AS the Malaysian Anti-Corruption Commission (MACC) urged against “trial by public opinion” over the RM43.9 mil losses incurred in FashionValet Sdn Bhd by Khazanah Nasional Bhd and Permodalan Nasional Bhd (PNB), a whistleblower has tipped off the graft buster with a scam that he alleged happening in Xeraya Capital Sdn Bhd.

“Next big scam or even the biggest scam in Khazanah is in Xeraya Capital. They have invested in too many Mat Salleh con job companies,” exposed FreeMalaysian (@FreeMsian) on the X platform.

Next big scam or even the biggest scam in Khazanah is in Xeraya Capital. They have invested in too many mat salleh con job companies.

— FreeMalaysian (@FreeMsian) November 2, 2024

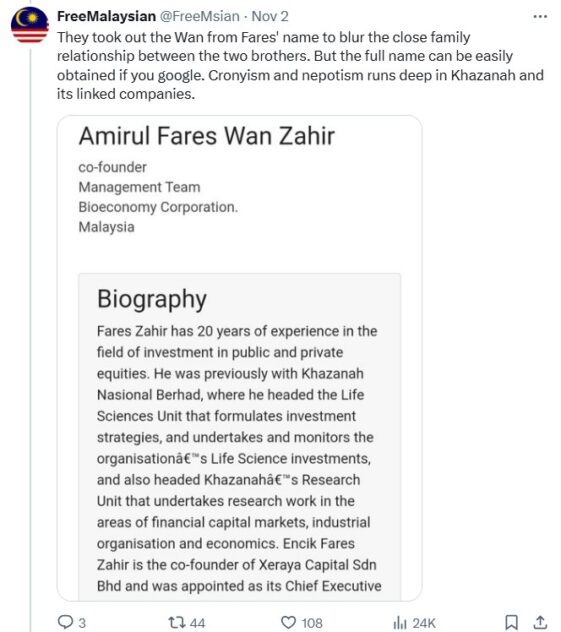

According to FreeMalaysian, Xeraya Capital is helmed by Fares Wan Zahir who is the elder brother of Khazanah’s managing director Datuk Amirul Feisal Wan Zahir.

“Nepotism at best!” alleged FreeMalaysian who is renowned for his whistle-blowing exploits.

“They took out the ‘Wan’ from Fares’ name (referring to his profile on the Xeraya website) to blur the close family relationship between the two brothers. But the full name can be easily obtained if you Google (Search). Cronyism and nepotism run deep in Khazanah and its linked companies.”

According to FreeMalaysian, Xeraya Capital – by their own admission – was the brainchild of the sovereign wealth fund whereby the former provides “capital support via venture capital” and “private equity to catalyse life sciences … Lot of con words”.

“They have a website but very little information on their financial achievements to date. For a public-owned company managing funds in hundreds of millions – if not billions – that is no transparency at all,” claimed FreeMalaysian.

He further shared the companies that Xeraya claimed to have invested under its “Medical Technologies category”.

“The first one Acutus Medical don’t even have its own website and mirrors the same Xeraya Capital if you click the link. Red flag,” revealed FreeMalaysian while furnishing website evidence to substantiate his claims.

