A QUICK resolution to the negotiations on reciprocal tariffs would be an ideal scenario.

However, as the Malaysian contingent sets out on 25 April to meet with US Trade Representatives, an immediate tariff level negotiation outcome is not the main objective, but rather to outline role in supply chain.

“Thus, there is risk that discussions may take time. We examine some of the second order effects if discussions are more drawn out, and reactions by corporate Malaysia,” said Kenanga Research (Kenanga) in a recent report.

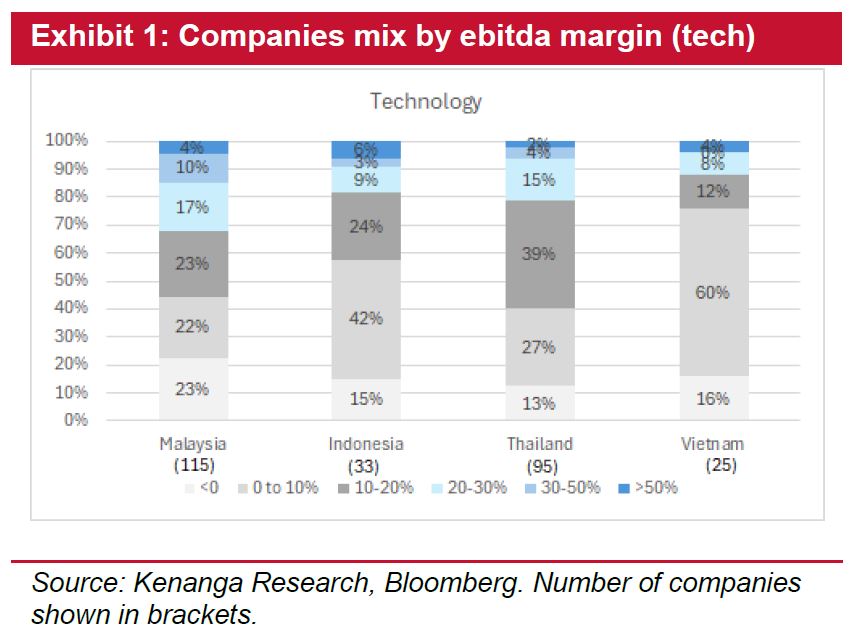

For Malaysia, the tech sector margins appear relatively healthy versus peers. As of now, rerouting are still just in talks phase from Kenanga’s checks.

“Preparation work is underway for trade rerouting though still monitoring tariff situation. There is also no widespread frontloading from our channel checks, however,” said Kenanga.

But there is risk of broader growth concern. This spotlight is broadly shone on loans growth for banks, consumer, and planters in the more cyclical space.

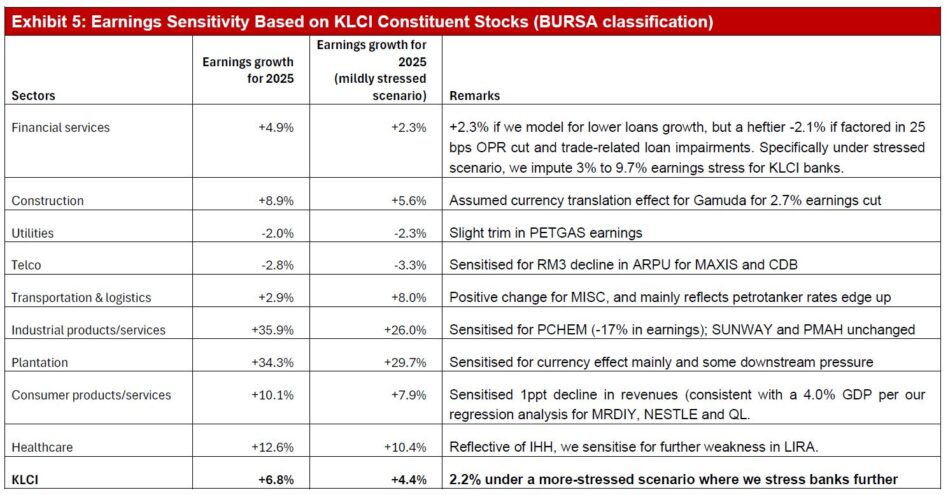

Kenanga performed bottom-up sensitivity in this report on FBM KLCI stocks and find earnings growth likely to drop from 6% range to 2% range, assuming a more stressed scenario.

