A BARRAGE of brickbats was hurled at former AirAsia Malaysia head honcho Aireen Omar over her defensive stance on FashionValet Sdn Bhd (FV) which burned a RM43.9 mil hole in the pockets of government-linked investment companies (GLICs) Khazanah Nasional Bhd and Permodalan Nasional Bhd (PNB).

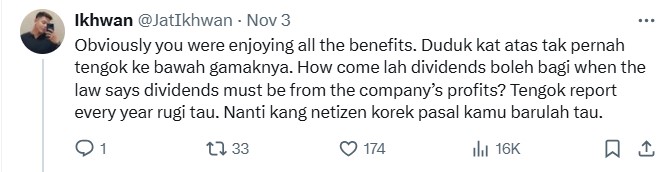

Firing the first salvo was self-proclaimed in-house legal advisor Ikhwan (@JatIkhwan) who ticked off the current AirAsia Digital (formerly RedBeat Ventures) president for showing off “as if she’s over-functioning”.

“She was pathetic sitting on the AirAsia board yet the same degree of disappointment is repeated on the FV board,” fumed Ikhwan on the X platform.

Bising lah Aireen Omar ni. Macamlah terpaling function. Duduk dalam board Air Asia pun ke laut, duduk dalam board Fashion Valet pun menjunam. Konon “I know the facts” but obviously as one of the directors you failed miserably. Company wasn’t making profits but dividends keluar?

— Ikhwan (@JatIkhwan) November 3, 2024

“She claimed ‘I know the facts’ but obviously as one of the directors she failed miserably. The company wasn’t making profits yet how could it be dishing out dividends?”

For context, Aireen had in a preview clip of her appearance on the “Apa Cerita Podcast” dismissed allegations of fraud and abuse behind losses incurred at FV by contending that she was privy to its finances as a director.

@tunasyrafkhalid On @apaceritapodcast , we spoke with Aireen Omar about the recent developments at Fashion Valet. As a member of its Board of Directors, Aireen provided her perspective, noting that the challenges faced are a natural part of the business cycle. Despite these hurdles, she emphasized the importance of resilience and learning from such experiences. Aireen reassured us that Fashion Valet is now on a positive upward trend, showing considerable progress. I personally hope that Vivy Yusof, the founder of Fashion Valet, is handling these challenges well. When she’s ready, many people will likely be eager to hear directly from her about what transpired.

♬ original sound – Tun Asyraf Khalid ™ – Tun Asyraf Khalid ™

Brushing aside as mere speculation, she went on to suggest that critics “have a life and look at other things” instead.

Deliberating further on the subject of dividends, Ikhwan further questioned how it could be possible for FV to be making dividend payouts when it had actually been incurring losses for five straight years (2012-2017) before Khazanah and PNB decided to invest in the deemed early e-commerce pioneer and Malaysian start-up poster-child in 2018.

“Obviously you’re enjoying all the benefits. You never look down once you sit on top, do you?” lamented Ikhwan.

“How come dividends can be paid when the law clearly stated that dividends must be from the company’s profits? Kindly read FV’s annual report to find out. Don’t let netizens dig up more dirt to shame you.”

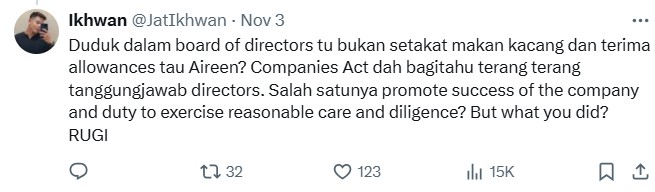

The lawyer further schooled Aireen who is an economics graduate of the London School of Economics (LSE) in addition to holding a Masters in Economics from New York University:

“Sitting on the board of directors (BOD) is not just about munching away peanuts and receiving allowances, my dear Aireen.

“The Companies Act (2016) has clearly stated the responsibilities of directors. One of them is to promote the success of the company while you’re also duty-bound to exercise reasonable care and diligence? But what was the ultimate result? LOSS.”

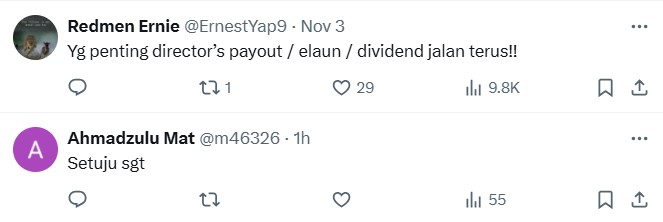

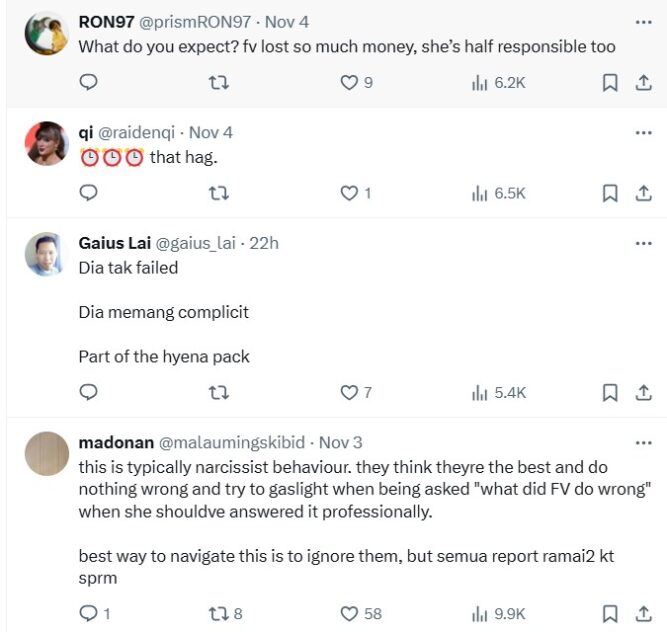

Ikhwan’s views seemed to be well-received. Below are samples of the darndest comments: – Nov 5, 2024

Main image credit: Campaign Asia