QUARTER four 2024 (4Q24)’s results have beat street’s estimates driven by higher palm products prices. Among the large caps, SDG’s results outperformed market’s expectations while KLK missed estimates.

Despite good year-to-date (YTD) crude palm oil (CPO) price of MYR4,705/t, 1Q25 results are likely to be much weaker quarter-on-quarter (QoQ) on seasonally lower output cycle and higher costs. Stay NEUTRAL on the sector.

“Our preferred BUYs are SDG, GENP and SOP. Land sales and JS-SEZ will continue to catalyse interests on SDG and GENP, while SOP is simply undervalued,” said Maybank Investment Bank (MIB) in a recent report.

Core profit after tax and minority interest (PATMI) of 38% of the stocks under coverage exceeded MIB’s expectations while 38% missed, and 24% came in-line.

Cumulative revenue rose 6% year-on-year (YoY) to MYR17.52 bil while cumulative core PATMI jumped by 57% YoY to MYR1.48 bil.

The strong earnings delivery was mainly buoyed by strong CPO average selling price (ASP) and PK ASPs driven by the tightness in palm oil supply especially in Indonesia which was affected by biological tree rest and the lagged impact of 2023’s mild El Nino.

The higher prices in 4Q24 more than offset the generally lower YoY fresh fruit bunch (FFB) output growth.

While upstream performed better than expected for most planters, there were exceptions as KLK and THP missed expectations due to some forward sales committed prior to the CPO price rally towards the year end.

As for downstream, KLK and IOI suffered downstream losses in part due to FV loss on derivatives financial instruments.

“Into 2025, we anticipate downstream outlook to improve especially the oleo-chemical segments,” said MIB.

On their forward strategies, integrated players such as IOI and KLK will continue to sustain their usual 2-3 months of forward sales strategy due to their downstream export commitments.

While such forward sales strategy provides stable margins, the downside is integrated players will not be able to benefit from the high CPO spot prices if BMD Futures price curve continues to be in steep backwardation.

If BMD Futures price curve stays in steep backwardation, pure upstream players who sell mainly on spot pricing will typically outperform.

“For 2025, we expect the sector’s earnings to grow by 12% YoY, driven in part by better downstream outlook as well as higher FFB output,” said MIB.

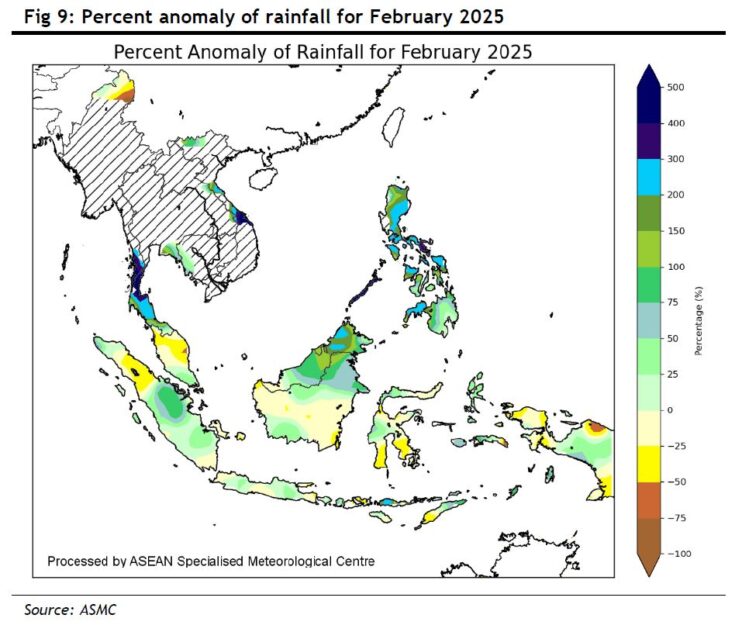

Looking at 1Q25, despite high YTD CPO ASP of MYR4,705/t, it is unlikely to outweigh seasonally low output cycle of Q1, further compounded by Jan-Feb’s heavy rainfall in selected States like Johor, Sarawak and Sabah.

1Q25’s earnings are likely to weaken QoQ on higher costs too, including a new minimum wage of MYR1,700 per month effective 1 Feb, and little brought forward stockpile to boost sales. —Mar 7, 2025

Main image: earth.org