QUARTER four 2024 (4Q24) results for the technology sector were mostly below expectations, with four of the nine companies under MIDF research (MIDF) coverage missing estimates, mainly dragged by margin compression despite overall revenue growth and higher loadings.

“We expect earnings to grow in 2025 on stronger demand, with potential upside in the immediate term on some urgent order deliveries stemming from impending tariffs to be imposed by the US,” said MIDF in the recent Monthly Sector Report.

The Bursa Malaysia Technology Index (KLTEC) tumbled to a 4-year low, after taking a huge dive over the past months due to:

i) Weaker-than-expected company results.

ii) Potential imposition of tariffs or sanctions from the US.

iii) Overall risk-off sentiment in the market.

“However, we continue to observe a stronger year-on-year (YoY) revenue growth trend in 4Q24, on a gradual recovery that we believe will gain pace moving further into financial year 2025 (FY25),” said MIDF.

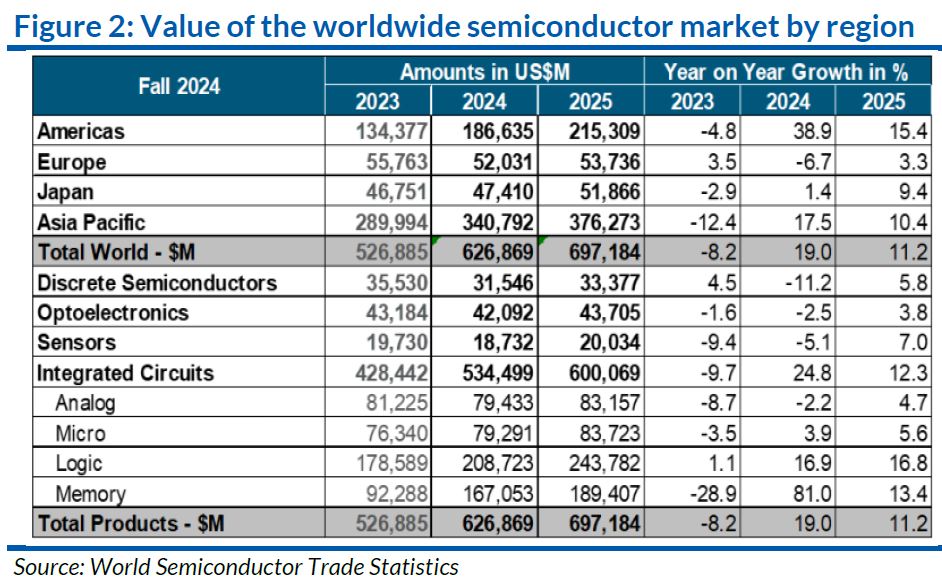

Despite the uncertainties instigated by the US-China trade war, the tone of technology players’ management teams indicates stronger orders ahead.

This is due to a recovery seen in certain segments such as smartphones, strength in artificial intelligence or AI, servers, and power management integrated circuits or PMICs, being further supported by new opportunities and clientele gained from the China Plus One and Taiwan Plus One strategies.

1Q25 earnings growth should be flattish-to-higher quarter-on-quarter (QoQ), on the strengthening of the USD vs the MYR, and flattish loading factors despite a seasonally weak 1Q.

Also, the peaking of the Federal Funds Rate should also underpin the sector’s valuation.

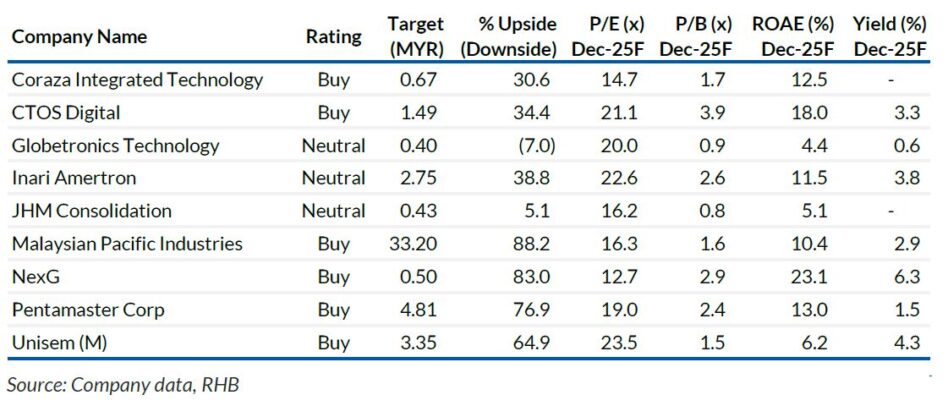

“We like MPI for its exposure in the semiconductor space, the demand recovery in China, as well as the commencement of new programmes/customers,” said MIDF.

CTOS is their pick in the domestic-centric space, premised on the digitalisation trend as well as its exposure to the financial technology or fintech segment.

In the smaller cap space, MIDF favours Coraza for its explosive earnings rebound on robust revenue growth and economies of scale. —Mar 17, 2025

Main image: O9 Solutions