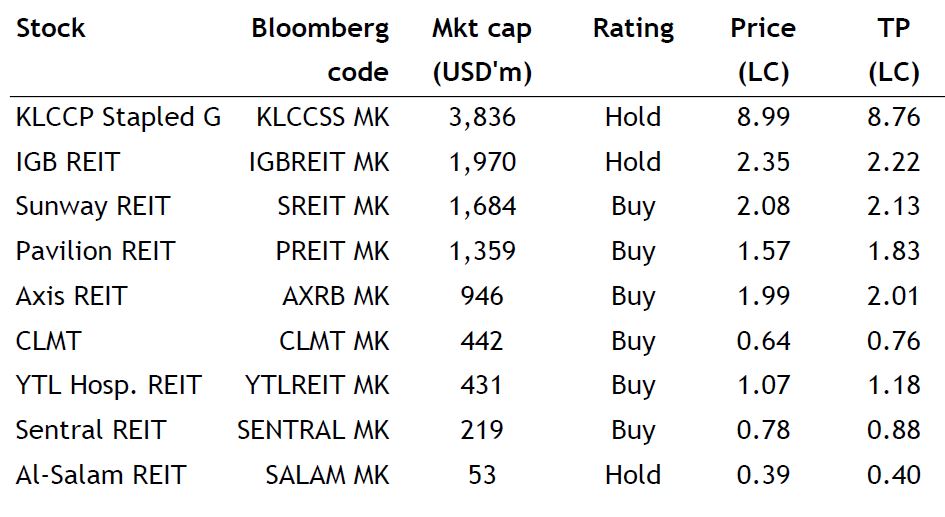

M-REITs delivered broadly in-line quarter one results, with notable year-on-year (YoY) earnings growth from Axis REIT, Sunway REIT, CLMT and Pavilion REIT.

This is driven by positive rental reversions, improved occupancy rates, and contributions from newly acquired assets.

Hospitality REITs saw some seasonal softness due to Ramadan. Operationally, the retail and industrial segments remained resilient, while office stayed challenging, though largely defended by long leases and stable occupancy.

“Looking ahead, we expect catalysts in the second half of 2025 (2H25) to include asset recycling, and new acquisitions,” said Maybank Investment Bank (MIB).

Active asset enhancement initiative by Sunway REIT and IGBREIT should further support income growth.

The hospitality segment for KLCCP and Sunway REIT, may see a seasonal rebound post-Ramadan.

“We also see strategic catalysts among REITs, including CLMT’s industrial diversification and Sentral REIT’s ongoing pivot away from pureplay office exposure,” said MIB.

Al-Salam is progressing on its “DISRUPT27” repositioning strategy, with asset recycling and KOMTAR JBCC’s on-going reconfiguration expected to support medium-term yield and valuation recovery.

PavREIT and CLMT’s planned placements and new assets also offer medium-term upside to earnings and distribution per unit (DPU) growth.

Most REITs continue to guide for stable dividends, and with gearing levels largely within comfortable thresholds. There remains room for selective growth via yield-accretive acquisitions.

That said, management across the sector maintained a cautiously optimistic outlook, flagging several macro uncertainties like potential implementation of an 8% service tax on rental, which would add costs for tenants while limiting REITs’ ability to raise rents, as well as potential increase to electricity tariffs and broader economic uncertainties, such as fuel subsidies and tariff wars.

MIB retains a positive view on the M-REITs sector, underpinned by resilient fundamentals, attractive yields, and visible catalysts for income growth in 2H25.

As the REITs appear to head towards further asset diversification, the quality of assets in its portfolio would be crucial. —June 10, 2025

Main image: Propertyguru