The Ministry of Health (MOH) has reaffirmed that private healthcare providers will still be required to implement the diagnosis-related group (DRG) system, although the initial roll-out will be limited to selected public hospitals.

The official implementation timeline for the DRG system will be determined by a newly established joint ministerial committee, co-chaired by the finance and health ministers, alongside Bank Negara Malaysia (BNM) and private sector stakeholders.

Also noted that DRG forms part of the MOH’s shift towards value-based healthcare, where providers are reimbursed based on outcomes and cost-effectiveness rather than volume of services.

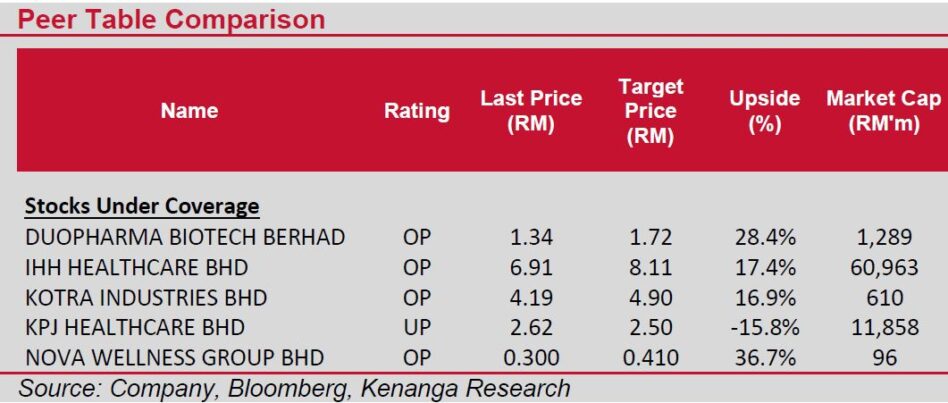

“We are positive on the recently announced news flow on efforts undertaking towards a major revamped in the healthcare sector is a step in the right direction,” said Kenanga Research.

However, the implementation of the DRG system could put pressure on margins for private hospitals but the near-term impact could be minimal as the initial roll-out is expected to target lower-value or minor illnesses.

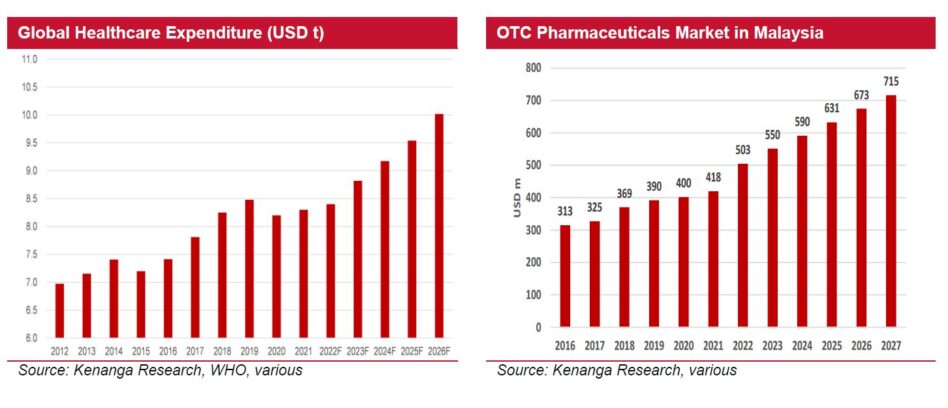

Overall, we are still positive on the private healthcare sector as investors could gravitate towards the defensive nature of healthcare stocks amid a more risk-off environment and taking a view of longer-term growth prospects of the healthcare sector, which will continue to be underpinned by an ageing population, rising affluence and cases of chronic diseases globally.

The Ministry of Finance (MOF) via its press release gave details on sales tax revision including an imposition of 6% sales tax on private healthcare operators which applies only to non-citizens; all Malaysians remain exempt, including for traditional and allied health services.

We believe private healthcare operators would be less affected by the recently announced 6% sales tax imposition.

Separately, we believe there is an urgent need to address national healthcare financing to ensure equitable access to healthcare for all Malaysians, irrespective of their income. Presently, Malaysia has a dual healthcare funding system i.e. private and public.

The private healthcare system is paid for by consumers via “out of pocket” and private healthcare insurance (personal, corporate or employers).

On the other hand, the public healthcare budget is borne by the government (i.e. tax payers) via mainly the Ministry of Health and to some extent the Ministry of Higher Education (university hospitals) and Ministry of Defence.

Briefly, it is a multi-payor, multi-provider system with payors including federal and state agencies, local authorities, SOCSO and the EPF.

In our view, a revamped healthcare insurance system could lead to better overall healthcare services for Malaysians, lower out-of-pocket spending, reduced waiting times and access to more modern medicines and technology.

For illustration purposes, the system could entail a hybrid version i.e. similar to the Australian system of a single-payer, multipleprovider arrangement, where public and private hospitals would provide equal facilities and functions to a patient (vs. current: multi-payer multi-provider system).

Basically, it would mean that everyone has to contribute. Theoretically, all working citizens are obligated to set aside a portion of their income into a fund which they can draw upon to pay their own medical bills when the need arises. —July 8, 2025

Main image: New Straits Times