A WRAP-UP of the 2Q CY2022 financial quarter has pointed to the healthcare sector – particularly the glove sub-sector – dragging down both of Bursa Malaysia’s year-on-year (yoy) and cumulative 6M CY2022’s overall performance.

This is not surprising given (i) a drop in volumes and average selling prices (ASP) due to oversupply; and (ii) higher operating costs incurred especially by the Big Four glove makers due to higher natural gas and minimum wage.

PublicInvest Research observed that glove players under its coverage continued to deliver weaker-than-expected results with performances of Top Glove Corp Bhd, Hartalega Holdings Bhd and Kossan Rubber Industries Bhd being below the research house’s and consensus’ expectations.

“Notably, all three companies reported weaker earnings on a sequential basis mainly due to falling ASPs,” the research house pointed out while reiterating its “neutral” call on three counters.

“Top Glove saw a 5% drop, Hartalega recorded a 13% decline while Kossan’s ASPs fell between 10% and 15%. The drop in ASP was mainly due demand-supply imbalances with more supply entering the market while demand continues to moderate.

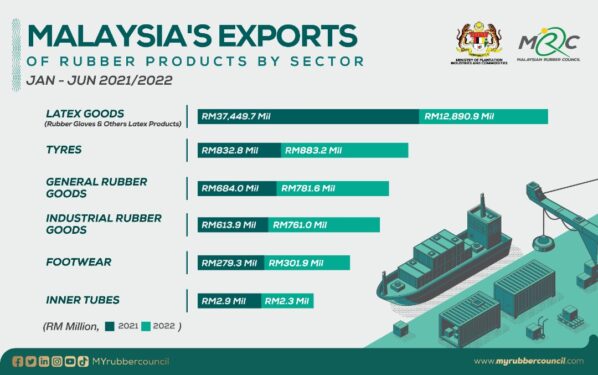

This is in line with the latest data by the Malaysian Rubber Council (MRC) that total exports of rubber products in 1H 2022 dipped 60.7% to RM15.63 bil from RM39.83 bil in 1H 2021. Of this, contribution from latex glove and related products contracted 65.6% to RM12.89 bil during the 1H 2022 period from RM37.45 bil a year ago.

Although ASPs are likely to bottom in 2H CY2022 as industry players adjust for inflationary pressures, PublicInvest Research is wary of the surge in fuel prices in 1H 2022 – and the ensuing time lag effect – which could spark a surge in energy cost in 2HCY22.

“We think companies are unlikely to be able to fully pass on the cost to buyers due to the intense competition,” projected the research house.

“Both Hartalega’s and Kossan’s sale volume remain flattish quarter-on-quarter (qoq). Top Glove’s sales volume increased +6% qoq with nitrile and surgical gloves increasing by +17% and +20% respectively though offset by the decrease in vinyl glove sales volume by 46%.”

PublicInvest Research attributed this to an increase in sales volume for surgical gloves which was mainly due to the resumption of elective surgeries as well as the commencement of its sterilisation plant. This resulted in the easing of bottleneck issues arising from reliance on third party sterilisation service.

“Sales volume for Top Glove’s natural rubber glove remains flattish meanwhile,” noted the research house.

Nevertheless, PublicInvest Research expects the longer-term outlook for the rubber glove sector to remain intact, supported by growing awareness for hygiene and growing usage per capita from developing countries.

“Re-opening of economies could further increase glove demand, particularly from non-medical sectors,” it further projected. – Sept 2, 2022