HAVING witnessed the glove industry reaching a saturation point would probably have prompted mid-sized glove maker Rubberex Corp (M) Bhd to thinking twice about sticking to its core business alone.

All too risky, perhaps, hence the company has decided to diversify its glove business by complementing it with a not so distant industry – healthcare.

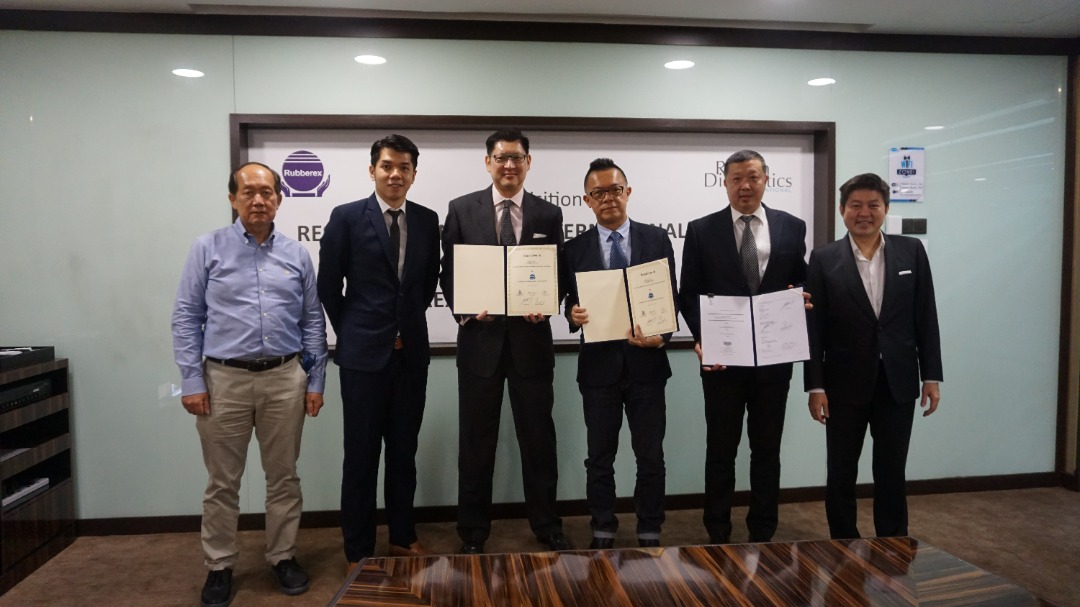

Yesterday (May 31), the Perak-based Rubberex announced its proposal to acquire the entire stake of 500,000 shares in Reszon Diagnostics International Sdn Bhd for a total consideration of up to RM180 mil.

The purchase consideration will be satisfied via a combination of cash and new ordinary shares of Rubberex and will be subjected to an annual profit guarantee of RM50 mil for each of the financial years 2022 and 2023.

Reszon which was founded in October 2010 develops and manufactures a strong portfolio of innovative in-vitro diagnostics (IVD) rapid tests and enzyme-linked immunosorbent assay (ELISA) kits for medical professionals, including clinical diagnostic markets worldwide.

Rubberex’s latest corporate manoeuvre seems timely coming off the pandemic years which had hugely benefited both the glove and healthcare industries.

“The group’s progression into the healthcare sector, specifically in the manufacture of medical devices such as test kits is complementary to our existing glove business,” Rubberex’s executive director Goh Hsu-Ming pointed out.

“We are able to offer a wider range of products to the market and provide an alternative income-generating source besides personal protective equipment.”

As testament to Rubberex’s commitment to the healthcare sector, the company has also proposed a name change to Hextar Healthcare Bhd which according to its sole largest shareholder, Datuk Eddie Ong Choo Meng, “is to better reflect the group’s core business and future undertakings moving forward”.

Note that Ong is also the managing director/executive director of Klang-based agrochemical company Hextar Global Bhd.

“In Budget 2022, the Government had allocated RM32.4 bil to the healthcare industry with the aim of improving healthcare services in the country and impacting positively on people’s lives,” justified Ong.

“Our proposed acquisition is in line with the group’s strategic aim of enhancing shareholders’ value in the long term through the provision of quality healthcare products and services for the global population.”

The inter-conditional proposals (diversification and name change) are expected to be completed by 2H 2022.

Meanwhile, Rubberex’s latest set of financial results could not better reflect the company’s foresight to complement its core business with healthcare.

The company posted a net profit of RM2.55 mil on the back of RM52.58 mil in revenue for its 1Q FY2022 ended March 31, 2022 with its net earning having shrunk by 72% from RM9.3 mil quarter-on-quarter (qoq) which it attributed to lower sales volumes, slower incoming orders and lower capacity utilisation.

“As we aligned ourselves during this endemic phase, the management is taking active steps to address the over-supply of gloves in the market,” noted group managing director Khoo Chin Leng.

“While prices are expected to stabilise back to pre-pandemic levels over the next few quarters, we are already witnessing higher levels of glove consumption due to improved health, hygiene and safety standards worldwide.”

At the close of yesterday’s (May 31) trading, Rubberex was up 2.5 sen or 4.17% to 62.5 sen with 3.33 million shares traded, thus valuing the company at RM572 mil. – June 1, 2022