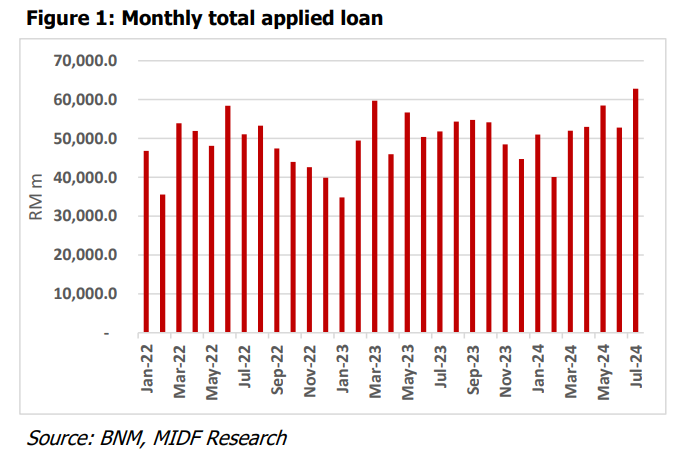

ACCORDING to data released by Bank Negara Malaysia (BNM), total loan application for purchase of property jumped to RM62.8bil in July 2024 from RM52.8bil in June 2024.

The loan application data in July 2024 is at its highest level since 2021. On a yearly basis, loan applications recorded a sharp increase of +21.2% year-on-year (yoy) in July 2024 after growing by +4.8% yoy in June 2024 and +3.1%yoy in May 2024.

“That brought the total loan application in the seven months of calendar year 2024 (7MCY24) higher at RM370.1bil,” said MIDF Research (MIDF) in the recent sector update report.

The solid growth in loan application indicates stronger buying interest on property which is in line with the better sentiment on the property market in Malaysia.

Approved loan for purchase of property jumped to RM29.6bil in July 2024 from RM23.3bil in June 2024, in tandem with the higher loan application.

The higher loan application is also helped by a higher percentage of total approved loan over total applied loan of 47.2% in July 2024 against 44.2% in June 2024.

On a yearly basis, the approved loan in July 2024 was higher, bringing 7MCY24 total loan approved higher at RM163.9bil.

The higher approved loan is positive to property developers as higher approved loan underpins the growth of new sales of property developers in CY24.

Meanwhile, most of the property companies recorded earnings growth in the first half of calendar year 2024 (1HCY24) due to stable progress billing of property projects.

On the other hand, new property sales of property companies in quarter two calendar year 2024 (2QCY24) were largely on track to meet management’s new sales targets as new sales momentum remains stable with stronger buying interest in property.

“Looking forward, we expect earnings of property developers to be higher as progress billing on the improved new sales should support earnings growth. Meanwhile, new sales momentum should remain strong in 2HCY24 due to improved buying sentiment on property,” said MIDF.

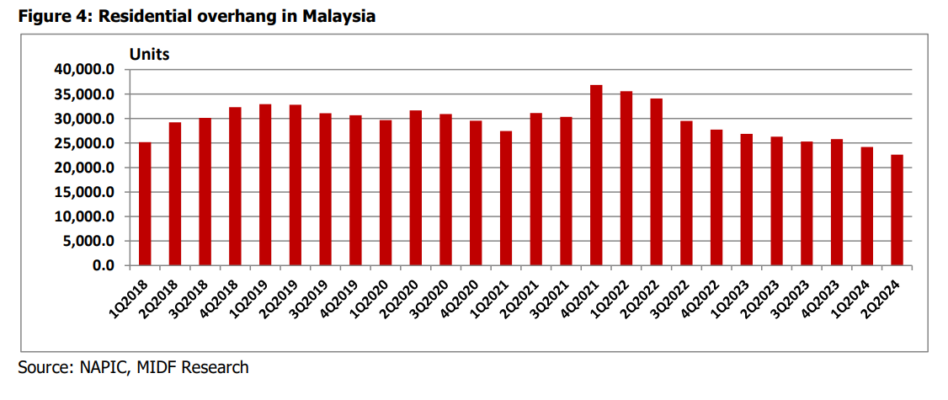

According to data released by National Property Information Centre (NAPIC), residential overhang improved to 22,642 units in 2QCY24 from 24,208 units in 1QCY24 and 26,286 units in 2QCY23.

The residential overhang is at the lowest level since 2018. Perak has the highest number of residential overhangs in 2QCY24 at 4,161 units (1QCY24: 4,588 units) followed by Johor with 3,219 units (1QCY24: 3,629 units) and KL with 3,051 units (1QCY24: 3,194 units).

Meanwhile, serviced apartment overhang in Malaysia declined to 21,158 units in 2QCY24 from 21,913 units in 1QCY24, led by decrease in serviced apartment overhang in Johor to 12,618 units in 2QCY24 from 13,027 units in 1QCY24.

Overall, the declining overhang in residential and serviced apartments is positive for the property sector as it signals a healthier underlying demand and supply situation of the property market in Malaysia.

“Hence, we think that the improving property overhang in Malaysia will keep buying interest on property supported,” said MIDF.

The loan application data in July 2024 is positive to the property sector as the strong growth in loan application indicates the stronger demand for property.

Meanwhile, the higher approved loan should signal improving new sales outlook for property developers.

On another note, the declining property overhang in Malaysia in 2QCY24 which is at the lowest level since 2018 is supportive to the recovery of the property sector in Malaysia. – Sept 18, 2024

Main image: cidb.gov