QUARTER three 2024 earnings included significant one-offs, primarily driven by land sales.

Meanwhile, the much-anticipated announcement of the details for Johor-Singapore Special Economic Zone (JS-SEZ) has been postponed again, this time to Jan 2025, from Dec 2024.

Looking ahead, sector themes are expected to remain focused on JS-SEZ, data center developments and corporate exercises aimed at enhancing company value through asset crystallization initiatives.

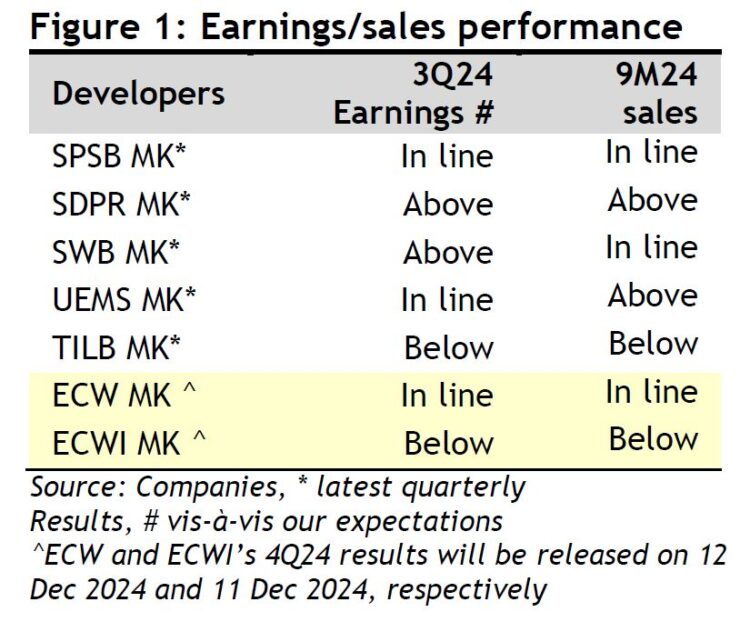

“We downgrade the sector to NEUTRAL (from POSITIVE) as we believe most thematic drivers in the sector have already been in play for some time, with no new themes emerging at present. Our top BUY is SPSB, followed by SDPR,” said Maybank Investment Bank (Maybank) in a recent report.

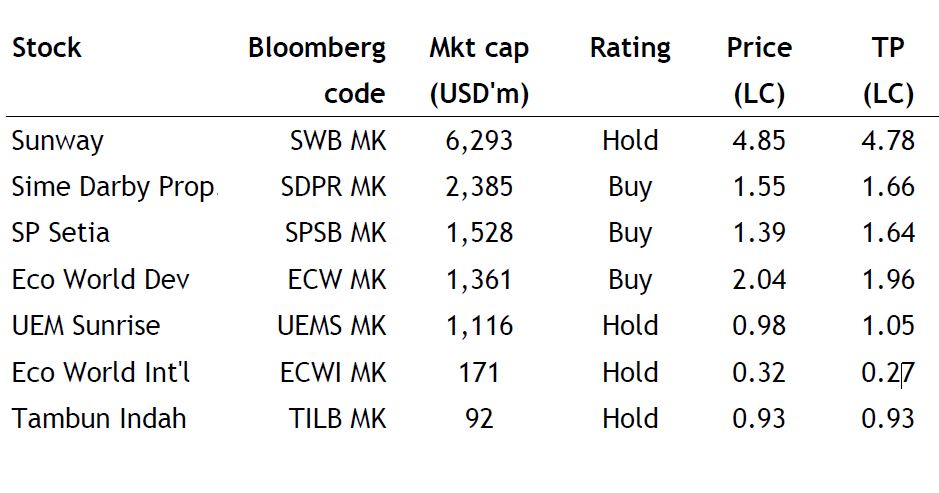

Five developers under their coverage – SPSB, SDPR, TILB, SWB, UEMS – reported their 3Q24 profits in November. SDPR and SWB’s core earnings exceeded Maybank’s forecasts, SPSB and UEMS were in line, while TILB fell short due to project launch delays.

They remain selective in their stock picking, focusing on companies with decent fundamentals, proven track record and growth prospects.

Risks to theirs are calls:

1/ Weaker-than-expected property sales dragged by weaker economic outlook.

2/ Policy risks.

3/ Stricter lending measures by the banks.

4/ Higher-than-expected Liquidated Ascertained Damages (LAD) compensation following latest ruling by the Federal Court.

5/ Rising building material costs and labour issues.

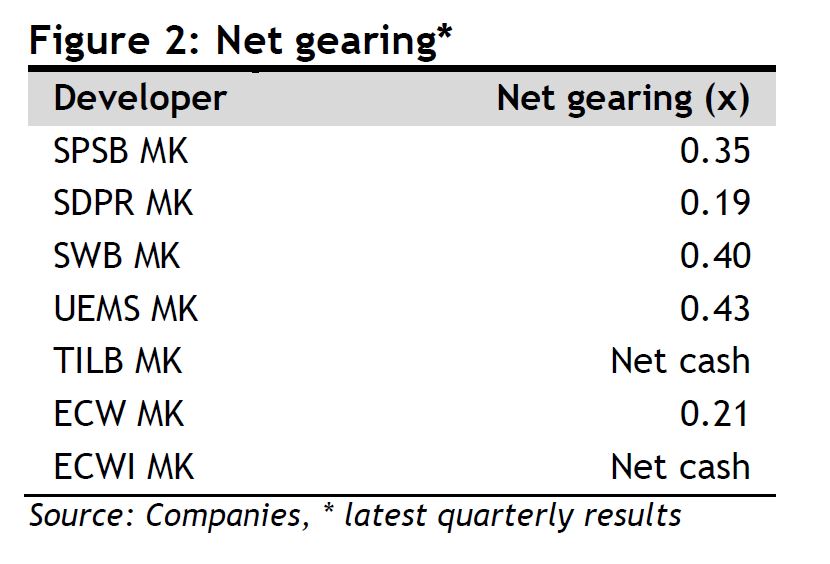

SDPR’s beat stemmed from higher margins, while SWB benefited from a lump-sum profit recognition from a Singapore project.

Property sales-wise, SPSB and SWB are on track with their financial year 2024 estimate targets, while TILB lagged, and SDPR and UEMS surpassed internal targets.

2025 is set to be eventful with corporate exercises like the listing of SWB’s healthcare business and SPSB MK, WCT MK, and probably IOIPG MK’s investment properties.

Thematic drivers like data center (DC)-related investments/land sales are expected to sustain interests in property stocks which have the relevant exposure.

SDPR has recently secured another 20-year lease with Google for its Elmina Business Park (77 acres), while ECW is pursuing more DC deals in its Selangor and Kulai industrial parks.

Elsewhere, SPSB is expected to finalize its Tanjung Kupang industrial park JV by the first half of 2025.

“For JS-SEZ, we believe it has reached a point where investors are looking to monetisation of expectations, as much have already been priced in, given that the JS-SEZ theme has been in play since July 2023,” said Maybank.

According to an earlier press article, the JS-SEZ’s location will cover an area governed by six authorities in Iskandar Malaysia and Pengerang, suggesting a level playing field for all landowners.

As a result, strong track records and capable management will be critical for competitiveness, Maybank believes.

“While we are positive on upcoming/potential developments – JS-SEZ, data centers, and corporate exercises which can enhance corporate value further – we believe the positives have been largely priced in,” said Maybank. —Dec 9, 2024

Main image: corporatefinanceinstitute.com