LET’S be very blunt, frank and straight when confronting the rise in the number of scam victims and the growing amount of hard-earned money siphoned from the victims’ account.

Are the victims themselves to be blamed? Are they expected to bite the bullet every time such an incident happen without any form of compensation – for their sheer stupidity, ignorance, carelessness or whatever words deemed fit by financial institutions to wash their hands off such misfortune?

Or will the Finance Ministry (MOF), Bank Negara Malaysia (BNM) and the Association of Banks in Malaysia (ABM) come out with a viable formula on how to ascertain who is at fault?

This is considering that the security of banks has in one way or another been compromised or exploited by scammers who are only getting bolder in their modus operandi with each passing day.

Or perhaps would it be sensible for this humble writer to propose a co-sharing solution whereby the quantum will be worked out based on circumstances surrounding a particular scam so long as both parties – the victims and their banks – are agreeable to the compensation rate?

As it is, nabbing the masterminds or big fish behind the scams is an arduous task given the sophistication of their strategies that leverage on owners of a mule account (a bank account of someone who has allowed others to control by handing over their ATM card’s pin numbers or the online banking password).

In 2021, 29,769 bank accounts in Malaysia were found to be mule accounts (but what about those who went undetected).

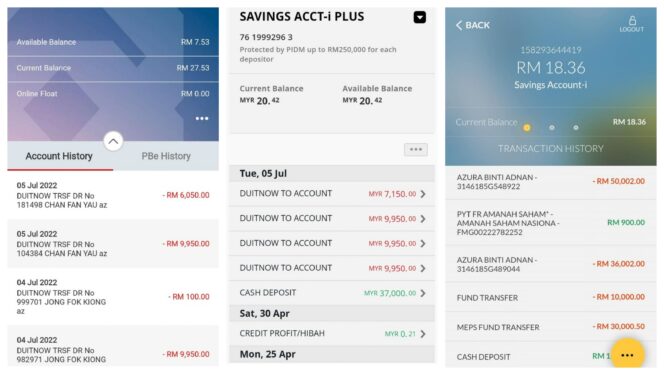

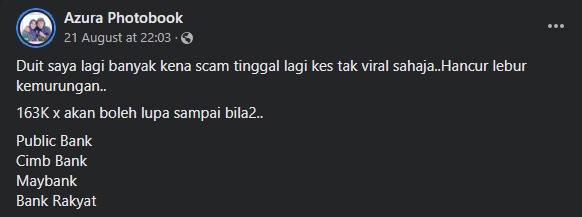

After FocusM exposed two cases that involved CIMB Bank (RM13,000) and Public Bank (RM11,688.16) with Hong Leong Bank coincidentally being the fund recipients’ bank on both occasion, another Malaysian by the Facebook (FB) name Azura Photobook has come forward to share her plight on how she had “lost money in July” and “in August lost (her beloved) dad”.

“The RM163,000 that I’ll never forget. Public Bank, CIMB Bank, Maybank and Bank Rakyat,” she pointed out in her FB posting. “Almost three weeks I was down with severe depression. Felt like the world is dark and losing the spirit to move on … but finally I was able to accept my fate.”

Azura Photobook provided images of her mobile banking applications’ transaction history, showing that the lowest amount fraudulently obtained in a single transaction was RM6,050 while the largest was RM50,002 in the screenshots made available on her FB page.

In sharing the modus operandi, Azura said “it was more or less the same story as the others” as shared by Lembah Pantai MP Fahmi Fadzil:

- Victims would receive a call from the scammers claiming to be from a bank. They would then inform victims that a transaction has taken place even though victims do not have any accounts in those banks.

- The call would be transferred to “Bank Negara Malaysia” (BNM) to assist victims in making a “police report”.

- Then, the call would be transferred to the “police station” where victims would be asked for their bank account details.

These large transactions typically happen quickly and require one-time passwords (OTPs). – Aug 26, 2022