in 2M 2022, indicating better new property sales outlook for property companies in 2022.

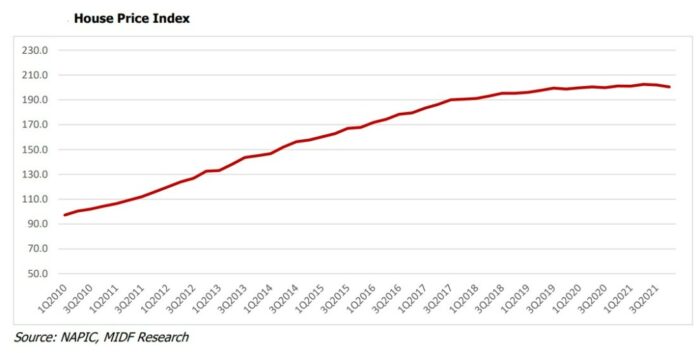

Moreover, MIDF Research also pointed to the subdued National Property Information Centre’s (NAPIC) House Price Index (HPI) whereby the preliminary HPI has dipped to 200.4 in 4Q 2021 (3Q 2021: 202.0; 2Q 2021: 202.5) as testament that “the HPI continues to decline as property market remains plagued by weaker demand for property amid the COVID-19 pandemic”.

All-in-all, MIDF Research reiterated its “neutral” stance on the property sector with a view that property companies may see slightly better new sales outlook in 2022 as buying interest should recover following the pick-up in economic activity.

“That should offset the adverse impact of absence of government incentives to purchase property as the House Ownership Campaign (HOC) has ended,” added the research house.

Elsewhere, Kenanga Research also maintained a “neutral” outlook on the property sector which is described as “fundamentally-challenged” from affordability, policy and oversupply stand-points.

The research house is cautious over FY2022 sales prospects due to:

- Absence of HOC (which ended in December 2021) which offers house buyers cash savings of RM6,350 to RM28,500 (2.1%-2.9%) for properties worth RM300,000-RM1 mil;

- Expected interest rate hike as the economy recovers (in-house assumption imputes two times 0.25% hike towards end-2022;

- PProperty cooling measures implemented in Singapore (in December 2021) which would restrain sales for Sunway Bhd;

- Growing residential units in circulation creating a more competitive landscape.

“Despite the low valuations (in price by volume terms), the entire sector still lacks sustainable earnings visibility and growth to justify a re-rating,” opined analyst Lum Joe Shen in his property sector update.

“That said, we feel that certain developers’ share price has undershot fair valuations and now provides appealing risk-to-reward opportunity. Such names include UEM Sunrise Bhd, Sunway Bhd and Sime Darby Property Bhd.” – April 6, 2022