If some level of tariffs eventually prevail, there could be indirect impact to the margin of companies, assuming requirements to share the burden of some of these tariffs through lower selling prices.

Outside gloves, most of the names Kenanga did not cover do not have exposures of more than 20% to the US.

At risk of broad-brushing, comparing across the region (Malaysia, Indonesia, Thailand and Vietnam), Kenanga observe that Malaysia companies generally have a slight edge in the technology space, with 31% of the companies having margins of at least 20%.

This compares with 20% or less by other countries. Separately, in the category of industrials (which includes construction, gloves, and others), this category sees Indonesia having more companies with healthy margins.

In the category of materials, which includes plastics and packaging players, high margins are usually not the norm and that is reflected in the fact that the bulk of companies here enjoy only nil-10% earnings before interest, tax, depreciation and amortisation margins, as the median category.

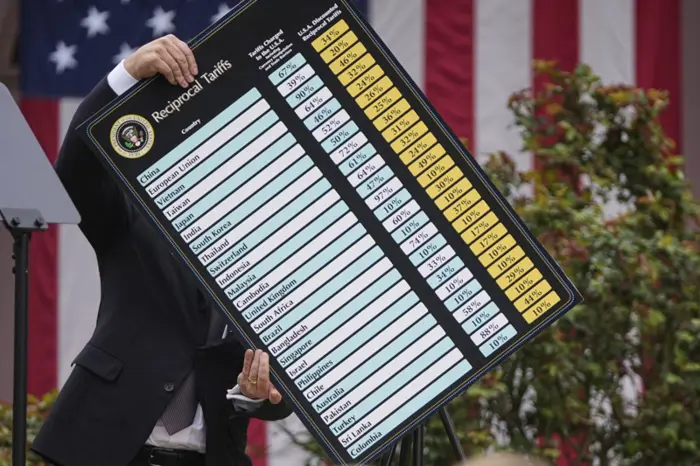

Recall that the reciprocal tariffs in Malaysia of 24% compare well against peers in this region, versus the likes of Vietnam at 46% and Thailand at 32%.

“Assuming there will be ultimately some tariffs that will be in place as the US looks to rebalance trade, we believe that margin advantage would count towards being able to improve market share position, by being able to absorb margin pressure,” said Kenanga.

As of now, frontloading not seen widespread, though talks of rerouting are happening There is wait-and-see’ on the ground; some substitution effect benefitting Malaysian gloves.

Frontloading impact is anticipated to happen in quarter two of 2025 to get ahead of tariff imposition during the 90-day suspension of the reciprocal tariffs.

“From our channel checks, additional orders have generally not taken place actively yet,” said Kenanga.

This may be a matter of wait-and-see and also depending on buyer stock levels; this is true for some packaging players. However, specific to glove makers, there was some pockets of market share gains.

Although plans for re-routing are being explored. Likewise, re-routing talks have been sparked but likewise put on hold given that there is a 90-day pause.

The tariff war being waged by the US has had the effect of a weaker USD. The weak USD could prevail as a reflection of investors’ confidence on US government debt and economic outlook.

Therefore, exposure to beneficiaries of a weaker dollar would be a play which offers some hedge against tariff uncertainty. Towards the banks, there will likely be weaker regional markets growth.

Trade related loan asset quality could be the first degree of concern, which Kenanga have previously analysed in their market strategy report dated 9 April 2025.

“We further assess as well loan growth weakness, starting with those outside of Malaysia. Some of the central banks have earlier moved to cut interest rates such as Indonesia and Thailand, whilst we expect Malaysian overnight policy rate to be stable at 3%,” said Kenanga.

Should regional portfolios underperform on loan growth, this will in turn exert pressure on earnings. For banks, Kenanga tests for stagnant overseas loans scenario.

Telco appears stable, as are utilities. One of the areas of weakness could be in the area of prepaid ARPU which is less sticky in times of economic stress.

Kenanga has maintained a 4.8% gross domestic product growth (GDP) at the moment, and a slower economy may come at the expense of some banking loan slippage.

“Additionally, we also strain the consumer segment, guided by our correlation study between drop-off in GDP to sales,” said Kenanga.

Specifically, Kenanga had pencilled in revenue growth that would be commensurable to a 4% GDP growth scenario.

“We have a more stressed case involving banks. While not our base case, if the economic strain was to intensify, banks would likely feel the brunt of the impact,” said Kenanga. —Apr 23, 2025

Main image: The Star