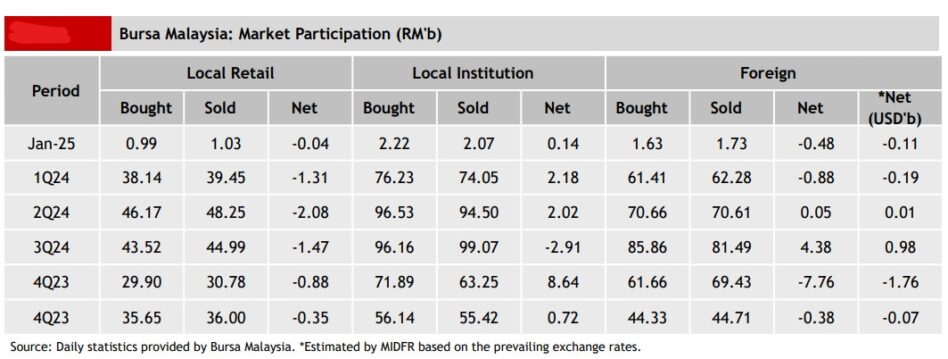

NET selling by foreign investors have extended to its 11th consecutive week – the longest streak in 2024 – with net outflows for the week ended Jan 3 totalling -RM427.1 mil which is almost one-fold (84.2%) of the prior week’s-RM231.9 mil.

They net sold through half the week with the exception of Monday (Dec 30) and Tuesday (Dec 31) during the shortened trading week due to the New Year’s holiday on Wednesday (Jan 1), according to MIDF Research.

“The most prominent net outflow was recorded on Friday (Jan 3) at -RM423.8 mil,” observed the research house in its weekly fund flow report.

“This was followed by Thursday (Jan 2) at -RM55.8 mil which erased inflows recorded on both Monday (Dec 30) and Tuesday (De 31) at RM570,000 and RM11.2 mil respectively.”

The sectors that recorded the highest net foreign inflows were property (RM115.7 mil), utilities (RM36.8 mil) and consumer products & services (RM29.0 mil) while the top three sectors that posted the highest net foreign outflows were construction (-RM89.3 mil), financial services (-RM45.8 mil) and plantation (-RM45.5 mil).

In contrast, local institutions continued to support the local bourse for the 11th consecutive week with net purchases totalling RM304.0 mil in domestic equities.

They net bought every trading session last week and have been on a net buying spell for 31 straight trading days.

However, local retailers remained net sellers of domestic equities with -RM256.9 mil n net disposals, thus extending their net selling streak to two-weeks.

The average daily trading volume (ADTV) saw inclines across the board last week. Foreign investors saw a rise of +37.5% while local retailers and local institutions saw increases of +7.8% and +13.2% respectively.

In comparison with another four Southeast Asian markets tracked by MIDF Research, only the Philippines recorded a net foreign inflow last week at US$800,000 to extend its net buying activity streak to two weeks.

In Thailand, foreign investors returned to net selling last week at -US$33.2 mil after a week of net buying. Likewise, they returned as net sellers in Vietnam last week after a week of respite with a foreign fund outflow of -US$30.4 mil.

Indonesia recorded the lowest net foreign outflow among the eight regional markets tracked by MIDF Research last week at -US$15.8 mil, reversing a single-week of net buying activities.

The top three stocks with the highest net money inflow from foreign investors last week were CIMB Group Holdings Bhd (RM45.3 mil), Tenaga Nasional Bhd (RM32.7 mil) and UEM Sunrise Bhd (RM31.0 mil). – Jan 6, 2025