AFTER a long wait, Petronas released its activity outlook for 2025 to 2027 which will possibly clear the majority of market’s concern on Petronas’ plans especially after the recent saga with PETROS and below are the key takeaways.

“Petronas plans to service 139 wells in 2025 versus 141 in 2024, with a higher emphasis on developmental wells (73 vs 56). Exploration wells and plug & abandonment activities are expected to decline year-on-year (YoY),” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Rig requirement is to be lower in 2025. Petronas plans to service 139 wells in 2025 versus 141 in 202, with a higher emphasis on developmental wells (73 vs. 56).

Exploration wells and plug & abandonment activities are expected to decline YoY.

A total of 346.6km of pipelines is expected to be installed in 2025, mostly in Sarawak, compared to none in 2024.

This benefits players like WASCO, involved in pipe coating and related services. Fabrication and construction will be increased but the focus is mainly on light platforms.

While no platforms were installed in 2024, three lightweight platforms are planned for 2025, with two in Peninsular Malaysia and one in Sarawak, indicating that fabricators will see a slightly slower 2025 compared to 2024. Activity is expected to accelerate in 2026 with 13 structures planned.

According to Kenanga, Hook-up and commissioning (HUC) man hours will still see an increase.

HUC activities are set to rise to 6.48mil man hours in 2025 versus 6.31mil in 2024, with Sarawak taking a larger share of activities. This could benefit players like DAYANG.

Offshore maintenance, construction, and modification (MCM) is expected to be 30% higher YoY in 2025. MCM man-hours are projected to rise 30% YoY to 13.6mil in 2025, with Sarawak and Sabah driving the increase.

Offshore support vessel (OSV) demand appears to be flattish but highlighted lack of newbuilds. OSV demand for production operations is expected to remain steady at 118 vessels in 2025, but demand for drilling-related OSVs will decline.

However, Petronas also highlighted concerns over the ageing fleet, emphasising the need for newbuilds in the next three years, indicating that ageing fleet could potentially lead to lower supply of vessels in 2025 despite slightly lower demand from Petronas.

Kenanga further reports that downstream plant turnarounds will see a surge in 2025.

Thirteen plants are expected to undergo turnarounds in 2025 versus four in 2024, providing opportunities for downstream maintenance players like HAWK.

Upstream activities remain largely intact, with selective YoY growth in HUC and MCM driving another strong year for maintenance players like DAYANG.

OSV demand may moderate downwards slightly but remains supported by a declining fleet supply.

KEYFIELD stands out due to its younger fleet and superior AWB specifications. Drilling and EPCC players may see reduced activity in 2025, but a stronger 2026 is possible if Petronas’ plans remain on track.

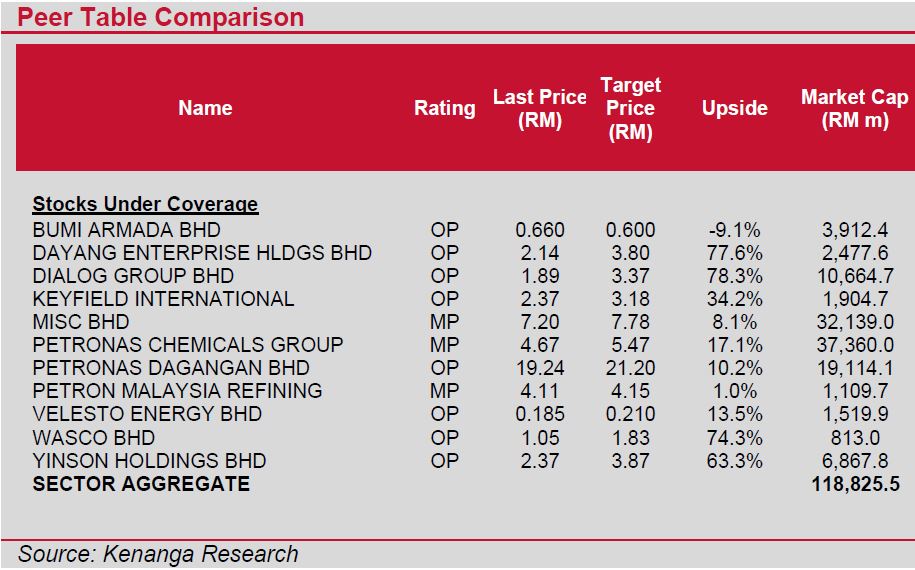

“Given their stronger and more resilient earnings outlook, we adopt a more selective stance on the oil and gas upstream sector, recommending that investors prioritise upstream maintenance-related counters such as OSV players and service providers focused on HUC and MCM,” said Kenanga. —Jan 31, 2025

Main image: CFI