SUSPENSION of the RM7 bil flood mitigation contracts that were approved/awarded without undergoing the tender process pending review is a negative development for construction sector contract outlook in 2023F although not totally unexpected.

Based on its pre-15th General Election (GE15) scenario analysis, CGS-CIMB Research said it has raised the possibility that contract suspension/cancellation or review risks may emerge if a new coalition government comes into power.

“What is unclear from the news is the details of the alleged RM7 bil total value of flood mitigation contracts awarded,” shared analyst Sharizan Rosely in a construction sector update. “To our knowledge, the disclosed projects have yet to be awarded since the tabling of Budget 2023 on Oct 7.”

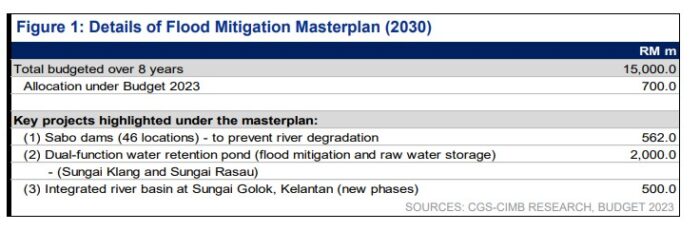

Recall that the Finance Ministry (MOF) has been ordered by newly minted Prime Minister Datuk Seri Anwar Ibrahim (who is also the Finance Minister) to pause the channelling of funds for the RM7 bil flood mitigation projects (out of the RM15 bil announced by the previous government).

Additionally, the MOF has also been instructed to conduct a full review of contracts that have been awarded through direct negotiations for possible procedural breaches.

“Although contractors under our coverage do not have direct tender exposure to the construction packages under the Flood Mitigation Masterplan 2030, this piece of new may raise concerns over the status of other larger-value projects mentioned in Budget 2023,” opined CGS-CIMB Research.

“Our immediate focus would be the status of the RM3.3 bil allocated for the MRT3 (Mass Rapid Transit Line 3 which costs RM32 bil in total value) under Budget 2023.”

While waiting for more clarity during the re-tabling of Budget 2023 which is likely in 1Q CY23F, the research house reiterated its “neutral” outlook on the construction sector with Gamuda Bhd and HSS Engineers Bhd as its preferred picks for MRT3 plays.

RHB Research also expressed concern over lingering policy risks. Although GE15 is over – thereby removing the political overhang on the sector – it still remains to be seen as how the unity government will handle the country’s fiscal position, according to the research house.

“The status of RM95 bil worth of development expenditure proposed before GE15 is pending the re-tabling of Budget 2023,” analyst Adam Mohamed Rahim pointed out.

“As such, we cannot discount the possibility of a review of infrastructure projects, mainly the MRT3 which could see a decrease in contract value while project owners may postpone investment decisions until there is better policy clarity from the Government.”

RHB Research added that it likes names from the small- and mid-cap construction space such as Kerjaya Prospek Property Bhd and Sunway Construction Group Bhd. – Dec 7, 2022