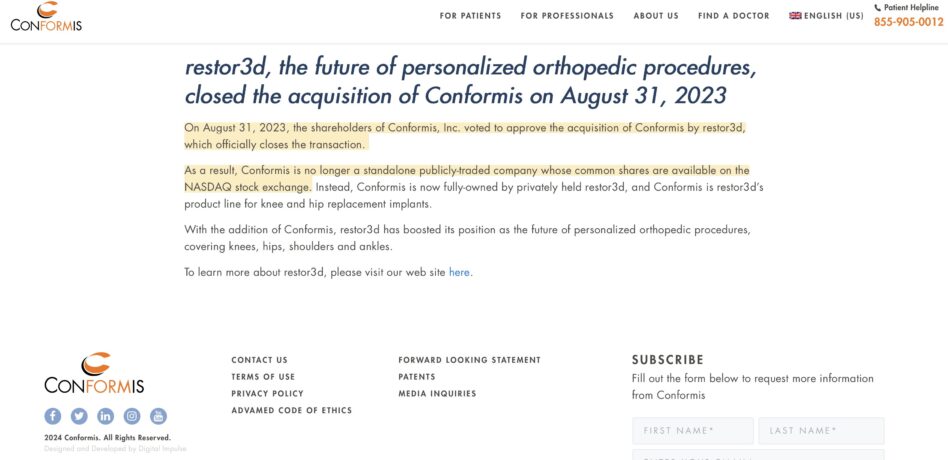

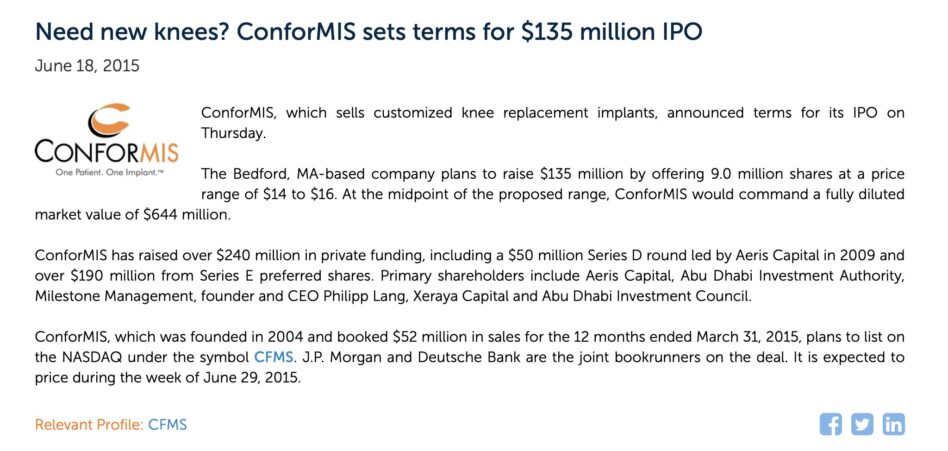

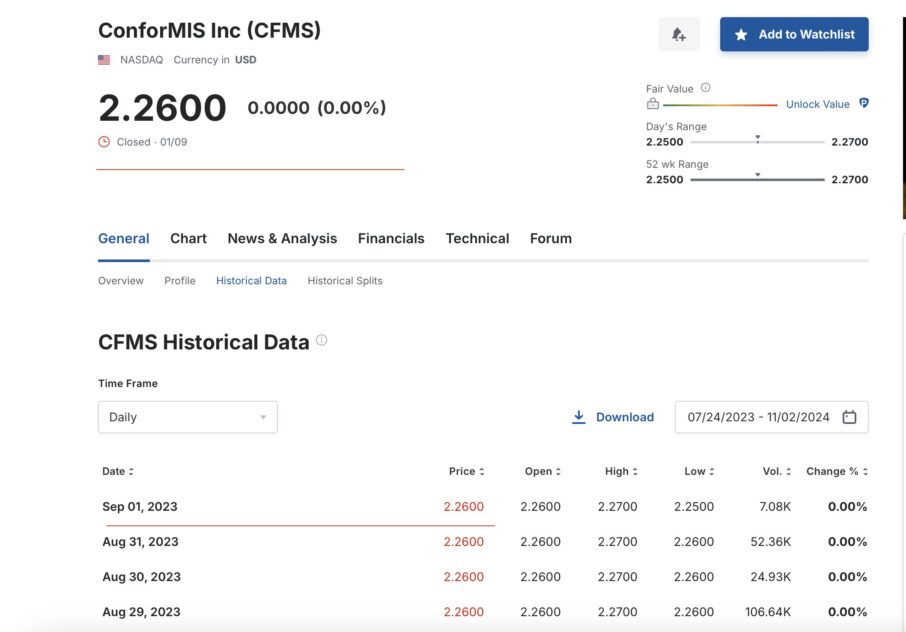

“Next one, ARIA CV don’t even have any link to any website. Even more shady than the first one. Third one is ConforMIS. Apparently, they divested in 2023 and the company is no longer listed. Not sure the exact loss they suffered in that investment.”

“I can bet Xeraya wouldn’t have made money in ConforMIS as at the time of their investment in 2015, the stock price the promoters IPOed (on NASDAQ) was US$14 to US$16 but when they delisted the shares in 2023, the stock price dropped to US$2.26. That’s an 83% drop in stock price!”

Added a fuming FreeMalaysian with a tinge of sarcasm: “The name itself sounded like ‘ConfirmMiss’ and only the idi*ts in Khazanah could invest there. LOL.”

The online whistleblower further appealed to “vvolunteers to dig more into Xeraya Capital and its mounting losses”.

“If you can’t share yourself, direct message,” suggested FreeMalaysian. “You can take your time to analyse the rest of their investments but almost (are) all bleeding massively and their losses could dwindle losses from Vivy Yusof’s FashionValet many times over. Now Khazanah is awaiting the right time to kitchen sink the massive losses.” – Nov 4, 2024