MAIN Market-listed property developer Paragon Globe Bhd (PGB) (formerly Goh Ban Huat Bhd) has rolled out its strongest-ever quarterly and full-year financial results for its FY3/2025 ended March 31, 2025.

The group’s impressive performance was primarily driven by robust property development activities, significant land disposals and effective operational management.

For its 4Q FY3/2025, PGB achieved a spike in revenue to RM151.54 mil (4Q FY3/2024: RM7.85 mil) while its net profit attributable to the owners of the parent company rose to RM53.38 mil which is a significant jump from RM1.32 mil in 4Q FY3/2024.

For the full FY3/2025, revenue surged more than 500% to RM306.3 mil (FY3/2024: RM50.98 mil) with the group making a remarkable turnaround to post a net profit of RM105.6 mil from a net loss of -RM1.24 mil in FY3/2024.

“This year’s outstanding financial performance underscores the strength of our strategic initiatives, prudent landbank optimisation and the diligent execution by our management team,” commented PGB’s executive chairman Datuk Seri Edwin Tan Pei Seng.

“The significant increase in our revenue and profitability highlights our successful execution of high-value land sales in Desa Cemerlang and strong market reception for our property developments in Pekan Nenas, both of which are located in Johor.”

The property development segment remained PGB’s primary revenue contributor by delivering RM151.5 mil in 4Q FY3/2025 and RM306.2 mil for the full financial year.

This impressive growth was primarily driven by strategic land sales and encouraging take-up of detached factories and shop offices.

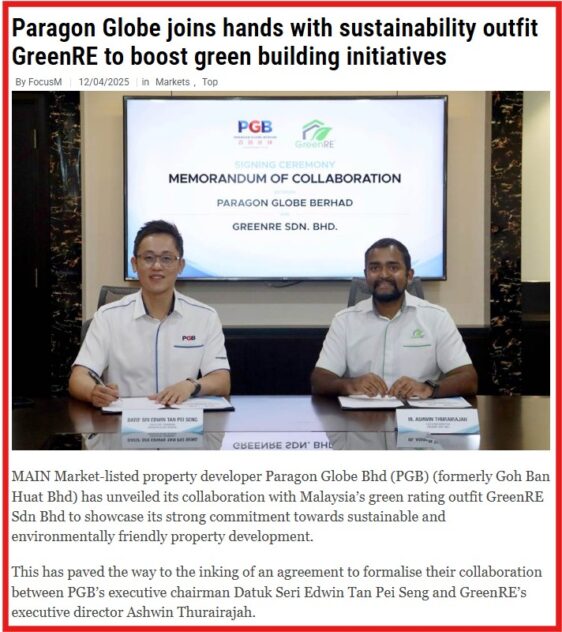

PGB also made meaningful progress on its sustainability agenda by inking a memorandum of collaboration with GreenRE Sdn Bhd in April 2025.

This strategic collaboration will enable the group to adopt GreenRE’s recognised certification standards, hence reinforcing its commitment to sustainable and responsible development in alignment with national ESG (environment, social and governance) goals.

“We remain optimistic about the prospects ahead, particularly given Johor’s accelerating development initiatives such as the Johor-Singapore Rapid Transit System and the Johor-Singapore Special Economic Zone,” projected Tan.

“These initiatives are anticipated to stimulate economic activity and property market, presenting substantial opportunities for our upcoming residential and industrial projects.”

At the close of today’s (May 29) market trading, PGB was down 2 sen or 2.9% to 67.5 sen with 219,300 shares traded, thus valuing the company at RM504 mil. – May 29, 2025